In January 2015, Chang-Go, one of the more successful prepaid card companies operating in China, was ordered by China's Central Bank to stop operations. According to the bank, the company was not giving customers refunds in a full manner, misappropriated reserve deposits and even forged financial documents.

On the 28th of December, China promulgated the next set of mobile payment regulations. Although some of the regulation was expected, how will the rest impact the mobile payment industry development in 2016?

2016 should be the year when finally Apple Pay manages to launch in China, as announced by the Cupertino-based company on its own website and as was already reported by the Wall Street Journal earlier this past autumn. This wasn't really a surprise as Apple had long talked about its China plans for Apple Pay. Less expected, Samsung Pay is also going through the same process and should also launch in 2016.

China’s digital travel landscape is a world in its own. Increasingly, globe-trotting Chinese are turning away from prepaid package tours and becoming more mobile savvy in applications from hotel booking to local entertainment. It is estimated recently by Dianping, a restaurant review and coupon website that Chinese outbound tourists are forecast to spend 250 billion yuan (US$39 billion) on food in 2015, 25% more than in 2014.

Early last month, in a statement released from the Monetary Authority of Macau, Alipay was approved for use in Macau's gaming market a fact confirmed by the industry that now macau residents and/or institutions can have an Alipay account and use it for payments.

As China's economy slows and people push to move their money abroad for better returns, the government is now trying its best to keep money at home. The PBOC has estimated that outflows of the China’s foreign reserve attributed to illegal underground banks amounted to about 800 billion yuan ($125 billion) from April to October this year. Chinese police launched a series of crackdown on underground banking and illegal foreign-exchange network to continue the anti-corruption campaign. But will it matter? Can they actually stem the flow of money out?

After nearly a year and a half from its US release date and after long preparations and cancelled announcements it finally looks like Apple will be releasing its mobile payment system, Apple Pay, in China somewhere in Q1 of 2016, possibly before Chinese New Year rolls around.

In a world where everything seems to be made in China there are still markets where China is no where to be found, but Western companies still dominate. One of those is the cashless payments market, with giant companies such as Visa, MasterCard and American Express owning the market for bank cards and payment networks.

Earlier this week at The Swatch Art Peace Hotel on the Shanghai Bund, Swatch launched a new smartwatch called the Swatch Bellamy. The Swiss based company announced that it is teaming up with China UnionPay and the Bank of Communications to allow the device to be used for mobile payments at any UnionPay POS as it seems like the Bellamy is NFC-enabled.

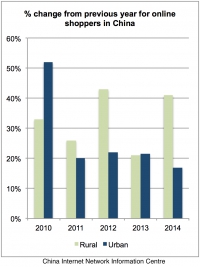

Delivery of online orders to the rural parts of China is becoming more prevalent now that rural consumers' wealth increases and they gain access to internet connected devices. But how will delivery teams navigate the challenging tight pathways, rice paddies and unmarked housing to make successful deliveries?

As mobile payments become increasingly abundant among global transactions and an increasing preference for mobile payments amongst Chinese consumers continues to develop both in China and overseas, it was only a matter of time for which mobile payment platform providers would see the opportunity to capitalize on the growing overseas demand for mobile payments.

Finance, cinema, bricks-and-mortar and soccer - what could be next for Alibaba? The e-commerce giant has been poised to undertake a new venture with the Chinese state owned arms, vehicle and machinery producer China North Industries Group Corp, or Norinco.

Alibaba’s strategy to integrate brick-and-mortar stores into its business model has become more prominent over the coming weeks when it was announced on 10th August that it would be investing $4.6bn (19.99% stake) in the Chinese electronics retailer - Suning Commerce Group Co Ltd.

Third party online payment services in China have disrupted the traditional financial industry, and enabled a new era of Internet finance lead by Alibaba group. To regulate and set benchmarks for this booming industry, the “Internet Finance Guidelines” was issued last month to curb potential risks, ensure competition, and protect information security and the legitimate rights of investors.

In July 2015 the Ping An Group announced the merger of 1qianbao, its payment solution and Wanlitong Loyalty Points Program. The merger came as a surprise for many employees of the payment division, as the service was successfully growing over the year and a half since the launch.

The versatile internet powerhouse Alibaba group is now sitting on the goldmine of big data and is innovatively monetizing it through internet finance. This time Alibaba Group's online payment system Sesame Credit applies the cutting edge big data-based credit rating system in partnership with Luxembourg's Consulate General in Shanghai for a launch of a credit-based visa application service.

Since its launch 3 years ago, popular third party POS payment provdier Square has gained a respectable level of global adoption. Clients have access to 130 currencies in four languages worldwide. Despite the great success, we haven’t seen any presence of Square in China.

The US online payment service provider PayPal has big plans for helping merchants and customers worldwide. Earlier this week, it has announced his partnership with the most popular payment card in China UnionPay to provide Chinese cross-border shoppers with an easier way to complete their transactions via UnionPay Online payments. The ability to make purchases using UnionPay cards has been one of the most requested features from Chinese customers.

China's taxi / ride hailing app sector is heating up again as internet giant backed Didi and KuaiDi Dache are about to launch 1 billion RMB subsidy for premium cars coupon. Not to be outdone, competitor Yidao teamed up with Baidu. The country's leading search engine allows Yidao to embed its chauffeured car service in its map app.

With over 270 million active Alipay Wallet users and extensive collaborations with overseas global online merchants, Chinese e-commerce payment powerhouse Alipay now is making its expansion into China’s domestic offline stores and soon to the global market.

Alipay has already gotten into transport cards, bill payments and hospitals in China, now it's focused on public services again with local government partnerships.

Rumors abound that Apple has finally reached an agreement with China UnionPay and is rolling out the China version of Apple Pay in April. According to a Bank of China-related Weibo post, April 15th is the day of official announcement and April 28th will be launch day. The timing is close to what was expected, even though there were reports that negotiations were going less smoothly than predicted.

News is that the China International Payment System (CIPS) is ready and selected 20 banks are about to start testing, among which seven are subsidiaries of foreign banks. The new system was developed by PBoC and aims to be a significant improvement on the current way companies make cross-border RMB payments.

Recently CUP announced a cooperation with some of Shanghai’s well-known hospitals to launch an app, where users will be able to perform many of administrative hospital visit procedures on the mobile. This is the first step of CUP’s Modern Hospital plan, aimed to connect major hospitals to its payment solution.

There are now 18 million shoppers in China who buy goods from international platforms and have already spent RMB 216 billion doing so, according to Nielsen. The market is constantly growing, boosted by a more affluent middle class and government support. In our Top 10 China Banking Technology Trends report we talk about how China UnionPay extended its cross-border payments expertise to the ecommerce and joined the industry with its Haigou service in 2014. A new entrant to the cross-border e-commerce market is SF Express. SF is one of China's major logistics and delivery companies and relies on an entirely different set of strengths to develop thier business.

Happy year of the Ram from the entire team at Kapronasia!

We'll be taking a few days off, but will be back in the office next week.

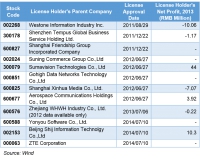

The total number of payments licenses currently stands at 269. Most of the licensed companies are private and do not disclose their financials, however, some publicly listed corporations have invested in the payment industry and a peek into their most recent annual reports allows us to know a bit more about the profitability of the payments industry in China. On one end of the spectrum, Alipay dominates the market and is very profitable. On the other, a prepaid-card company almost went bankrupt in January, which begs the question of how the industry is doing as a whole.

Some industry reports and rumors seem to indicate that the Chang Gou company's 'Chang-go' pre-paid payment cards are no longer usable. What does this mean for the industry?

Continuing along their international expansion strategy, China UnionPay launches Quickpass in South Korea. Could AndroidPay be next?

Happy holidays from the whole team at Kapronasia! We're off this week as well and will be back online January 5th. We're looking forward to an exciting 2015 kicking off with our annual 2015 Top-10 trends in fintech research Reports. Details soon and hope to have you there for the webinar!

More...

December 12th, 12/12, or Double 12, was Alibaba's sequel to the highly successful Singles Day (November 11th). The difference this time though was the incredible focus on and success of the online-to-offline commerce push.

This is part two of a two part series looking at China Unionpay's launch of Android Pay. Part one examined the potential impact of Android Pay on the mobile payment industry. Today we take a look at China Unionpay's business strategy in the mobile payments space as it launches Android Pay. We also answer the question of why China UnionPay would even be interested in having their own mobile payments app in the first place.

The new version of the popular Chinese payment app Alipay now supports Apple’s fingerprint touch sensor for account access and payment authorisation instead of a password.

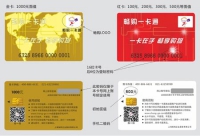

Alipay is making headway on its promises to expand globally and has now entered into an agreement with several foreign transportation card firms, which will allow Alipay users to buy transport service cards through the Alipay app as they travel abroad.