China is pushing its card industry towards tokenization as it seeks to make digital payments more secure on the Mainland. Banks and payment service providers (PSP) are required to use tokenization to process transaction data by the end of this year, according to Chinese business publication National Business Daily, citing a notice from China’s central bank.

Ant Financial will purchase 20 percent of Thai payments and online finance provider Ascend Money, with the right to increase its stake to 30 percent, China's Ministry of Commerce said in a statement on its website.

Rumours are swirling that Alibaba’s Taobao will collaborate with UnionPay. While details are still unknown, this partnership is noteworthy as Alibaba's online payments system Alipay and UnionPay have been fierce rivals for the past ten years.

Apple has turned to the mobile payments industry after the smartphone business has slowed down, as a way to increase revenue streams. Apple Pay, Apple’s mobile payment and digital wallet service, has been very successful in the United States. However, Apple Pay has been struggling to tap into international markets due to technical problems, the lack of user adoption, and resistance from banks.

Starting from only 18 employees and a small B2B platform, Alibaba has become an e-commerce giant in China and already expanded into many other industries. But Alibaba has no plans to stop, Alibaba is now working on an even bigger ambition: to insert itself into ever part of our everyday lives.

On May 20th, Samsung Pay and Alipay announced their intention to merge their online payment businesses. Now, users can import their Alipay account into Samsung Pay and with just one swipe, users can enable Alipay’s QR code. The whole process can be completed within 2 seconds, even if your screen is locked. This is a huge step for Alipay, since the new user experience increases convenience and eliminates the normal steps of finding the app and waiting for it to load. Alipay’s new process drastically decreases the inconvenience of using the QR code as a payment method. But it begs the question, why would Samsung betray UnionPay to partner with Alipay?

Over the past few years, Alipay, WeChat, and other mobile financial and non-financial platforms have become ubiquitous in China. This ubiquity has led to a fiercely competitive market, so increasingly these companies have begun to look overseas, expanding into foreign markets including Japan, Korea, and Southeast Asia. Although they are tremendously successful domestically, China's large tech players face multiple challenges when expanding abroad including regulation, which has become a real challenge for Tencent in Thailand as of late.

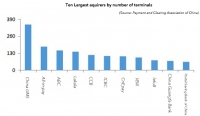

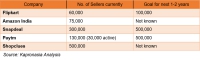

The PBOC-backed 'Payments Clearing Association of China' published its annual report in May. We talked about some of the digital payments statistics from the report in our previous commentary, but the report also features ranking for China acquiring market, which is even more significant because such data has never been officially published before.

The Annual Payments Report by the Payment and Clearing Association of China was published on May 19th and showed the continuing growth in payment transactions in China. The total amount of online payments reached RMB 2,042 trillion, spread between commercial banks and payment service providers (PSPs).

Global payments operator Fortumo and India’s Reliance Communications (RCOM) have launched direct carrier billing where RCOM’s customers can purchase digital content and games by charging the payments to their mobile bill or mobile prepaid account. Reliance customers can now enjoy a host of digital entertainment content on the move on their mobile devices, across movies, music, games and live TV, starting from just Rs. 10 (15 cents) for 1 day of access, all by paying through their mobile postpaid bill and mobile prepaid account.

As a growing number of foreign banks wind up operations in India, IT companies’ revenues from BFSI are growing slower than ever (21% in 2015 vs a projected 10% for 2016). Most IT majors derive a significant portion of their revenues from banking and insurance sectors - as high as 40% in some companies. However, this situation could improve with 'Payments Banks' (PB) set to roll out in the third quarter of 2016.

The long expected payment system of smartphone producer Xiaomi has finally entered the market. By cooperating with China’s dominant card-payment processor China UnionPay, users can now make purchases by using their phone and Xiaomi Pay through China UnionPays’ Quickpass system. The company’s latest offering comes as the third-party mobile payment market continues to grow tremendously. According to research firm Analysys Mason, the market valuation was set at 16 trillion yuan in 2015. This has attracted not only Chinese companies such as Huawei and Xiaomi, but foreign companies, as well.

The pie of banking services in India is well spread out amongst various types of banks, ranging from private sector, public sector, foreign banks, rural banks and even cooperatives. However, market forces are starting to whittle down the once varied field of payment service providers (PSPs), and it is starting to look more like a two horse race similar to other e-commerce markets in Asia.

There's a clearing platform in development that might change the playing field of the payments industry in China. The Payment and Clearing Association of China had a member congress in April and has approved a proposal to build an Internet payment clearing platform for non-bank payment institutions.

The financial services sector in India is at it again; at least the regulators and the mainstream business publications are. Talking up UPI (Unified Payments Interface) as a panacea for India’s challenges with financial inclusion, cash economy (read black money), plateauing digital ecosystem and you name it.

Ecommerce major Flipkart’s acquisition of UPI based startup PhonePe Internet Pvt Ltd shows that the payment space is heating up at a rapid pace. Incidentally PhonePe, the Bengaluru based startup was launched by three former Flipkart executives just four months back, and is focusing on peer to peer payments, bill payment and merchant payments- areas of interest for ecommerce companies.

Earlier this week the Department of Industrial Policy and Promotion (DIPP) came out with guidelines allowing for 100 percent Foreign Direct Investment (FDI) in online retail of goods and services.

China’s fintech sector has enjoyed significant development, but has recently been constrained by more active regulators who have increased their rate of regulation to try and stay ahead of the industry development. After two years of planning and industry development, a public-private body was established by the People's Bank of China - the National Internet Finance Association.

Last week saw the first ever IPO by an Indian e-commerce company. Infibeam’s IPO however, might not provide an accurate baseline for the booming Indian ecommerce industry.

Tencent was reporting its quarterly earnings on March 17th and for the first time the company disclosed its WeChat Wallet fees that the company pays to partner banks. Tencent CEO Pony Ma said the fees are 0.1% of each transaction and totalled more than RMB 300 million in January.

The payments space in India is heating up. Smaller players are looking at exits through consolidation into bigger players. The bigger players have challenges of their own.

The recent move by the National Payments Corporation of India (NPCI) to initiate a ‘Unified Payment Interface (UPI)’ which aims to simplify and provide a single interface across all banking payment systems is a welcome decision. It is understood that 30 banks have evinced interest to commence UPI-based services in the new financial year (April 2016-March 2017) in India.

China’s mobile giant Huawei held a signing ceremony in Huawei's Shenzhen headquarters with Bank of China to co-develop next mobile based payment system Huawei Pay. This announcement was just released after Apple Pay and Samsung Pay claimed to make its entry in to China.

Currently Indian IT companies draw between 25-40% of their revenues from the Banking and Financial Services and Insurance (BFSI) sector. This revenue size of about $35-45 Billion implies that Indian IT continues to draw its sustenance from the BFSI universe.

Although UnionPay is known for its control of the domestic Chinese payment market, it also has over 50 million cards issued overseas. So in other words, a China UnionPay branded card issued by a foreign bank in a foreign country and a foreign currency. In its international push, UnionPay would like its cards to be used both online and offline. Foreign cardholders are increasingly using them for paying at POS and for ATM cash withdrawal, however, there was never a compelling case to use UnionPay cards online, where established card brands like Visa and MasterCard dominate.

The last few months saw some big announcements in the e-wallets space in India. Wallet adoption, particularly on mobile, has been quite rapid in India, with wallet based transactions doubling in both number of transactions (153 Million in 2015 vs 67 Million in 2014) and value ($820 Million in 2015 vs $329 Million in 2014) as compared to the previous year (Q4 comparison from RBI data).

Recently a lawyer in China caused a stir in the payments industry by filing a complaint with the People's Bank of China (PBOC) on Meituan, China’s major O2O platform which is worth tens of USD billions. The complaint alleged that Meituan is engaged in payment settlement without having a required payments license.

The 11 applicants were given a go ahead last year by the RBI to start payments banking services in the country and are readying to start operations around the middle of this year. This will be the Indian central bank's first tryst with pure play fintech enabled service institutions in the country. This will also be a first for several of the licensees planning to operate in this space.

For many years, the Chinese government has encouraged cross-border investment, both to support the domestic stock markets, but to also give domestic investors more choice in investment options and products. One such program was the QDLP program or Qualified Domestic Limited Partner scheme. Due to the renewed focus on controlling outflows, this program is now stopped.

A tightening regulatory policy towards third party payment has driven China's payment industry into a period of consolidation and M&A. For some, this has been a great opportunity to get into other segments of the market like O2O (online to offline). We saw this in 2015 when Wanda bought 99bill. This time it's Lakala with a help of with a company called ‘Tibet Tourism.’

More...

In January 2015, UnionPay Smart, a China UnionPay company specialized in business intelligence, customer profiling and online marketing, announced an agreement with Isobar China, a part of global Top-5 advertising conglomerate Dentsu Aegis. Together with Isobar China, UnionPay Smart will build a data management platform (DMP) targeting online advertising.

When talking about O2O (Online to Offline), we should keep in mind that the key to the O2O business success lays in the hardware and acceptance support from offline merchants. Eventually, it’s up to merchant’s willingness to accept a new digital payment method or not. Beyond the merchant fee and technology required, the key criteria for a merchant to decide is the user base of a particular payment method.

The global payments market has seen a variety of challenges that have restricted payment systems from either successfully expanding overseas or gaining significant market share. Samsung Pay seems to have maneuvered itself around many of the challenges that overseas expansion brings, and has taken steps to increase its global merchant acceptance in the US and China for South Korean consumers.

Many commercial partnerships result in a broader pool of knowledge, increased resources and the prospect for rapid market growth. This is certainly the case for India’s largest payment startup Paytm and Alibaba’s cloud computing division Aliyun who have just signed an agreement that should be a tremendous opportunity for both companies.