According to data from the People's Bank of China, by the end of 2014 China had 614,900 ATMs in operation across the country, up 18.25% from 2013. While certainly a rapid growth, it was actually slower than a year ago when the number of networked ATMs increased by 25.12%, and is significantly lower than its peak growth of 36.18% in 2008.

P2P woes continue in China as illegal fundraising through P2P platforms grew in both 2014 and 2015. When will the government intervene?

Accenture recently released its Accenture North America Consumer Digital Banking Survey for 2015. One of the findings was that banks run the risk of being seen as a 'utility' to their customers. Could the same thing happen in China?

You would be forgiven for missing the news with most of the focus this week on Shanghai's never ending stock market run or the latest mention of liberialization and opening in the bank card clearing market, but now it appears that the insurance industry will be the next segment of China's transforming financial industry to be opened up to competition.

It appears, as the WSJ reported, that the implementation of China's controversial banking technology rules has been paused for the moment. But what can we expect in the future?

China's P2P industry, which is technically a shadow banking / lending channel, continued its explosive growth in 2014 as 1,200 new platforms launched and transaction volumes grew 2.39 times as compared to 2013. At the same time the number of platforms suffering serious problems was 275, up 260% from the year before.

Talked about for many years, one of the key reforms in China's outsized and ambitious plan is the launch of the deposit insurance program. An announcement yesterday confirmed that the program will finally launch in May.

Shanghai based Lufax, one of China’s biggest P2P platforms, has just received a USD 483 million-worth investment from foreign institutional and private investors. Is the investment rearranging deck-chairs on a sinking ship or a clear signal that everything is fine in the troubled P2P industry?

A few days ago, the upstart Chinese manufacturer of android-based smartphones Xiaomi launched a public beta of their new online money-market fund. With Chinese tech companies furiously investing in and creating platforms bundling key products and services together, could we see Xiaomi competing directly with Alipay and Wechat in the near future?

The China Banking Regulatory Commission (CBRC) released its annual banking industry statistics for 2014. Banks accumulated RMB 172.3 trillion in assets, up 13.87% since 2013. The Big 5 large commercial banks had a slower growth rate than the joint-stock commercial banks, 8.25% and 16.50% respectively.

The recent PBOC annual Payments Industry Overview report shows plenty of impressive data and the main message that comes through is that "everything is growing". However, not all growth is the same and the numbers for credit cards industry are especially interesting.

One of the latest ads from Huawei, the large Chinese manufacturer of networking equipment, is a rather disturbing wrapped up ballerina's foot. While the idea is good, the advertisement shows that there's still a gap in understanding between tech and the consumer.

Personal credit ratings in China have never been a pretty subject. Without a centralized credit database accessible to all, getting accurate credit information has proved challenging for any company in China providing loan products. With Ant Financial, the financial arm of Alibaba, launching Sesame Credit, we felt it was worth taking a second look at what might be happening here.

The explosion in margin lending has fueled a baseless rally in the Shanghai Composite, but the magnitude of leverage in the stock market is still coming to light.

Based on a note from the People's Bank of China, China's personal credit scores may very soon be coming from the tech giants rather than any financial institution or credit data provider. On January 5th, the People's Bank of China (PBOC) sent out a note to eight non-banking institutions that they should "prepare for personal credit information operations" within 6 months. Although the note is a bit vague, the effort could indicate the end of what has been a continual problem with personal finance in China.

According to data from Online Lending House, a China P2P industry data provider, as many as 92 P2P websites had issues in December 2014, significantly more than the 76 that had trouble in all of 2013, Some websites went offline temporarily, some products turned out to be fraudulent and some businesses were closed outright.

It's official. Although the bank has already technically been approved (several times), it seems like WeBank, 30% owned by Tencent, will finally make its big splash on January 18th.

Sneaking it in while the west was busy sipping eggnog and taking a break, the Chinese government has big plans for expanding the Shanghai Free Trade zone geographically. The new zone will include some of the most important real estate in Shanghai including the Lujiazui Financial disctrict.

On December 12th, Webank, the proposed bank from Tencent received regulatory approval to start operations.

Kapronasia is pleased to release our P2P Lending in China report. Based on primary and secondary  research, the report is one of the most comprehensive reports on the development of Peer to Peer lending in China.

research, the report is one of the most comprehensive reports on the development of Peer to Peer lending in China.

For more information on the report click here.

The PBOC has announced it will be introducing a deposit insurance system in China, which will have a profound impact on banks’ behaviour. Liberalizing the banking sector may put it on a more sustainable path but short-term risks should not be ignored.

October has been a tough month for China's P2P lending platforms as more and more are pressured to shut down due to capital shortages and fraudulent behaviour.

The digital revolution has finally caught up with the Chinese banking sector. As it undergoes important reforms, industry leaders are faced with numerous challenges and must innovate to stay on top of their game.

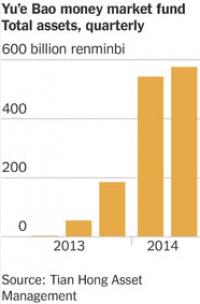

Like a piece of delicious cake, all good things come to an end and after robust growth since the launch, Yuebao has seen the first decline in 2014Q3. According to the data from financial news website East Money, although Yuebao has achieved 5.69 Billion in net profits, Yuebao AUM has declined 6.84% for the first time, reaching RMB 534.89 Billion. Is this part of a larger trend?

After over a year of incredible growth, Yuebao is starting to slow slightly and the expected returns on the platform are dropping down to about 4%, not entirely different than what is possible in a bank. In April 2014, Alibaba made a decision to roll out a new online finance product, a bankers' acceptance online lending.

Last week, Alibaba’s finance arm rebranded their “Small and Medium Financial Services Company today to “Ant Financial Services Group” or “Ant Financial”.

Mr. Li Xiaofeng, head of PBoC Financial IC Card Panel, believes that Chinese payment providers will not play a major role in payments in China's financial industry. “From the scale and channel perspective, Central Bank and commercial banks remain the main payment providers.”

Although Alibaba was in the first round of initial approvals to setup a private bank in China earlier this year, it was only at the end of September 2014 that they finally received approval to move forward on the project along with Juneyao, another large Chinese company who is also looking to setup their own bank.

In the wake of the largest IPO in the U.S., there has been increased attention on China's innovation and its potential disruptive nature on global banking and e-commerce. Yue bao's future strategy is in the spotlight once again.

Tokenization seems have become a buzzword since the Apple Pay announcement. However, the technology itself is not new.

More...

China's online banking and mobile banking continue to be the key channels for customers who interact with their banks through 'e-channels' as data from iResearch, a Chinese online customer survey service provider, shows.

According to Online Lending House, an internet finance news source, P2P transaction volume has reached RMB 81.84 Billion in 1H2014. The most active regions are Guangdong, Zhejiang, Shanghai, Beijing and Jiangsu.

Earlier this year, we published our 2014 “Top-10 China Banking Industry Trends” report and predicted the advent of direct banks. We were right: in a month Minsheng Bank rolls out its Chinese direct banking institution.

On July 25th, Shang Fulin, the chairman of CBRC, disclosed three private banks that had been approved by the CBRC. Hua Rui Bank, planned to be set up by Fosun and Juneyao, was not on the list. Later the Shanghai branch of CBRC revealed that the Fosun and Juneyao partnership had broken up.