India and Indonesia key to Facebook's fintech prospects

Libra is the most visible profile prong of Facebook's fintech offensive, but it may not be the most important. Not for now, anyway. U.S. officials and regulators remain circumspect about Facebook's digital currency project. Facebook has a long way to go before it wins their trust. In Asia, Facebook has a seemingly simpler task: Roll out the digital wallet of WhatsApp to monetize its large regional user base, concentrated in India and Indonesia. That's proving to be difficult too though.

In every crisis, there are opportunities. While many investors are tightening their belts during the coronavirus pandemic, some are opening their wallets. Now is the time to double down on certain investments. Take Australia's Airwallex as an example. The Melbourne-based cross-border payments platform closed a mammoth US$160 million (A$250 million) funding round in April, bringing its valuation to US$1.8 billion from US$1 billion. Less than half of the capital was raised in January, according to Australian Financial Review. Airwallex managed to raise the rest amid the pandemic's surge.

How are Xiaomi's digital banking prospects shaping up?

Xiaomi is the first Chinese smartphone maker to foray into digital banking. The Beijing-based firm secured a digital banking license in Hong Kong last year and began a trial period in late March. It also applied for a digital wholesale bank (DWB) license in Singapore, which allows the holder to provide non-retail banking services.

The Philippines has long been one of the most promising Asian markets for fintechs. The archipelago of more than 7,641 islands has a population of nearly 107 million, second only to Indonesia among Asean countries. Nearly 70% of adults in the Philippines are unbanked, while smartphone penetration in the country is growing steadily. Given the Philippines' geography - with many people living far from retail banks - and development stage, fintech adoption can drive financial inclusion.

Digital banking had been growing steadily in the Philippines prior to the coronavirus outbreak. The pandemic hit the country in early March, resulting in the government implementing a lockdown in the metro Manila area beginning from the middle of that month. Some banks have seen online banking grow more quickly since the restrictions were imposed than previously. Rizal Commercial Banking Corp. (RCBC) posted a 117% increase in new sign-ups for its online banking services from March 17-26 according to fintechnews.sg. RCBC also recorded a 633% increase in the number of times its cardless ATM withdrawal function was used during that period.

Finally after all the discussions about China's central bank digital currency, we're getting close to the actual launch as the platform goes into pilot.

Libra 2.0: evolutionary, not revolutionary

As it turns out, Facebook's much hyped Libra cryptocurrency project is more evolutionary than revolutionary. Libra 2.0, rolled out in mid-April, is modest in its ambitions. Gone is the concept of a global digital currency to potentially rival the dollar and evade regulatory oversight. Instead, Facebook wants to launch a series of digital coins backed by fiat currencies. The proposal includes the idea to build a "digital composite" of some of the coins for cross-border transactions and use in countries with no virtual currencies. Of equal importance, Libra will not be decentralized and "permissionless." That was never going to fly with central bankers or politicians, who don't want to deal with Bitcoin on a much larger scale.

To be sure, many crypto diehards are crestfallen. Even those who are not fans of Facebook liked the idea of an anonymous, decentralized digital currency that might one day challenge fiat currency hegemony. If Facebook could have pulled off such a project, crypto in an iteration close to how Bitcoin founder Satoshi Nakomoto (a pseudonym) imagined it would have finally broken into the mainstream global financial system. When Nakomoto launched Bitcoin in 2009, he sought to reduce our reliance on centralized financial institutions to transfer funds, and instead foster anonymous peer-to-peer transfers on the blockchain.

Australia's neobanks grapple with impact of virus

2020 started well for Australia's neobanks. Deposit bases were growing quickly. Some Australian neobanks were on track to reach their deposit goals well ahead of their sales forecasts. That was before the coronavirus became a global pandemic. The virus has spread like wildfire globally in the past few months, sickening 2.5 million people and causing more than 170,000 fatalities. Australia has not become an epicenter of the outbreak, but it has still had to contend with thousands of cases and entered a strict lockdown on March 23. It is highly likely that the Australian economy will soon enter recession for the first time since 1991.

Under this scenario, neobanks may face a tough uphill climb. Grim economic conditions could affect Australians' willingness to switch their primary banking provider or even open a new account with a different provider.

Hong Kong's virtual banks gradually go live

Hong Kong issued eight digital banking licenses more than a year ago, but just one of the new virtual banks is fully operational, ZhongAn Insurance-backed ZA Bank. ZA Bank began operations this month after completing a mandatory trial in March. Three other Hong Kong digital banks recently began trials: Ant Financial's Ant Bank, Xiaomi and AMTD's Airstar Bank and Standard Chartered-backed Mox Bank. The other four Hong Kong digital banks have not announced when they will launch trials.

Initially, it seemed Hong Kong's virtual banks had arrived in the right place and at the right time. The city has plenty of banking options, but innovation among incumbents has been limited in recent years. Retail customers are eager for new digitally forward banking platforms. But last year's protests and the coronavirus outbreak have delivered a punishing blow to Hong Kong's economy. The city fell into recession well before the global economic malaise brought on by the coronavirus. Hong Kong's digital banks have struggled to gain momentum under these circumstances.

The Singaporean government recently released the second edition of its Model Artificial Intelligence Governance Framework, which includes recommendations for governing Artificial Intelligence that could influence international guidelines and regulations. The updated framework introduces some notable changes from the first edition, which was published back in January 2019. Among them are recommendations that AI developers and operators strive to make their systems human-centric, explainable, transparent and fair. This emphasis on responsible governance is in keeping with the Monetary Authority of Singapore's FEAT guidelines from 2019, and presents a stark contrast to the approach taken by the European Union in their recent white paper on Artificial Intelligence.

Singapore-based Arival Bank is one of the less high-profile applicants for a digital bank license in the city-state. It's easy to get lost in the crowd when you're competing against names like Ant Financial, Xiaomi and ByteDance. Arival Bank, a fintech startup, has applied for the same digital wholesale bank (DWB) license as those Chinese tech giants. In a nutshell, that license allows the holder to serve non-retail clients in Singapore. The Monetary Authority of Singapore (MAS) has said it would issue three DWB licenses.

China's burgeoning blockchain bandwagon

Here comes China's blockchain bandwagon, ready or not. The novel coronavirus may have slowed the Chinese economy down, but now that life is slowly returning to normal, blockchain hype is back. China currently has about 35,000 blockchain companies, according to information portal Tianyacha. In Guangdong Province alone, there are 20,000 of them. Even amidst the coronavirus pandemic, more than 2,000 new blockchain companies were formed between January and March, according to Forkast News.

Unsurprisingly, most of these firms are not focused on distributed ledger technology. Research by Forkast shows that just over 500 of them have a state-issued blockchain service filing number. Without one of those, a company is not a certified blockchain provider in China. China's 01 Think Tank found that about 1,000 of 30,000 blockchain firms in China are engaged in business that uses distributed ledger technology.

The coronavirus outbreak is weighing heavily on the balance sheets of some neobanks, while others appear to be weathering the crisis well. For digital banks in Europe, which is the second hardest hit region behind the United States, the challenge to their businesses is particularly formidable. Very few of Europe's top neobanks by valuation were profitable before the contagion broke out. In fact, they occasionally played down the need to be profitable. WeWork's abortive IPO helped change their calculations. Yet it is hard to see how they will come closer to profitability amidst a painful economic downturn.

What went wrong at China's Starbucks rival Luckin?

In early April, China's Starbucks rival Luckin Coffee was revealed to be a paper tiger. The company that was supposedly giving the U.S. coffee giant a run for its money in the world's largest consumer market had literally fabricated its success. To be sure, Luckin's 4,500 China stores - exceeding Starbucks' 4292 - were no mirage. But the company's sales figures were bogus. On April 2, Luckin publicized the results of an internal investigation showing RMB2.2 billion (US $311 million) in fraudulent sales from the second to the fourth quarter of 2019.

Why is ByteDance venturing into fintech?

China's ByteDance, best known as the owner of the popular TikTok video-sharing app, is reportedly now the world's most valuable startup with a US$75 billion valuation or more. That's quite a price tag. Of course, since the valuation is occurring in private markets, it is difficult to assess its accuracy. WeWork was once worth US$47 billion too. Now the company is fighting for its survival.

To be sure, ByteDance is on firmer footing than Adam Neumann's troubled company. In the quarter ended Dec. 2019, TikTok's short-video app revenue increased 310% annually, according to research firm Apptopia. Overall, ByteDance recorded between US$7 billion and US$8.4 billion in revenue in the first half of 2019, data from Reuters show.

The Kakao Talk messenger app's financial arm became the majority shareholder of Baro Investment & Securities in February, taking a 60% stake in the brokerage. This is the type of cooperation between incumbents and fintechs that Korea's Financial Services Commission (FSC) likes to see. Kakao is focusing largely on the underserved retail segment, with an eye on financial inclusion. Kakao could likely become the definitive Korean super app if its fintech business grows large enough.

Kakao is nearly as dominant in Korea as WeChat was in China when it moved into fintech. The Kakao Talk app has about 50 million active users in a country of about 51.5 million. Kakao Pay, which is already one of Korea's largest fintech platforms, has about 30 million registered users. Kakao Bank, one of the first two neobanks launched in Korea, has about 11.3 million customers.

Virus slows momentum of Hong Kong IPO market

Hong Kong's IPO market was expected to be one of the world's best performing this year, attracting Chinese firms eager to raise capital internationally. Whereas such firms may have preferred listing on the NYSE or Nasdaq in years past, tensions in the U.S.-China relationship have caused many of them to reconsider.

Then the novel coronavirus broke out, sapping the steady momentum that had been building in Hong Kong's capital markets since Alibaba's mammoth secondary share listing in November 2019. Artificial intelligence startup SenseTime is the latest major Chinese tech firm to put off a planned Hong Kong IPO this year. SenseTime will instead seek up to US$1 billion in private funding.

Across Asia, the cashless drive had been gaining momentum long before COVID-19 broke out in late 2019. In less than a decade, China, the region's largest and the world's No. 2 economy, has transformed from a cash-dominant into a cash-light economy. Its neighbors have been following suit.

A 2019 McKinsey study found that digital payments in Asia are growing at a roughly 15% annual clip, more than 2.5 times the typical economic growth rate in the region. Overall, cashless payments have been underpinning the rise of digital banking across APAC.

Asia may be at an inflection point for cashless payments as the coronavirus rages globally and hygiene concerns about the use of physical currency are growing.

Japan mulls central bank digital currency

Japan stealthily has become among the world's most pro-crypto countries. Amidst the boom and gloom that have defined the crypto space, Tokyo has avoided irrational exuberance or draconian restrictions on the use and trade of virtual currency. Instead, it has quietly incorporated digital currency into its existing financial system, linking it to the wider push to boost cashless payments. In Asia, no nation has been more consistent in its crypto approach. The next logical step would be to create a central bank digital currency. Japanese officials, however, have yet to commit to a CBDC. Pressure is mounting though, especially as China pushes ahead with its sovereign digital currency.

Pressure builds on Philippines to strengthen AML regime

The Financial Action Task Force (FATF ) told the Philippines in October to improve its anti-money laundering regime or else face the possibility of being placed on the organization's blacklist once again, an unenviable position. FATF gave Manila one year to get its house in order. The Philippines does not want to be on that blacklist: Banking sanctions could ensue that would make it harder for Filipino workers to remit money home, while foreign countries could increase due diligence checks on Philippine companies. Philippine banks might also charge higher interest rates as their own costs rise due to the tougher business environment.

“We cannot afford to have the Philippines in the FATF’s list of high risk and non-cooperative jurisdictions. Hence, we should be very strategic in our focus for the next 12 months,” Bangko Sentral ng Pilipinas Governor Benjamin Diokno said last October.

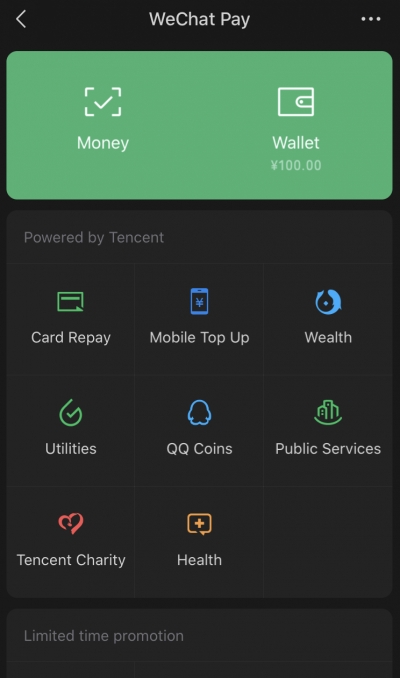

How will COVID-19 affect WeChat Pay's global expansion?

WeChat Pay has for several years been trying to develop its business outside of China. The first step is usually to partner with local merchants, making WeChat Pay available at points of sale where Chinese tourists shop. The second step is to target the local market. Thus far, WeChat has been more successful capturing Chinese tourists' wallet share overseas than in becoming a trusted local digital banking provider.

The novel coronavirus outbreak could slow WeChat Pay's global expansion considerably in the short term. Put simply, what happens if your international payments business primarily depends on Chinese tourists and suddenly there are none?

The competition for Singapore digital banking licenses is heating up as yet another fintech throws its hat into the ring. This time, the contender is homegrown fintech MatchMove which is applying for a digital full-bank (DFB) license together with Singapura Finance, the Thai blockchain startup LightNet and the London fintech startup OpenPayd. There are only two DFB licenses up for grabs. They allow licensees to conduct both retail and corporate banking. Digital wholesale bank (DWB) licenses are valid only for non-retail banking.

Tencent launches virtual credit payment product Fenfu

On March 26th, Chinese internet giant Tencent’s messaging app WeChat launched a test version of a virtual credit payment product called Fenfu (分付). Fenfu, which literally means "installment payment," allows users unable to get a credit card from a bank to spend money first and later pay it back with WeChat. There is no fee for using Fenfu, which is focused on offline consumption. The virtual credit payment product does not support WeChat transfer and red envelope function.

What went wrong at India's Yes Bank?

Yes Bank, one of India's largest private lenders, posted a US$2.5 billion loss in the October-December period as non-performing assets surged to 19% from just 2% a year earlier. To stymie further deterioration, the Reserve Bank of India (RBI) stepped in and took over Yes Bank in February. The bank's founder, billionaire Rana Kapoor, was arrested and accused of money laundering and taking kickbacks. Kapoor denies the charges.

Yes Bank's downfall is a cautionary tale of what can happen when a lender in an ascendant emerging market gets too big too fast, while taking on excessive risk. Yes Bank was the most gung-ho of India's non-public lenders established in the past two decades. Deep-pocketed foreign investors liked its focus on growth, which helped Kapoor and his colleagues ensure a steady flow of funding.

Singapore-based Credify, a digital identity startup, closed its US$1 million seed-funding round in late February. Leading the round were venture capital firm Beenext and Deepcore, a SoftBank-backed Japanese artificial intelligence incubator. Credify provides digital identity and trust system solutions aimed at mitigating credibility issues in e-commerce and lending. Credify says that it will use the seed funding to enhance its product suite, boost localization of software development in Southeast Asia and push ahead with client engagements.

Tencent and Alibaba duke it out in the Middle East

The leading enabler of digital commerce across the Middle East and Africa region, Network International, made an agreement with Tencent Holdings Limited in February 2020 that will enable millions of Chinese tourists to transact through Network International’s extensive UAE merchant network with their WeChat mobile wallets.

The largest merchant acquirer in the United Arab Emirates, Network will perform as a settlement partner or acquirer as well as solution provider in order to enable mobile-based transactions via WeChat Pay at points of sale as well as for online purchases.

Gaming company Razer isn't the most obvious shoo-in for one of Singapore's digital banking licenses, but has unique advantages it brings to the table. Those include a user base 80 million strong primarily composed of millennials, one of the key target demographics of neobanks. Razer established a fintech unit in 2018 to respond to the need for in-game payment. If it gets the license, Razer wants to expand its digital banking services beyond East Asia to the Middle East, Europe and North America.

The United States is currently focused on fighting the coronavirus outbreak, which has surged in the country since early March. Containment efforts are occupying much of the government's time, and with good reason. The massive health and economic threat posed by the virus means that Washington has little time for less pressing matters. Yet underlying tensions between the U.S. and China remain, with the financial sector the next front of an emerging cold war.

In early March, U.S. lawmakers sought to curb the access of Chinese telecoms giant Huawei to American banks. The White House had mulled doing so in December but decided against it amidst a flurry of activity to reach a phase-one trade deal with China. The NETWORKS Act introduced earlier this month would effectively ban 5G producers such as Huawei from accessing the U.S. financial system if they are found to be violating sanctions or engaging in industrial or economic espionage.

North Korea's growing nuclear program has long been a point of contention between the U.S. and China. Beijing prefers to handle its mercurial neighbor with kid gloves while Washington favors a tougher approach, namely economic sanctions. To evade sanctions in the digital age, Pyongyang has upped its hacking game. Both banks and cryptocurrency exchanges are victims. Digital currency offers North Korea a way to raise funds and do business outside the US dollar led global financial system. North Korea stole more than US$2 billion from both traditional financial institutions and crypto exchanges - including South Korea's Bitthumb - the United Nations said in an Aug. 2019 report.

Hong Kong's future as a financial center at a crossroads

Well before COVID-19 broke out, Hong Kong's future as a global financial center was in question. The protests that broke out last year have raised concerns about the city's ability to maintain its unique competitive strengths. Further erosion of political stability and the rule of law will augur ill prospects for the former British colony. In the short run, it is true that none of Hong Kong's neighbors can challenge its position as the region's preeminent financial center. But Hong Kong cannot assume that will never change.

How are China's fintech giants responding to COVID-19?

The novel coronavirus outbreak has crimped business activity across China, bringing the world's second largest economy to a virtual standstill. Yet amidst those unprecedented conditions, China's fintech giants have been busy developing digital solutions to mitigate COVID-19's impact. Some of the solutions are aimed squarely at the consumer economy, while others support government efforts to track people's health status.

More...

P2P lending in South Korea faces rising backlash

Peer-to-peer lending is one of the fintech segments that most struggles to gain credibility. Next to cryptocurrency, it may be the most susceptible to scams. But it is not only borrowers who are at risk. Lenders can easily get burned when borrowers default. Since many borrowers on P2P lending platforms are those unable to get a loan elsewhere, their credit is typically not optimal.

P2P lending began growing quickly in South Korea about four years ago, offering attractive returns to investors amidst very low interest rates. Some P2P businesses began venturing into risky investments such as real estate project funds, non-performing loans and mortgages. South Korea had 239 P2P lenders in December 2019, up from just 27 four years earlier. Their outstanding loan balance totaled 2.38 trillion won.

Cambodian and Thai regulators recently announced the launch of an interoperable payment QR code for use between Cambodia and Thailand. Cambodian tourists who visit Thailand may now use their mobile banking app to pay in Cambodian riel when shopping at stores that display a Thai QR Payment sign, while the same functionality will be extended to Thai tourists in Cambodia by Q3 this year.

A collaboration between the Siam Commercial Bank (SCB) and five Cambodian commercial banks, the interoperable QR code was developed upon domestic electronic transfer system PromptPay which runs on Vocalink infrastructure. ACLEDA Bank PCL, Cambodia Commercial Bank (CCB) and the Foreign Trade Bank of Cambodia (FTB) are sponsoring banks of the collaboration, which mean that other banks would be required to work with the three in order to provide the service.

WhatsApp Pay closes in on long anticipated India launch

The India digital payments market makes for a fascinating contrast to China's. Unlike China, India has allowed foreign tech giants to compete on a mostly level playing field against its homegrown firms. In fact, Chinese tech giants are strategic investors in some of those Indian fintechs. Competition in the surging Indian payments market - Credit Suisse reckons it will grow fivefold to US$1 trillion by 2023 - is fierce. Google Pay is the market leader followed by Walmart-backed PhonePe according to research firm Razorpay. India's own Softbank-backed Paytm has fallen behind. AmazonPay is also vying for market share.

Entering into this fray is WhatsApp Pay, the digital wallet of the global messaging giant. WhatsApp Pay is aiming to do what in India what WeChat did in China: Segue from chatting and photo sharing into digital banking on the back of a popular messaging app. The difference is that WhatsApp Pay has a lot more competition. The only major digital wallet WeChat faced was Alipay. Interestingly though, WhatsApp has about as many users in India - 400 million as WeChat had when it expanded into digital banking in 2014. Today, WeChat has more than 1 billion users, mostly in China.

Why did global fintech deals fall 3.7% in 2019?

Fintech investment declined 3.7% in 2019 to US$53.3 billion as deals in China dropped off dramatically, according to a report published by Accenture in February. The slow in China deal flow can be attributed in part to the protracted U.S.-China trade war. Investor enthusiasm for the China market has cooled amidst an uncertain business environment. China's economy grew 6.1% in 2019, the slowest pace in three decades. At the same time, it would have been hard for China to equal its 2018 deal tally, buoyed by Ant Financial's mammoth US$14 billion funding round.

It is important to note that some of the most high-profile fintechs which raised millions of dollars last year have yet to break even, never mind post a profit: Revolut, N26, the fintech units of Grab and Gojek, to name a few. Yet, that did not stop investors from continuing to support their costly expansion. Accenture's data show that the 92% drop in China's fintech investment was the main reason for the modest decline in global fintech investment last year.