South Korea goes cashless all over again

South Korea is going cashless. Again. This time it's e-wallets and digital banks driving the trend, not credit cards. South Korea is already one of the world's most credit-card friendly countries. By some estimates, it has the world's highest credit card penetration rate. South Korea also has the world's highest internet connection speeds. These factors are much more integral to South Korea's Cashless 2.0 movement than covid-19, even if the pandemic is pushing more of the economy online.

China's P2P lending endgame

China's peer-to-peer lending crackdown has been a lesson in risk management with Chinese characteristics. While SOE juggernauts in China may be too big to fail, the P2P lending sector was too big to prevail. Massive scams on the largely unregulated platforms defrauded retail investors of their life savings, threatening social stability. The China Banking and Insurance Regulatory Commission reckons that P2P lenders still owe depositors about RMB 800 billion (US$115 billion). There are just 29 P2P lenders left in China today, compared to 6,000 when the crackdown began in 2015.

Indonesia's digital wallets benefit from e-commerce surge

Indonesia's e-commerce market is surging amid the pandemic, giving a big boost to digital wallets. Transactions at the four largest e-commerce sites in the country will double to US$29 billion from US$14 billion in 2019, according to a study by the Bank of Indonesia published in July. Digital wallets accounted for 90% of cashless payments in the first five months of the year, while bank cards handled the rest.

Grab boosts fintech services, downplays profitability

Ride-hailing Grab is pushing deeper into digital banking, launching an auto investment service similar to Ant Group's Yu'e Bao. In Grab's case, the AutoInvest service allows users to invest - the minimum is set at just S$1 - while using the company's ecosystem. Fullerton Fund Management and UOB's fixed income funds are responsible for the investments. They expect annual returns of 1.8%, similar to what banks in Singapore offer. At the same time, Grab plans to offer third-party consumer loans from licensed bank partners, with which the ride-hailing giant will integrate APIs.

Why is Lufax planning a U.S. IPO?

Amid clouds of a U.S.-China financial war, Hong Kong is fast becoming the default for Chinese fintech IPOs. The former British colony offers liquid capital markets both close to both home and global investors. But there are exceptions. Lufax, one of China's largest online wealth management platforms, is reportedly instead eyeing a New York IPO that could raise up to US$3 billion. If Lufax moves fast, it can list in the U.S. before new rules go into effect that may prevent Chinese firms non-compliant with American accounting standards from listing on U.S. exchanges.

Revolut's losses tripled. Does it matter?

It is not often that a company can shrug at its losses growing 300%. But in the world of fintech unicorns, where we don't always know what is real and what is make believe, going deep into the red is par for the course. Just ask Revolut: The UK's most valuable fintech startup lost £107 million in 2019, more than triple the £33 million loss a year earlier. A hiring spree was largely responsible for that, the company says, noting that it its headcount rose to 2261 from 633. Otherwise, Revolut says that it is in shipshape and expects to be profitable by year-end, pandemic or not.

While Alipay and WeChat Pay maintain a duopoly over China's mobile payments market, that duopoly does not warrant the antitrust investigation reportedly in the works. To be sure, no competitor has emerged able to pose a credible challenge to the duopoly, but primarily for reasons out of the companies' control. Beijing's market barriers have been key enablers of Alipay and WeChat Pay's ability to dominate mobile payments. Together they control 94% of China's mobile payments market, Alipay 55% and WeChat Pay 39%, according to research firm Analysys.

WeLab looks to stand out among Hong Kong's virtual banks

Hong Kong's eight virtual banks largely represent vested banking and tech interests in the city. Most of the newcomers are actually oldcomers if you stop to think about how well established they are outside of Hong Kong's nascent digital banking segment. WeLab, a Hong Kong-based fintech startup, is the exception. Founded in 2013 by ex-Citibank executive Simon Loong and two other partners, the company has steadily grown over the past seven years, and says it now has 40 million customers and disbursed more than HK$50 billion in loans in Hong Kong, mainland China and Indonesia. WeLab's Hong Kong virtual bank went live in July.

Kakao Bank defies downturn, posts record earnings in Q2

It's good to be Kakao Bank. Kakao was already South Korea's most successful neobank story before it reported record earnings in the second quarter of 26.8 billion won ($22.6 million), a nearly 900% year-on-year increase from 3.0 billion won a year earlier. Kakao's net profit for the first half of the year reached 45.3 billion won, a more than fourfold increase from 9.6 billion in the first half of 2019. That Kakao achieved this exponential growth amid the pandemic and a weak overall South Korean economy is particularly impressive.

According to Kakao, its profits surged on the back of rising net interest income and commissions from the sale of financial products. "We were able to make more profit from increased revenues from lending and fees from partnering with credit card companies and brokerages," the company said in a statement published by South Korean media.

The picture for Kakao Bank's lending business is fairly rosy. Its outstanding loan balance grew to 17.68 trillion won in the second quarter, up from 14.88 trillion won a year earlier. Financial inclusion is one name of the game as well: Kakao said it provided 660 billion won in mid-rate loans to consumers with mid- to low-level credit scores from January to June and plans to disburse a total of 1 trillion won of such loans in 2020.

Like many successful fintechs, Kakao Bank is steadily developing partnerships with key incumbents. It has four local credit card partners in South Korea, including Shinhan Card and Samsung Card. From April to July, Kakao issued 260,000 credit cards, according to The Korea Herald.

Kakao Bank also has a burgeoning equities trading business. As of late June, it had more than 2.18 million such accounts, up from 1.14 million in December 2019. Its partners among incumbents include Korea Investment & Securities, NH Investment Securities and KB Securities.

At the same time, Kakao Bank benefits from the stickiness of the Kakao ecosystem, which is a super app in all but name. Kakao Bank already has 11 million monthly active users, more than half who are under age 50. And there are many more potential customers where those came from: The dominant KakaoTalk messaging app has almost 45 million monthly users, about 87% of South Korea's population.

Thanks to its strong brand name and ecosystem, Kakao Bank managed to reach profitability in just two years from its establishment in 2017. Further buoying its growth was when its parent company Kakao Corp became the virtual bank's majority shareholder, the first instance in Korea of a non-financial firm holding a majority stake in a bank. That change allowed Kakao Bank to issue new shares worth 500 billion won and increase its paid-in capital to 1.8 trillion won.

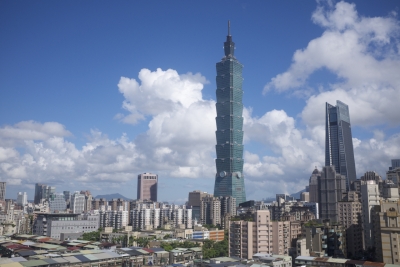

Can Taiwan become a regional financial center?

When it comes to Asian financial centers, Hong Kong and Singapore are no longer the only games in town. Tokyo, Seoul and Sydney have recently signaled intent to bolster their financial sectors and take on a larger regional role. Yet right on Hong Kong's doorstep there is another potential contender: Taiwan. In recent weeks, Taiwan's government has highlighted its plan to develop a more globally oriented financial sector. That will be easier said than done. Taiwan takes a fundamentally conservative approach to finance that will not be easily changed.

Pandemic takes toll on Australia's neobanks

Before covid-19, the sky seemed to be the limit for Australia's virtual banks. They were rapidly accruing users, in some cases surpassing their own forecasts. Venture capital kept flowing into their coffers. The pandemic slammed the brakes on the neobanks' ascendancy. Demand in Australia remains for innovative digital banking services - if the neobanks can survive the downturn. Since the neobanks are startups built for fast growth, rather than steely resilience, they face a long road ahead.

Can Vodacom and Alipay build a super app for South Africa?

The super app is the most elusive of tech platforms. It's not easy to bundle messaging, digital banking, e-commerce and content into one tidy package at enormous scale. So whenever we hear about platform companies ready to bring users a super app, we take it with a grain of salt. It's not easy to duplicate the success of WeChat or Alipay in mainland China. The latest company to throw its hat into the super app ring is South Africa's telecoms giant Vodacom Group, which is teaming up with Alipay.

Shanghai's STAR board shakes up China's capital markets

Shanghai's STAR board is introducing a more market-driven approach to China's initial public offerings. Listing on the STAR market is more streamlined than the traditional process in China, where new listings are subject to an informal price cap of 23 times earnings and a 44% ceiling for first-day gains. Before the Shanghai STAR Board was launched it July 2019, it could take many years before companies' plans to go public were approved. Now a flurry of tech listings on the Shanghai STAR market are shaking up China's capital markets.

Why is Monzo struggling more than Revolut?

As the pandemic-induced downturn worsens, two of the UK's most prominent neobanks are taking diverging paths. Revolut continues to defy gravity. It raised yet another US$80 million as part of an extended Series D round in July. In total, Revolut raised US$580 million in that round at a valuation of US$5.5 billion, unchanged from February. Monzo, on the other hand, appears to be on shakier ground. While Monzo recently managed to raise another US$76 million, its valuation plummeted 40% to US$1.6 billion from US$2.6 billion. Worse yet, the company's annual report reveals heavy losses of US$149.5 million in its 2020 fiscal year, up 140% from the previous year's US$62 million.

The Philippines has not raced to go cashless. Efforts to digitize the financial system got underway nearly two decades ago, but have made limited inroads. Cash still accounts for 90% of transactions, according to the Better than Cash Alliance, and looked like it was going to remain dominant - until the pandemic. Within a few months, the payments landscape has changed dramatically in the Philippines, with digital payments emerging as a must-have.

Will Brazil greenlight WhatsApp Pay?

WhatsApp Pay just can't catch a break in the largest BRICS economies. China banned WhatsApp ages ago, so launching a payment app there is a moot point. India is ambivalent, as seen by a seemingly endless approval process. Brazil is the latest BRICS country to get cold feet about Whats App Pay. Things started out well enough when the company launched its payment app in Brazil on June 15. Yet within a week, Brazil's Central Bank ordered it to shut down. Now Brazilian regulators are suggesting that they may allow WhatsApp Pay after all, as long as Facebook comports itself properly.

Digital banking race in Malaysia accelerates

The pandemic has disrupted Malaysia's digital banking plans, but the ensuing delay may be a boon for interested firms that now have more time to select partners. The original contenders for up to five digital bank licenses include ride-hailing giant Grab, telecoms juggernaut Axiata Group Bhd (owner of e-wallet Boost) and the banks CIMB, Affin Hong Leong, AMMB Holdings and Standard Chartered Bank. Those banks are now reportedly less interested in obtaining a license, while several non-financial firms may throw their hat into the ring: gaming giant Razer, conglomerate Sunway Group, telecoms company Green Packet. Hong Kong investment bank AMTD may also bid for a license.

2 listings are better than 1 for Ant IPO

For the IPO of China's fintech giant Ant Group, two listings are better than one. Instead of going public only on the Hong Kong Stock Exchange or the Shanghai STAR Market, Ant plans to list on both. Ant has not disclosed the size of its coming IPO, but the firm is reportedly valued at US$200 billion, up from US$150 billion during its 2018 fundraising. Ant reportedly plans to sell 10% of its shares through the twin listing, which could come this year or in 2021. An uncertain market outlook will inevitably weigh on timing.

Paytm bets on insurance

It is not easy to stand out in India's crowded payments segment. Users are spoiled for choice. There's Google Pay, Walmart-backed PhonePe, Alibaba-backed Paytm, or Amazon Pay, and perhaps one day WhatsApp Pay - if Indian regulators ever let it operate in the subcontinent. In theory, the first payment provider that can build a super app that bundles together all the services users want in one place will be the biggest winner. But that has proven elusive. It might be enough to build the best digital financial services platform - and forget about the rest. Paytm's entry into the insurance sector follows this line of thought.

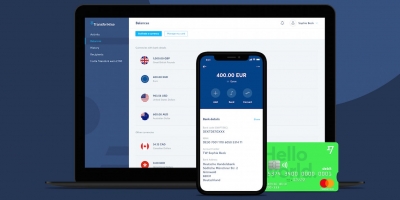

TransferWise is on a roll

London-headquartered TransferWise continues to buck pandemic-induced economic malaise. The money-transfer firm is one of the few fintech unicorns that was profitable before covid-19 hit. With cash saved for a rainy day, it has continued to expand strategically over the past six months. TransferWise has reportedly reached a valuation of US$5 billion, a 30% increase over its previous US$3.5 billion price tag, in a secondary share sale that raised roughly US$300 million. The U.S. hedge fund D1 Capital bought US$200 million in TransferWise shares as part of the deal, according to Sky News. Other key investors in TransferWise include Merian Global Investors, Andreessen Horowitz and Sir Richard Branson.

Can Airwallex disrupt the global payments system?

Airwallex is among a handful of fintech unicorns that have closed huge funding rounds in the middle of the coronavirus pandemic. In April, Airwallex raised US$160 million from investors as its valuation climbed to US$1.8 billion. Airwallex was established in Australia in 2015 and while now headquartered in Hong Kong, is still considered an Australian fintech. The company has sought to capitalize on demand for cheaper cross-border payments services among SMEs in its home market, where the major banks are notorious for charging high foreign-exchange fees. Airwallex says that its machine-learning technology enables fast, inexpensive and transparent global payments.

Japan sees catalyst to go cashless

Japan has been trying to digitize financial services for years, given the high costs of maintaining a cash-based economy and the need for convenient payment options during the upcoming Olympics. The government's"Cashless Vision" initiative that seeks to increase non-cash transactions to 40% by 2025 began back in 2018, well before the covid-induced cashless drive that's sweeping across Asia. Going cashless to promote hygiene would probably seem superfluous in Japan, a country already known for its exacting hygiene standards.

AMTD will take controlling stake in FOMO Pay

AMTD is stepping up efforts to build a regional fintech ecosystem in Southeast Asia and plans to take a controlling stake in Singapore's FOMO Pay, a payments solution provider. The FOMO Pay deal follows AMTD's recent acquisitions of the leading insurtech PolicyPal, and CapBridge, Singapore’s first regulated securities exchange for digital assets and private companies.

Southeast Asia's most valuable tech startup is coming down to earth at last, despite maintaining a sky-high valuation of more than US$14 billion. Faced with the pandemic-induced downturn, Singapore-based Grab is scaling back its ambitions and remarkably, cutting costs. That involves eliminating some superfluous business units and trimming about 5% of its workforce. Grab's professed goal is to rejig its operations to focus on three core businesses: ride-hailing, food delivery and digital banking. Its unstated goal is to get its finances in order so that its bid for a Singapore digital full back license is successful.

The Hong Kong IPO market's hot streak shows no sign of slowing down, despite political turmoil and the pandemic-induced downturn. The reason is simple: Whatever changes come in Hong Kong, Chinese firms are prepared for them. After all, the firms listing on the HKEX are all based on the mainland. At the same time, China's economy is gradually recovering. Business activity is picking up.

China's payments market is so big that U.S. credit-card giants reckon it's better to arrive late to the party than never. Although China's fintech giants Ant Group and Tencent control about 90% of the US$27 trillion payments market, the remaining 10%, at US$2.7 trillion, is not exactly chump change. Among the U.S.'s big three card companies, Amex is the first to have its clearing license approved for China. That first mover's advantage, coupled with cooperation with numerous local banks and payments firms, could give Amex an edge over Visa and Mastercard.

Australia enters open banking era

Australia launched its open banking regime on July 1, ushering in an era of increased competition and customer choice. The regime allows a customer of any of Australia's Big Four banks - National Australia Bank, Commonwealth Bank, Australia and New Zealand Banking Group and Westpac - to ask that their account and card data be sent to a third party accredited by the Australian Competition and Consumer Commission. In November, mortgages and personal loan data will be introduced, while smaller banks will join in 2021.

Cambodia steps up digital banking initiatives

Cambodia's digital banking initiatives are increasingly on the money. The Kingdom has focused on fast-tracking digital banking to boost financial inclusion and develop the broader banking sector, which only serves a limited portion of the population. Just 22% of Cambodia's population of 16.2 million is banked. The good news is that fintech is bringing more Cambodians into the formal financial system. In 2019, active digital wallets in Cambodia jumped 64% to 5.22 million, according to a June report by the National Bank of Cambodia (NBC).

Pandemic delays launch of Taiwan's virtual banks

Taiwan's virtual banks were supposed to go live this summer but the coronavirus pandemic has delayed the launch date. The three neobanks, which include consortia led by Line Financial, Chunghwa Telecom and Japanese e-commerce giant Rakuten, will likely launch later in the year, according to Taiwan's Financial Supervisory Commission (FSC). The three neobanks have yet to start one-month operation simulation tests, a pilot period required by the FSC to ensure the banks are in shipshape.

Is India picking winners among fintechs?

China and the U.S. have both invested big in Indian fintech. Google Pay is one of the most popular digital wallets in the country, along with Walmart-backed PhonePe and Alibaba-backed Paytm. Facebook recently invested in India's Jio in a bid to build the subcontinent's first super app. There's just one problem: Indian regulators are concerned that foreign companies may dominate India's fintech market. WhatsApp Pay has yet to receive approval to launch in the subcontinent, two years after applying for a payments license. At the same time, New Delhi is cracking down on Chinese apps and enhancing scrutiny of Chinese investment amid rising geopolitical tensions with Beijing.

More...

What went wrong at Wirecard?

It was only a matter of time before an erstwhile high-flying fintech crashed amid the pandemic-induced downturn. After all, what goes up always comes down. What surprises us is that the insolvent party is not a unicorn with an inflated valuation in private markets, but a listed company founded in 1999: Germany's Wirecard. One would think that Wirecard would be able to manage the basics of banking and not cook the books. Unfortunately, creative accounting looks like the only explanation for how Wirecard "misplaced" US$2 billion that probably did not exist in the first place.

Cashless payments steadily gain momentum in Vietnam

By now it's a familiar story: COVID-19 is driving cashless payments adoption in Southeast Asia. As one of the region's key economies and recipients of fintech investment, Vietnam is a market to watch. What's notable about Vietnam is that it's better poised for an economic recovery than almost any other country because of how well it has controlled the coronavirus pandemic. While the rest of the world was in recession, Vietnam's economy grew 0.36% in the second quarter, beating a 0.9% contraction forecast by economists surveyed by Bloomberg.

Singapore's digital banking race accelerates

The Singapore digital banking race is accelerating. The Monetary Authority of Singapaore (MAS) has winnowed down the applicant field from 21 to 14. While the MAS did not say which contenders failed to make the cut, observers close to the matter say that the consortia headed by Grab/Singtel, Sea, Razer and MatchMove have all advanced to the next round. Those four applicants are all bidding for a coveted digital full bank (DFB) license, which permits holders to serve both retail and non-retail customers. The MAS plans to issue a maximum of two DFB licenses.

When will Starling Bank reach profitability?

The UK's Starling Bank is that rare neobank that espouses an interest in profitability. Who would have guessed in the wake of the 2008-09 global financial crisis, when fintech was in its naissance, that the banks of the future wouldn't worry about making money? Starling though remains of a more traditional mindset than its contemporaries Revolut, Monzo and N26. That can be attributed in part to its founder Anne Boden, a banking veteran who previously worked at Lloyds, Standard Chartered, AON Corporation, UBS, ABN AMRO and RBS. In May, Starling closed a £40 million fundraising round led by current investors JTC and Merian Chrysalis Investment Company Limited.