Will Asia embrace Revolut's 'global financial super app?'

Revolut always thinks big, so it is no surprise that the UK neobank unicorn is now billing itself as a global financial super app. Revolut's CEO Nikolay Storonsky spoke about this topic at Singapore's recent Fintech Festival. It was hard not to see the irony there. While Revolut was talking about its super app dreams, Grab-Singtel, Sea Group and Ant Group were mulling how to best use their newly won Singapore digital bank licenses. Revolut was not even in the running for one. It dropped out of the race more than a year ago due to the stringent capitalization requirements.

CHAI aims to shake up Korea's payments market

South Korea's digital payments market has grown at a brisk clip amid the pandemic. From January to November, contactless payments rose 17% as businesses and consumers shifted to online transactions, according to the Bank of Korea. E-commerce transactions rose 26% during that period. It is against this backdrop that the Korean startup CHAI sees an opportunity for an API that allows online merchants to accept more than 20 payment systems.

Losers of Singapore digital banking race must shift gears

Now that Singapore's digital banking race is over, the losers must shift gears. And there were far more failed than successful bids. Of the 14 applicants which made it to the final round, only four were awarded licenses. The Monetary Authority of Singapore (MAS) may issue a fifth license in the future, but none of the remaining 10 applicants will sit around waiting for that day. Instead, they will look for opportunities outside of Singapore.

When will Japan launch a CBDC?

Japan may be a cashless payments laggard, but it still plans to launch a central bank digital currency (CBDC). Tokyo's newfound interest in a digital yen derives at least in part from a desire to stay competitive with China. Beijing's launch of DCEP pilots this year showed that it was leaps and bounds ahead of other countries in the CBDC department. At the same time, a CBDC offers Japan a chance to accelerate the overall digitization of its financial system. Cash still accounts for about 73% of all transactions in Japan.

ShopeePay's Indonesia surge is turning heads

E-commerce is an ideal platform from which to launch a digital payments business. Alibaba figured that out early on, launching Alipay back in 2004. Today, it is hard for any e-wallet to become as dominant as Alipay, especially in a market as competitive as Indonesia. Yet Sea Group's ShopeePay is fast becoming one of Indonesia's most popular e-wallets on the back of Shopee's ascension. Shopee was Indonesia's top e-commerce platform by site visits in 2019 and looks set to repeat that feat this year.

Lufax's pivot away from P2P lending pays off

Lufax is one of the few prominent Chinese fintechs that foresaw tighter regulation of online lenders, perhaps because the company began as a peer-to-peer lender. As Beijing in 2017 launched what would become a sustained campaign to eradicate the scandal-ridden P2P lending sector in China, Lufax moved to exit the industry. By 2019, Lufax had transformed from a P2P lender into an online provider of credit facilitation and wealth management services. It is thus no surprise that Lufax is weathering the current microlending crackdown well so far. The company's IPO went off without a hitch in New York, raising US$2.4 billion.

Big platform companies prevail in Singapore digital banking race

The Monetary of Authority of Singapore (MAS) set the bar high for aspiring digital banks to ensure that the licensees would be well capitalized and have a clear path to profitability. The stringent requirements ensured that defiant upstarts like the UK's Revolut opted out of the competition. In the end, the MAS awarded four licenses, two digital full bank (DFB) and two digital wholesale bank (DWB). There were few surprises. The winners were primarily big platform companies long considered leading candidates. The one exception was the consortium made up of Greenland Financial Holdings, Linklogis Hong Kong and Beijing Co-operative Equity Investment Fund Management, which was awarded a DWB license.

Hong Kong stock listings hit 10-year high despite nixed Ant deal

Hong Kong's IPO market has been almost unstoppable in 2020. Neither the worst pandemic in a century nor the nixing of Ant Group's long-anticipated blockbuster debut have been able to dampen market sentiment for long. To be sure, fintechs have shelved plans to list in Hong Kong, but there are many other Chinese companies unaffected by the microlending crackdown eager to go public in the former British colony. In fact, while the fintech unit of JD.com will likely delay its listing indefinitely, JD's health unit is set to raise US$3.5 billion.

Indonesia's e-wallet wars could weigh on Gojek's digibanking dreams

Gojek began more than a decade ago as Indonesia's answer to Uber. It since has evolved into a large platform company with super app ambitions. For Gojek, the key to becoming Indonesia's dominant app lies in mass monetization of its e-wallet services. The trouble is, that's easier said than done. Indonesia has a surplus of e-wallets all trying to cash in on the booming segment. User loyalty is shaky.

Illegal online gambling proliferates in China's digital economy

China is strict about gambling, only permitting it in the special administrative region of Macau. Elsewhere in the country, gambling is illegal. China's restrictions on gambling cover cyberspace too. Yet that ban is hard to enforce, especially as the pandemic has pushed so much economic activity online. According to a recent Caixin report, some of China's largest internet companies have become party to the illegal online gambling ecosystem. The internet giants may not be privy to the illicit transactions, in some cases because of inadequate due diligence.

Chinese tech giants vie for Singapore digital bank licenses

Three Chinese tech giants are competing for digital wholesale bank licenses (DWB) in Singapore: Ant Group, Xiaomi and ByteDance. Ant Group applied for the license alone, while Xiaomi (with AMTD) and ByteDance lead respective consortia. Prior to its abortive IPO, Ant had been widely considered one of the top candidates for a DWB. Ant's online banking experience far outstrips that of Xiaomi or ByteDance. However, China's crackdown on microlending could a deal a blow to Ant's prospects.

Kakao is dominating South Korea's nascent digibanking sector

Kakao Bank is having an exceptional year, setting the stage for a blockbuster IPO in 2021. Kakao's third-quarter profit rose more than 700% year-on-year to 40.6 billion won (US$35.9 million). Through September, Kakao had recorded 85.9 billion won in profits, up more than 458% annually. The Seoul-based neobank attributed its outstanding third-quarter performance to additional interest income and its non-interest business swinging to profitability for the first time.

How will China's fintech crackdown affect Tencent?

China's fintech boom was great while it lasted. The abortive Ant Group IPO heralded the end of that era. That's not to say that digital finance will fade away in China. Rather, the state will exert greater control over fintechs. Tighter regulations, similar to what incumbent banks face, will cut into fintechs' bottom lines and constrain their growth prospects. That does not augur well for Tencent, which counts fintech - through its WeChat Pay wallet and WeBank digital bank - as one of its core business groups. Bloomberg estimates that Tencent's fintech business was worth RMB 200 billion to RMB 300 billion before the Ant IPO was suspended.

Judo an outlier among Australia's neobanks

Australian neobank Judo is weathering the pandemic-induced downturn better than many of its counterparts. The Melbourne-based neobank reached unicorn status in May as it raised an additional A$230 million and says it was profitable as of August. Judo expects to raise an additional A$200 million to A$300 million before the end of the year.

Sea Group advances on Singapore digital bank license

Sea Group is closing in on one of two Singapore digital full bank licenses (DFB). Although Sea's losses doubled in the third quarter to US$425.3 million, the company's revenue surged 99% to reach $1.21 billion. Instrumental to that brisk revenue growth is Shopee, which is fast becoming one of Southeast Asia's premier e-commerce platforms. The integration of e-commerce, digital finance (SeaMoney) and gaming (Garena) into a digital services ecosystem with broad reach should be a winning combination for Sea.

JD Digits' IPO may have to wait

The suspension of Ant Group's blockbuster IPO has cast a shadow over China's fintech industry as online microlenders scurry to figure out how to meet tough new capitalization requirements. JD Digits, the fintech unit of e-commerce giant JD.com, is one of the firms most affected by the nixed Ant IPO. JD Digits filed in September to list on the Shanghai STAR board, a deal that was expected to raise up to US$3 billion.

Why did Grab invest in LinkAja?

Grab has long had its eye on Indonesia, the home turf of its rival Gojek and Southeast Asia's largest economy. If Grab is going to be region's dominant super app, it needs to have a strong foothold in Indonesia, which by population is nearly as large as the Philippines, Vietnam, and Thailand combined. By leading a US$100 million Series B funding round in Indonesia's homegrown e-wallet LinkAja, Grab is signaling its intention to challenge Gojek more forcefully in the country's burgeoning digital finance segment.

China Issues Draft Rules Clamping Down on Online Microlending

On November 2nd, the People’s Bank of China (PBoC), the China Banking and Insurance Regulatory Commission (CBIRC), the China Securities Regulatory Commission (CSRC) and the State Administration of Foreign Exchange held talks with Ant Group’s management executives, including its founder Jack Ma. The next day, regulators issued new draft rules to tighten China’s rapidly growing online microlending sector. Ant Group’s IPO in Shanghai and Hong Kong was subsequently suspended after Ant said there had been “material changes” in the regulatory stance on financial services, which could result in Ant failing to meet the conditions for listing and providing information disclosures.

Singapore steps up fight against financial crime

After banks in Singapore were ensnared in the 1MDB scandal, Singaporean authorities stepped up their fight against financial crime. Having strict anti-fraud and anti-money laundering controls in place to fraud is essential for Singapore to strengthen its status as a global financial center for wealth management and major fintech hub. Yet some financial crime in the digital realm is posing new challenges to Singapore. The city-state's involvement in the Wirecard scandal is a case in point.

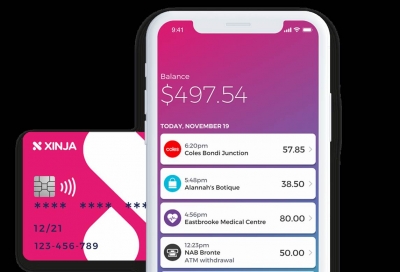

Xinja's future looks uncertain

For digital banks, the pandemic is a double-edged sword. It is increasing demand for digital banking but revealing the fragility of the typical neobank business model. Many of the neobanks that couldn't make money in better times are now in varying degrees of financial trouble. Australia's Xinja finds itself in such a predicament. It needs to borrow a page out of the book of Revolut or N26 and secure another massive capital injection. That is proving to be easier said than done though. An investment of A$433 million led by Dubai-based World Investments Group (WIG) announced in March has yet to be confirmed.

Fintechs could boost pandemic-hit remittances in Asia

After years of solid growth, global remittance flows are set to shrink in both 2020 and 2021, weighed down by the pandemic and its associated economic fallout. Asia, one of the fastest growing regions for remittances in recent years, will be one of the hardest hit regions, the World Bank estimates. Remittances in East Asia and the Pacific are projected to fall by 11% in 2020 and 4% in 2021. In South Asia, remittance flows are predicted to fall 4% this year and 11% the following year.

Singapore's SMEs may prove receptive to digital banks

All too often, the digital banking conversation focuses on retail customers. It makes for a good story, tech-savvy millennials doing all their banking from the convenience of a smartphone. And the promise of achieving massive scale is alluring. But in Singapore, the retail banking market will be a tough nut to crack. 98% of Singaporeans already have a bank account, while DBS, UOB and OCBC are well prepared for digital challengers. The less glamorous but more promising market opportunity for digital banks lies with small and medium-sized enterprises.

Suspended Ant IPO creates uncertainty for Chinese fintechs

With the suspension of Ant Group's IPO, Beijing is once again signaling that its patience for fintech-induced disruption has limits. In the past, Chinese regulators throttled entire fintech industry segments - cryptocurrency and P2P lending - that they deemed excessively risky to the financial system and a threat to social stability. To be sure, Ant Group plays an integral (some would say peerless) role in the Chinese financial system which makes it very different from P2P lenders and crypto firms. However, Beijing places a premium on controlling systemic financial risk. No company can expect the enthusiastic backing of regulators if it appears too gung-ho about disruption and somewhat contemptuous of the system. China officially remains a socialist market economy, lest fintechs or their investors forget.

UPI transactions cap shakes up India's payments market

WhatsApp Pay just launched in India for 20 million users. That is big news, given the long and drawn-out waiting period. Indian regulators, however, made a more consequential decision than giving WhatsApp Pay a belated green light, which is overshadowing the app's rollout. The National Payments Corporation of India will restrict the market share of third-party payment applications by capping at 30% the total transaction volume any single digital wallet can process on the preeminent Unified Payments Interface (UPI) platform.

Is Cambodia's 'retail CBDC' a game changer?

Cambodia has become the first country in Southeast Asia to launch a blockchain-based payment platform backed by its central bank. The Cambodian government is calling the platform, known as Project Bakong, a "retail central bank digital currency." Co-developed with the Japanese fintech firm Soramitsu, Bakong enables transactions in both Cambodian riel (KHR) and US dollars and works with Cambodia's existing payment systems. The Bakong app allows users with a Cambodian phone number and bank account to set up a digital wallet in either Riel or US dollars, transfer between accounts and make payments with a phone number or QR code.

Grab and Singtel close in on Singapore digital bank license

The Grab-Singtel consortium is in many ways the ideal candidate for a Singapore digital full bank license (DFB), which allows the holder to serve both retail and corporate clients. Both firms are based in the city-state but have a strong regional presence. Grab is Singapore's most prominent unicorn, Singtel its foremost telecoms firm, backed by Temasek. Joining forces, they could draw on large troves of user data to tailor digital banking services for a target demographic of millennials and SMEs. In Singapore, Singtel has 4.3 million subscribers.

GCash sees surge in downloads and transaction volume

By at least a few metrics, Ant Group-backed GCash is the Philippines' top e-wallet. GCash, a subsidiary of the Globe Telecom-owned fintech startup Mynt, recorded 10 million downloads in the first nine months of the year, more than any other finance app, according to analytics firm AppAnnie. User growth rose 130% over that period. GCash expects transaction volume to reach P1 trillion this year, an amount that it took the company the three previous years combined to reach.

Will Ripple relocate to Asia?

U.S. regulators have always been ambivalent about blockchain technology and cryptocurrency. That translates to a lack of regulatory clarity for firms operating in the space. In the U.S., crypto could be a currency, property, commodity or security, depending which regulatory authority you ask. But for now, it remains in limbo. Frustrated with this situation, San Francisco-based Ripple Labs is considering packing its bags and relocating to Japan or Singapore, countries which have taken a more proactive approach to regulating cryptocurrency than the United States.

How is BNPL developing in Southeast Asia?

Buy now, pay later is taking the payments world by storm in Europe, the United States and Australia. Firms like Klarna, Afterpay, Sezzle and PayPal (with its "Pay in 4" product) are tapping strong consumer demand for interest-free installment payments. In Southeast Asia, however, BNPL remains at a nascent stage. None of the big BNPL players have launched their services in the region yet. There are some promising local startups though.Singapore-based hoolah is one of Southeast Asia's ascendant BNPL startups. In March, Hoolah raised an undisclosed eight-figure sum in its Series A round. Hoolah will use the cash to expand regionally. Investors participating in the round included venture-capital firm Allectus, iGlobe Ventures, Genting Ventures, former Lazada group CEO Max Bittner, and FNZ CEO Tim Neville.

Hoolah has been in Singapore since 2018 and works with merchants including HipVan, Castlery, Sennheiser and Skin Inc. The firm charges merchant-partners a fee for every successful transaction. Hoolah's BNPL service lets shoppers make purchases in three interest-free monthly installments. The company's key customer segments are youngsters (aged 18-26) who are not yet able to qualify for a credit card, some 26 to 35-year-olds and gig-economy workers. The latter segment likes using hoolah because the workers do not receive fixed salaries.

Hoolah enjoys a first-mover's advantage in Singapore. In an interview with Vulcan Post last year, co-founder and COO Arvin Singh explained why BNPL has been slow to arrive in Southeasts Asia. “There’s a high degree of complexity of achieving a seamless checkout experience while managing a flexible payment solution that includes risk management, consumer payback, direct merchant integration, merchant side funding and the commercials," he said.

In September, hoolah launched its BNPL service in Singapore's physical retail stores, where it sees an opportunity to grow sales as the pandemic eases in the city-state. To use the service, customers scan a QR code at the point of sale with hoolah's app. They then enter the total order amount, which is divided into three monthly payments.

Hoolah launched in Malaysia earlier this year and plans to expand to Hong and Thailand before the end of 2020.

Meanwhile, of the major global BNPL players, Afterpay is likely to be the first to expand to Southeast Asia. The Australian firm is reportedly mulling the acquisition of EmpatKali, which like hoolah is based in Singapore, but is focused on the Indonesia market. EmpatKali has "an established, albeit, very early stage position in Indonesia,” Afterpay's CEO Anthony Eisen told Reuters.

Ant Group's global prospects hinge on Southeast Asia

Ant Group's IPO is a big deal. In fact, the listing is expected to raise US$34 billion, would make it the biggest IPO of all time. Ant's valuation based on the pricing will be roughly US$313 billion, similar to Mastercard (US$319 billion) and JPMorgan Chase (US$309 billion). Can Ant justify that valuation? After all, the company derives the vast majority of its revenue from just one market: mainland China. And Ant has long benefited from a dearth of digital competition. Once the IPO is over, Ant will likely use some of the proceeds to fund its expansion in Southeast Asia. Ant has invested in a large number of e-wallets across the region and applied for a digital bank license in Singapore.

More...

TransferWise begins to carve out a niche in Asia

TransferWise is one of the few European fintechs making inroads in Asia. That's because the UK-based firm has a coherent Asia strategy: Enhance payments of every stripe - cross-border, domestic, real-time, credit card, e-wallet and more - and enable its partners to integrate the TransferWise open API directly into their infrastructure. TransferWise's APAC headquarters are in Singapore and it operates in Australia and New Zealand as well. The company has inked a deal with Alipay that allows it to begin serving the China market, albeit in a limited manner.

The interminable delay of WhatsApp Pay's launch in India

The Facebook-Jio deal appeared to pave the way for the long-awaited launch of WhatsApp Pay in India. Thanks to its US$5.7 billion investment in Reliance's Jio Platforms, Facebook finally had a heavyweight local partner in the subcontinent. Political pressure is mounting on New Delhi to prevent foreign tech giants from dominating the digital economy. The Facebook-Jio deal directly addresses those concerns. Yet, more than four months after India's Competition Commission approved the deal, WhatsApp Pay remains in beta launch.

K bank looks to get back in the neobanking game

South Korea's K bank has struggled since its inception in 2017. It lacks the super-sticky ecosystem and vast resources of its competitor Kakao Bank, which was set up at roughly the same time. In April 2019, K bank suspended most of its services amid fundraising difficulties. Although it resumed some services in July, K bank is still far from full strength. It has about 900 billion won in capital, compared to Kakao Bank's 1.8 trillion won. K bank will need to secure large capital injections in order to compete on an even footing with Kakao and Viva Republica's Toss Bank.

Razorpay joins India's unicorn ranks

The fintech narrative has adapted swiftly to the worst public health crisis in a century. Digital banking is now depicted as an epochal shift, driven by drastic pandemic-induced changes in human behavior. In many cases, this is an exaggeration. But some fintech startups, like the newly minted Indian unicorn Razorpay, have turned this crisis into a genuine opportunity. The Bengaluru-based firm raised $100 million in a series D financing round that closed in October, co-led by Singapore’s sovereign wealth fund GIC and Sequoia India, and is now valued at roughly US$1 billion.