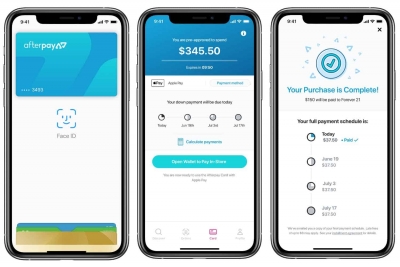

Why is Afterpay considering a US IPO?

Buy now, pay later may be the greatest thing for payments since well, credit cards, or even better, depending whom you ask. “What we’re seeing now is a once-in-a-lifetime generational shift away from traditional credit products,” Afterpay CEO and co-founder Anthony Eisen recently told The Australian. While the concept of zero-interest installment payments is not exactly revolutionary, Afterpay is one of the fintechs that has figured out how to package it right. As a result, Afterpay is not only one of the biggest BNPL firms in Australia but also the US. In March, Afterpay surpassed AU$1 billion in monthly sales in the US. With the US increasingly driving Afterpay’s growth, the company is considering an IPO on the Nasdaq.

The arrival of digital banks in Hong Kong and Singapore has put some pressure on incumbents to up their game. At a minimum, traditional banks in Asia’s two main financial centers have slashed some unpopular fees and invested in more digital technology. Now that Malaysia has decided to introduce digital banks, its incumbent banks face some similar challenges to their counterparts in Hong Kong and Singapore.

Line Bank launches in Taiwan

At long last, Line Bank has arrived in Taiwan. On April 22, the Japanese messaging app’s virtual bank went live, becoming the second digital bank in Taiwan after Rakuten Bank. Line Bank had been hampered by both pandemic and regulatory related delays. It originally planned to launch in mid-2020. Of the three virtual banks approved by the Financial Supervisory Commission (FSC), Line Bank has the strongest digital services ecosystem thanks to the popularity of its messaging app, e-wallet, entertainment and social commerce with Taiwanese consumers.

Gojek + Tokopedia = GoTo?

After years of raising funds in private markets, Southeast Asia’s largest platform companies are suddenly eager to exit. The region’s foremost super app rivals are leading the pack, but the exit routes vary considerably. Grab is making SPAC history with the largest ever such deal, on the Nasdaq. Not to be outdone, Gojek and Tokopedia are moving to finalize their expected merger, which will likely include a listing both in New York and on Indonesia’s own stock exchange. The combined entity, the aptly named “GoTo,” could attain a valuation of US$30-$40 billion.

Is something awry at Airwallex?

In the world of fintech unicorns, a bit of exaggeration comes with the territory. After all, we are talking about companies valued in the billions or tens of billions of US dollars, despite failing to make a profit (in most cases). This is a world where what counts is not the shaky balance sheet today, but the supposed potential to revolutionize banking tomorrow. Growth is paramount – that’s how to keep the funding spigot on. But this approach to financial services comes with manifold risks. Possible compliance deficiencies at Australia’s Airwallex illustrate this point.

Singapore looks to carve out green finance niche

Singapore is steadily carving out a niche for itself in the emerging green finance segment. Much as it has done with fintech, the Monetary Authority of Singapore (MAS) is taking steps to make the city-state a hub for this up-and-coming area of financial services. MAS reckons that Asean will need annual green investment of US$200 billion annually. Given its role as the region’s leading financial center, Singapore is a natural choice to lead green financing efforts.

Here comes the Grab SPAC

Grab is heading for the exit ramp SPAC style. IPOs are slow, costly and let regulators hold a magnifying glass to a firm’s balance sheet. Less so with this SPAC on the Nasdaq, which will give Grab a high valuation (US$40 billion) and investors a way to cash out. Grab has been operating for about nine years. The merger will include roughly US$4.5 billion in cash, the largest share sale yet by a Southeast Asian firm in the U.S.

Digital banking efforts accelerate in the Philippines

The Philippines is determined to speed up financial inclusion through digitization. By 2023, the BSP aims to digitize at least 50 percent of total retail transactions and bring 70% of Filipino adults into the formal financial system. To that end, it introduced guidelines for digital banks in December 2020 and has thus far received two applications. The rules require licensees to hold at least 1 billion pesos in capitalization, operate a head office in the Philippines and offer only-only banking services. Licensees are not permitted to set up physical branches. The review process will likely carry on through 2021, with the winners being announced on a rolling basis. Yet some fintechs are determined to enter the market earlier.

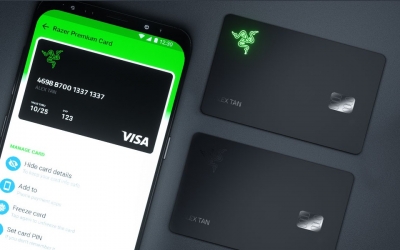

Can Razer still become a digital bank?

Singapore’s digital banking race had far more losers than winners. Of all the failed bids, Razer’s must have been among the hardest to swallow. The gaming hardware firm was a strong contender and had Sea and Grab not both been in the running, may well have prevailed. The question now is, can Razer still become a digital bank? The answer is maybe in Malaysia and/or the Philippines.

What is the outlook for Revolut in India?

If there is one thing Revolut excels at, it is growth. It would be hard to find another neobank with as many accounts in as many different markets. All that growth is expensive, as seen in the £107 million Revolut lost in FY 2019, which it attributed to a hiring spree. Whether the UK’s most valuable fintech startup is any closer to profitability is an open question. What we do know is that it is eyeing expansion across Asia in 2021-22, with India the first stop.

Fintech crackdown slows Shanghai STAR board's momentum

Before Ant Group’s IPO was nixed, the Shanghai STAR board was red hot. Since then, it has cooled off considerably. Not only is Ant’s IPO in limbo, but other Chinese tech companies are scuttling their plans to go public, one after the next. Ant is the bellwether for the market, whether it is a bull or bear. Data compiled by Financial Times show that 76 firms suspended their IPO applications in March, more than twice the number in February. Overall, 168 companies have put their plans to go public on ice since November.

BNPL competition in Southeast Asia heats up

The buy now, pay later frenzy is moving from the advanced economies into emerging markets with Southeast Asia a hotspot. Given the rapid growth of fintech in the region and lack of credit card penetration in most countries it is relatively easy for BNPL to make inroads. In fact, BNPL is proving so popular that the segment is growing fast in Singapore too, where credit card penetration is 73%.

Will Thailand issue digital bank licenses?

Thailand is one of the few major Southeast Asian economies that has not unveiled a digital banking roadmap. Singapore's digital banks will go live in 2022. Malaysia will accept applications for licenses this year and issue them by early next year. The Philippines recently announced it would issue digital bank licenses. Indonesia plans to clarify digital bank regulations by mid-2021. In contrast, Thailand's central bank has been quiet about the possibility of digital banks for more than a year.

Hong Kong IPO market continues hot streak in Q1

Hong Kong's IPO market picked up in the first quarter right where left off in 2020, soaring to a new high in terms of overall proceeds, according to KPMG. Deals raised on the Hong Kong Stock Exchange totaled US$13.9 billion. The nixed Ant Group deal last October has sidelined most fintech listings but not the rest of what KPMG describes as "innovation companies," notably biotechs.

The cross-border challenge for China's CBDC

China is leading the world in CBDC development, prompting speculation that DCEP (digital currency, electronic payment) is on its way to becoming the digital equivalent of the U.S. dollar. The reality is more nuanced. To be sure, China's digital fiat currency is at a more advanced stage than any other major country's CBDC, and China has many potential applications for it domestically. When it comes to cross-border use, however, many questions remain about the digital yuan.

Digital investment platforms grow in Indonesia

Heading into 2021, Indonesia's prospects for fintech investment were looking pretty good. Among Asia's key emerging markets, Indonesia checks all the right boxes. It is huge, relatively open to foreign investment, has a fast-growing economy (hindered by the pandemic for now, but certain to rebound sharply) and has a large unbanked population. With most Indonesians new to retail investing, fintechs see a strong opportunity to get in on the ground floor. Since January, several Indonesian online investing startups have closed successful funding rounds.

South Korea is warming to a CBDC

To date, South Korea has been less enthusiastic about launching a central bank digital currency (CBDC) than China or Japan. Beijing leads the world in CBDC development while Tokyo sees a CBDC as a necessity to stay competitive with its giant neighbor. Yet Seoul is now coming around to the need for a digital fiat currency, even if one of the government's purposes in developing one is to reduce the use of crypto in its economy.

Will Australia's neobanks endure?

Australia's digital banking honeymoon is winding down. With Xinja and 86 400 both out of the picture - albeit in very different ways - the Australian Prudential Regulatory Authority (APRA) is moving to raise the sector's barrier to entry. It will become harder to get a banking license. Under the revised regulations, neobanks will have to be better capitalized and launch both an income-generating asset product and a deposit product in order to be approved for a full license.

Airwallex reaches for the stars

Nobody can accuse Airwallex of having modest ambitions. The Australia-founded and Hong Kong-based unicorn just raised another US$100 million in an extended Series D round at a valuation of US$2.6 billion. The U.S.'s Greenoaks was the lead investor. The cross-border payments upstart plans to use the capital injection to expand across four continents - Australia, North America, Europe and Asia.

Unpacking the possible Grab SPAC

After umpteen funding rounds and nearly nine years in operation, Grab is finally heading for the exit ramp. The question is, will the Singaporean decacorn choose to go public the usual way or do something different? Until the past few weeks, a standard IPO in New York looked like the obvious choice. But with the current SPAC (special purpose acquisition company) craze, Grab might decide to hop on the bandwagon.

Crypto exchange tie-up revives K bank's fortunes

Korea's K bank may have finally found the secret sauce. Long a laggard among Korean fintechs, the country's first digital lender is now riding the bitcoin boom thanks to a tie-up with the crypto exchange Upbit. Under a deal K bank and Upbit reached in June 2020, retail investors who want to trade crypto with Upbit must do so through the digital lender. Since last March, Korea has required exchanges to work with lenders like K Bank to ensure the use of valid, real-name accounts for trading. Eager to capitalize on the bitcoin boom, retail customers are signing up at K bank in droves.

Can buy now, pay later (BNPL) get any hotter in Australia? Judging by Commonwealth Bank of Australia's (CBA) foray into the market, yes, it can. CBA's move comes less than two weeks after PayPal announced it would enter the market. CBA is the first of Australia's big four banks to roll out a BNPL product, and it likely will not be the last. The product, CommBank BNPL, will be available to four million of the bank's retail customers for transactions up to AU$1000 from mid-2021.

Amazon steps up its India fintech play

Amazon may be the world's biggest e-commerce firm and a major player in India's online shopping market, but that has not translated into digital payments dominance in the subcontinent. In fact, Amazon's share of the Indian payments market is paltry compared to Google Pay, Walmart backed-Phone Pe and Alibaba-backed Paytm. But with India's payments market expected to grow more than 300% to Rs 7,092 lakh crore by 2025, Amazon sees plenty of room to boost its market share and eventually expand into more lucrative fintech segments.

WeLab teams up with Allianz Group

Hong Kong's virtual banking field is crowded with eight neobanks that have similar value propositions. In their fledging stage, the digibanks have focused on quickly bringing customers onboard, highlighting their digital agility and offering high deposit interest rates for a limited time. The unicorn WeLab, the only native Hong Kong virtual bank, is one of the first to signal it has a broader strategy. WeLab in early March received an undisclosed investment from Allianz Group's digital investment unit as part of its Series C-1 fundraising and plans to collaborate with Allianz's asset management arm to develop wealth management products.

Paytm eyes the exit ramp

Paytm is India's most valuable tech startup and largest fintech. The company says it processed 1.2 billion transactions in January, more than its rivals Google and PhonePe that are dominant on the UPI platform. It claims to serve more than 17 million merchants. Yet Paytm is still losing money after more than a decade, burning cash faster than it can earn revenue. That must change soon if the SoftBank-backed firm expects a successful IPO in 2022.

Why is PayPal entering Australia's BNPL market?

Australia is a key market for PayPal in Asia Pacific. The U.S. payments giant has 9 million accounts Down Under - not too shabby for a country of 25 million people. It has a 17% share of what JP Morgan calls the "alternative payments market (essentially non-cards), ahead of Google Pay, Apple Pay and Samsung Pay. But there is a new payments game in town led by firms like Afterpay and Zip. To maintain its competitive edge in Australia, PayPal needs to enter the buy now, pay (BNPL) segment.

China's crackdown on fintech giants has just begun

Three times is usually the charm, but in this case it means that China's fintech giants are finally out of luck. Firms that had seemed untouchable in two previous crackdowns are suddenly in regulatory crosshairs. Perhaps tech juggernauts should have seen the writing on the wall. After all, Beijing dealt harshly with crypto and P2P lending firms - when it got around to dealing with them. This time around, regulators will make it harder for Ant Group, WeChat Pay and others to profit handsomely from digital finance. They will force the tech giants to meet tough new capitalization requirements and take on more risk for lending, instead of passing it on to incumbent banks. This strategy will not hobble China's platform companies, but it will force them to rejig their business models.

Japan's Line has super app potential. Its messaging app is popular in Japan, Taiwan and Thailand. It has content, e-commerce and a growing portfolio of fintech services, with Line Bank set to launch in Taiwan by the middle of the year. And a recent merger with SoftBank affiliate Z Holdings brings an additional US$4.7 billion in capital to the table. The new entity, which integrates Line with Yahoo in Japan, projects that it will post revenue of 2 trillion yen and operating profit of 225 billion yen by fiscal year 2023. It is the brainchild of SoftBank founder Masayoshi Son, who aims to build a Japanese tech juggernaut able to compete with Google, Amazon, Facebook and Apple in Japan.

Fintech is the magic glue that holds startup ecosystems together in Asia. One after another, the region's biggest platform companies have pivoted to fintech, and then declared themselves super apps, usually in that order. Indonesia's Traveloka is expanding its fintech offerings from Indonesia to Thailand and Vietnam as it eyes going public in the U.S. this year through a blank-check company.

Sea Group shrugs off US$1.62 billion loss

Sea Group's latest earnings report is packed with good news. Its gaming and e-commerce businesses grew expeditiously in 2020 as people stayed home, shopped online and played online games. EBITDA surged to US$107 million, compared to a loss of US$178.6 million in 2019. Gross profit doubled to US$1.3 billion from US$604 million a year earlier. Net income, however, remained negative. In fact, net losses widened to US$1.62 billion from US$1.46 billion. The question for Sea and investors is, does it matter?

More...

P2P lending's future in South Korea looks shaky

When South Korea introduced a peer-to-peer (P2P) lending law last year, it seemed regulators had paved the way for the industry to grow stably. Seoul recognized that P2P lending could promote financial inclusion. The industry just needed proper supervision to minimize fraud and loan delinquency. However, the loan delinquency rate is rising, Korea's fintech giants are cutting their ties with P2P lenders and many of the firms are struggling to meet the law's requirements.

Stripe intent on Asia-Pacific expansion

Stripe may be the biggest fintech to fly under the radar in Asia Pacific. In private markets, its valuation is reportedly close to US$100 billion, up from about US$35 billion in April 2020. The San Francisco-based merchant payments provider saw its fortunes soar during the pandemic as its many North American customers moved online. It is now looking east to fuel its next stage of growth, including China, India, Southeast Asia and Australia. In 2020, Stripe increased its staff in the APAC region by 40% to more than 200.

PayPal is unlikely to become a super app in Asia

PayPal is a payments giant with super app ambitions but a small footprint in Asia. Indeed, although PayPal has been present in many Asian markets for ages, it is not a market leader in any of them. In fact, to date, it is more notable for reducing its presence - exiting the domestic payments business in both Taiwan and India, for instance - than scaling up. Becoming a bigger player in Asia will not be easy for the US$340 billion company, despite its vast resources.

Why is TymeBank expanding to Southeast Asia?

South Africa’s TymeBank has big plans for Southeast Asia. The South African neobank plans to launch a digital bank in the Philippines and may also apply for a digital bank license in Malaysia. Measured by account numbers, Tyme is one of Africa’s most successful digibanks, claiming to have signed up almost 3 million customers since its launch two years ago. In late February, Tyme announced it had raised US$109 million from investors for expansion in Southeast Asia, one of the largest deals ever by a fintech in South Africa.