How is Zip’s global expansion shaping up?

With the Australian buy now, pay later (BNPL) segment increasingly crowded, some of the biggest players are searching for greener pastures overseas. While Afterpay has been the most aggressive in terms of global expansion, its rival Zip (Australia’s No. 2 pure-play BNPL firm) is catching up. Having already expanded to New Zealand, the U.S., Canada, Mexico and the UK, Zip is now foraying into Africa with the acquisition of South African payments startup Payflex.

Digital banks are fast becoming a fixture of the Asia-Pacific fintech boom, in many ways a manifestation of Big Tech’s desire to become Big Fintech. In contrast to the United States and Europe, where ascendant digital lenders are usually pure-play operations that began as humble startups, APAC has an increasing number of so-called digibank startups backed by the region’s largest tech companies and some major incumbent financial services firms.

2021 could be a record year for India's IPO market

India’s tech sector has been booming for years, but it is only now that the growth is coming to fruition in the subcontinent’s capital markets. Many of the country’s most successful platform companies, like Zomato and Flipkart, and fintechs, like Paytm, are choosing to go public in 2021 and they are listing at home rather than on the NYSE or Nasdaq.

Why is the Philippines back on the FATF grey list?

The Philippines has returned to an unenviable position: It is once again one of the only East Asian countries on the Financial Action Task Force’s (FATF) Grey list, alongside Cambodia. Countries on the grey list have been flagged by FATF for insufficient anti-money laundering and/or counterterrorism financing controls. Being on the list creates regulatory headaches for financial institutions – such as higher interest rates and processing fees – and can be detrimental to a country’s business environment.

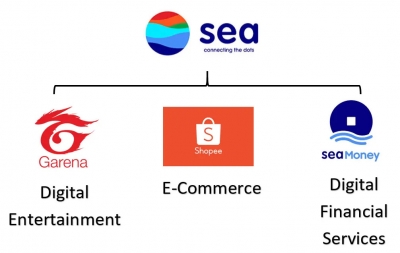

What has Sea got to lose? US$433.7 million

Sea Group just can’t lose when it comes to investor sentiment, even though the company’s losses widened on an annual basis to US$433.7 million in the second quarter from US$393.5 million a year earlier. The day before it reported Q2 earnings, Sea’s share price was about US$291 and as of August 23 it had reached US$315. Over the past year, the stock has risen more than 105% while Sea’s market cap now stands at US$168 billion.

Taiwan’s virtual banks arrived at the right time

With 37 retail banks for a population of 23.5 million, Taiwan is not the easiest market for digital banks to crack. Just about every Taiwanese adult has a bank account; in fact, many have more than one because of the tendency of companies in Taiwan to require employees to open a bank account with the company bank. Nevertheless, near ubiquitous smartphone penetration and the popularity of certain platform companies’ ecosystems offer digital banks an opening in Taiwan, especially given the effect of the pandemic on people’s banking habits.

Vietnam’s e-payments market heats up

The super app trio of Grab, GoTo and Sea is growing increasingly dominant in Southeast Asia, but not yet in Vietnam. In fact, it is the homegrown MoMo which leads Vietnam’s e-payments market. MoMo says it has a 60% market share and processes US$14 million annually for 25 million users.

What’s happening with CBDCs in Southeast Asia?

Southeast Asia is home to some of the world’s fastest growing economies and is rapidly adopting digital financial technology, including blockchain-based solutions. Thus, it is only natural that central banks in the region are starting to think about a possible role for digital fiat currencies. The first country to make the jump to a CBDC is Cambodia, and it will definitely not be the last.

AirAsia’s super app project may have wings

We have to hand it to AirAsia: They tell the super app story well, probably better than some of the others whose task is less daunting than the beleaguered airline’s. Indeed, AirAsia is not a high-flying tech company aiming to use fintech to take its valuation and exit to the next level, but an airline facing an existential crisis wrought by the never-ending coronavirus pandemic. If AirAsia pulls off its transformation, it will stand as one of the great turnarounds in recent Asian corporate history, and perhaps pave the way for a new breed of platform company.

Is Razer’s fintech foray ailing?

Not every tech company is cut out to be a fintech. Even the super apps that have bet everything on a fintech transformation will agree with that statement: They just will insist their particular business model is a winner. Not gaming hardware maker Razer though. The Hong Kong-listed firm is the latest non-financial company to have second thoughts about a fintech foray, pulling the plug on its Razer Pay e-wallet and card after failing to win a digital bank license in Singapore.

Will Revolut’s travel app give it an edge in Asia?

Revolut is the biggest neobank most of Asia has never heard of. Try as it might, Revolut just has not been able to make much of an impact in any APAC market yet, which is not a huge surprise given the amount of competition it faces and its distant home base in the UK. Revolut needs something to make it stand out from the crowd in APAC. Its new travel app Stays might be just what the doctor ordered.

Can Singapore become a crypto hub?

Try as it might, the cryptocurrency industry has not yet been able to shake its reputation for being not quite above board. The rebellious, underground side of crypto has won it many devoted fans – just not usually among financial regulators. But what if crypto – like many segments of Asia’s fintech industry – found a home in Singapore?

Kakao Bank’s IPO is a blockbuster

Kakao Bank has been South Korea’s top digital lender, both in terms of users and profitability, for several years. Following a blockbuster US$2.2 billion IPO in which its shares surged more than 79%, it is now also the most valuable publicly-listed South Korean financial firm, with a market capitalization of 32 trillion won (US$28 billion), compared to KB Financial Group Inc. (22 trillion won) Shinhan Financial Group Co. (20 trillion won) and Hana Financial Group Inc. (13 trillion won).

Singapore’s largest banks have a better-than-expected Q2

It would have been difficult for Singapore’s Big 3 banks – DBS, OCBC and UOB – to beat their performance in the first quarter. That holds especially true for DBS and OCBC, which both posted record earnings in the January-March period. So while all three banks saw earnings fall in the second quarter on a quarterly basis, they still turned in a solid performance that beat analysts’ expectations.

Nium reaches unicorn status

Move over Grab and GoTo: There is a new Southeast Asian unicorn in town. The rapid ascendancy of Singapore-based payments startup Nium, which reached a US$1 billion valuation following a Series D round that raised more than US$200 million, shows that there is more to Southeast Asian tech than consumer-oriented super apps.

The sky still looks like the limit for UPI in India

United Payments Interface (UPI), the National Payments Corporation of India’s (NPCI) flagship payments platform, had another stellar month in July. According to NPCI data, UPI processed a record 3.24 billion transactions in July, up 15.7% from June, while in terms of value the payments platform processed transactions worth Rs 6.06 trillion, up 10.76% from a month earlier.

Unpacking Square’s US$29 billion acquisition of Afterpay

Just when buy now, pay later (BNPL) had seemingly reached an apex in Australia, Jack Dorsey’s Square buys Afterpay for US$29 billion, the largest M&A deal in Australian history. Anyone who thought Afterpay would be easily surpassed by deep-pocketed global payments giants like PayPal or Australia’s own banking heavyweights will have to think again.

Why are Grab and Bukalapak teaming up?

Indonesia is fast becoming the most hotly contested of Southeast Asia’s digital services markets. No other market is both as large and untapped. With that in mind, Singapore’s Sea Group and hometown favorite GoTo have made significant plays in recent months. The former acquired Bank BKE, while Gojek upped its stake in Bank Jago and then merged with Tokopedia. Not to be outdone, Grab is teaming up with Tokopedia's rival Bukalapak. This move finally brings e-commerce into the Singaporean firm's ecosystem and strengthens the hands of both Grab and Bukalapak as they prepare to go public.

South Korea is keener on a CBDC than crypto

The crypto party may be over in South Korea, where the government is less than ecstatic about the widespread use of decentralized virtual currency in its economy. Unlike Japan, a crypto pioneer that has always been tolerant of decentralized digital currency, South Korea sees it as somewhere in between an annoyance and systemic financial risk. Seoul is now moving to curtail crypto’s influence in the country through strict regulation and higher taxation.

PayPal steps up its APAC play

Big Tech increasly has its eyes on Asia-Pacific’s growing fintech market. Yet most of the US tech giants are off to a late start in the region. Although it has been present in numerous APAC markets for years, PayPal is not really an exception to the rule. The U.S. payments giant has historically focused on North America and to a lesser extent Europe, with only a minor footprint in APAC. That is changing now that PayPal has super app ambitions and sees new opportunities in China, Southeast Asia and Australia.

If you can’t beat ‘em, join ‘em. That seems to be true in just about every market that has introduced digital banks, and it is a two-way street. Hype about the challengers unseating incumbents tends to give way to a more nuanced reality in which there is some room for cooperation. In Australia, where four large banks have long dominated the market, the incumbents are steadily increasing their cooperation with fintechs in a bid to strengthen their digital offerings.

Chinese companies raised more than US$12 billion in U.S. markets in the first half of 2021, a half-year record, according to Dealogic. The great U.S.-China financial decoupling had seemingly hit a snag. Then came Didi Chuxing's catastrophic debut on the NYSE, and just like that, the U.S. IPO pipeline for Chinese firms froze. But the companies have to list somewhere offshore and Hong Kong will likely step in to fill the void.

Bukalapak readies for blockbuster IPO on IDX

Indonesia’s tech juggernauts are coming into their own this year. First Gojek and Tokopedia merged to create GoTo, which plans to list in both the U.S. and Indonesia. Now Tokopedia’s rival Bukalapak has announced its own plans to go public on the Indonesia Stock Exchange in what looks to be the archipelago nation’s largest ever IPO. Bukalapak recently said that it would increase its IPO size to US$1.5 billion.

Why are BNPL firms foraying into banking?

Australia’s Afterpay is making the jump from payments into banking as it seeks to develop new revenue streams amid intensifying competition in its core buy now, pay later (BNPL) business. Afterpay said on July 20 that it would launch its banking app, Afterpay Money, in October. The move into banking has a hint of irony to it, coming on the heels of the recent entry of several incumbent banking giants - such as Citibank and Commonwealth Wealth Bank of Australia – into Australia’s BNPL segment. Afterpay is the only BNPL firm besides Klarna to segue into banking.

Here comes Paytm’s IPO

2021 will likely be remembered as the year that Asia’s fintech unicorns (ex-China) cashed out. India’s Paytm has become the latest high-flying fintech to cement its plans to go public, filing a draft prospectus with the Securities and Exchange Board of India (SEBI) for a deal expected to raise US$2.2 billion. The deal will be one of India’s largest of all time, including a fresh issue of US$1.1 billion and a secondary issue or offer for sale of the same size.

Viva Republica and Big Fintech in South Korea

Big Tech may have reached an apex in the United States and China, but in South Korea it is ascendant. In a country where chaebols have long been dominant, it is not hard to imagine internet companies – and indeed fintechs in particular – taking a similar path. And that is exactly what is happening. First, Kakao became a fintech giant, and now it is Viva Republica’s turn. The company, which operates Toss, the largest fintech app in South Korea, recently raised US$410 million at a valuation of US$7.4 billion.

Will Traveloka’s fintech gambit succeed?

If there ever was a “We are all fintechs now” moment, it must have been earlier this year when Indonesia’s online travel unicorn Traveloka stepped up its rebranding as a digital financial services provider. Skeptics could have been forgiven for rolling their eyes. Yes, the pandemic has hit the travel industry hard and companies like Traveloka need to rejig themselves or they may not survive. On the other hand, not every platform company is suited to reinvent itself as a fintech.

Sea Group is one of the most successful loss-making companies in the world outside of private markets. Sea lost an astronomical amount of money in the first quarter of the year: US$422 million. That is not normally cause for celebration among listed companies, but its revenue also grew 147% year-on-year to US$1.76 billion. Investors are cheering: Sea’s stock price has risen more than 300% to US$283 over roughly the past year. Helping to drive that bullish investor sentiment are expectations about Sea’s potential in Southeast Asia’s nascent but fast-growing digital finance space.

Why has Kakao been successful as a fintech?

Many of the world’s preeminent platform companies have tried to reinvent themselves as fintechs. Outside of China, South Korea’s Kakao is the only one that is an undisputed success. Kakao boasts South Korea’s largest e-wallet, with 36 million users, and leading digital bank. Both will go public in Korea in August and are likely to raise US$1.4 billion and US$2.3 billion respectively. The speed of Kakao Bank’s swing to profitability (it took just two years) – paving the way for the IPO just four years after its founding – has been remarkable by industry standards.

Fly the super app skies with AirAsia

Just about every major tech company now wants to be a fintech, super app or both. What makes AirAsia different is that its core service has nothing to do with the internet or banking. Indeed, AirAsia is an airline that happens to have a digital services arm. The Malaysia-based firm probably would have stayed that way had it not been for the coronavirus pandemic and its devastating effect on airlines and the travel industry. AirAsia is now going all in on its super app gambit, applying for a digital banking license in Malaysia and acquiring Gojek’s Thailand business.

More...

In both Singapore and Hong Kong, digital banks are nice to have. In Malaysia, whose digital banking application period ended on June 30, the need for digibanks is somewhat greater. But in the Philippines, where 71 million adults remain unbanked and 1/3 of municipalities lack a banking presence, the need for neobanks is more pressing. With that in mind, the Philippines’ central bank is approving digital banks’ applications on a rolling basis in the hope of reaching key financial inclusion targets by 2023. Tencent-backed Voyager Innovations and RCBC are the two most recent entrants to the country’s digital banking race.

How are Kakao’s two IPOs shaping up?

Two IPOs are better than one, as far as Kakao is concerned. The banking and payments arms of Korea’s super app are both preparing to go public in Korea in August. Kakao Pay, South Korea’s largest payments provider, which has 36 million users and is backed by Ant Group, plans to raise up to 1.6 trillion won ($1.4 billion). Kakao Bank, South Korea’s largest online lender, could raise up to 2.55 trillion won.

Hong Kong may be attracting the lion’s share of offshore listings by Chinese companies, but New York is no slouch. In fact, for all the talk of U.S.-China decoupling, the world’s most liquid capital markets retain significant appeal for Chinese companies. According to Dealogic, 36 Chinese companies had raised US$12.59 billion in U.S. markets as of June 30, a half-year record.

June 30 was the deadline for Malaysia’s digital bank licenses and there were 29 applicants for a maximum of five licenses from a wide variety of would-be neobanks, among them platform companies, incumbent lenders, conglomerates, state governments, fintechs and more. The Malaysian central bank will name the winners of the licenses in early 2022.