How are Mynt's prospects shaping up?

Ant Group and Globe Telecom-backed Mynt was the Philippines' one and only unicorn until April 12 when Voyager hit the milestone. Mynt reached the status last November after raising US$300 million from global investors including Warburg Pincus and Insight Partners. Mynt made good on its promise to become a “double unicorn” by reaching a US$2 billion valuation. While its long-term prospects in the vastly underbanked Philippines look good, questions remain about Mynt’s business model and the timing of an eventual IPO.

GoTo's strong IPO defies the odds

Heading into GoTo’s IPO Monday, one could be forgiven for being a bit skeptical. Here was another loss-making platform company with a sky-high valuation and a lot of subsidy-driven digital services. If you’ve seen one, you’ve seen them all, right? Not necessarily, say investors. GoTo raised US$1.1 billion in a triumphant IPO on the Indonesia Stock Exchange. Shares rose up to 23% and closed the day 13% higher at 382 rupiah, valuing the firm at about US$31.5 billion.

Has Hong Kong's IPO market bottomed out?

Hong Kong’s IPO market has likely hit a nadir, with funds raised from new share listings plummeting 90% year-on-year in the first quarter. Just 11 companies went public on the Hong Kong Stock Exchange in the January-March period, raising a total of US$1.72 billion. It was HKEX’s worst performance since the first quarter of 2013.

Australia’s casino gaming sector has long had lax money laundering controls. However, historically, Australian banks have borne the brunt of regulatory ire for money laundering breaches. Both Commonwealth Bank of Australia and Westpac have paid massive fines for such violations in recent years. However, with AUSTRAC launching a probe into Crown Melbourne and Crown Perth on March 1 and allegations emerging later in the month that the Star Entertainment Group laundered money in Macau, the casino gaming sector is likely to come under much greater scrutiny.

Will Chinese stocks be able to remain listed in the US?

There is a growing list of Chinese companies that could be forced to exit U.S. stock exchanges under legislation passed in 2020. The legislation requires all public companies in the U.S. to comply with auditing requirements that Chinese companies have resisted due to Beijing’s own state secrecy laws. On March 30, the Securities and Exchange Commission (SEC) added Baidu to the list. A total of 11 Chinese companies facing delisting have been named so far.

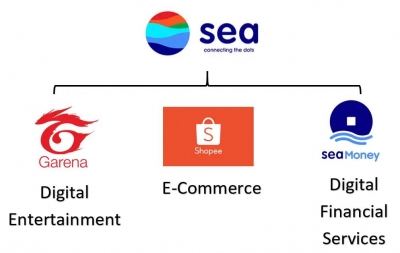

Sea Group should focus on Southeast Asia

Southeast Asia is the most dynamic market for the digital economy in the world, especially e-commerce and fintech. It has a population of 655.3 million, which ought to be big enough for most young tech companies. Not Sea Group though. Sea has done well in the region, but like many platform companies, it is getting overly ambitious, overextending itself, and making costly mistakes.

India turns the screws on crypto

There is more than one way to drastically curtail crypto activity in a country. China’s approach has been largely effective, but is generally not applicable elsewhere. In the case of India, which has a very different political system than China, blanket bans could face legal challenges while being difficult to enforce. A better approach is to tax the heck out of crypto transactions, which regulators and some politicians almost certainly hope will reduce the attractiveness of the asset class.

Malaysia’s digital banking race is not over yet

We had thought Bank Negara Malaysia (BNM) would have announced the winners of Malaysia’s five digital banking licenses by now, as the deadline was originally set for the end of March. The BNM has been mum about any reasons for a delay, though the longer deadline could give Capital A (the erstwhile AirAsia), one of the more enthusiastic applicants for a digital banking license, more time to improve its financial condition. With 29 applicants, there will be many more losers than winners in this race.

It’s slow going for SPACs in Asia so far

Remember that SPAC boom in the U.S.? To be sure, it has slowed in recent months, but the Nasdaq and NYSE continue to attract some high-profile listings by special purpose acquisition companies, such as Grab’s December debut. It is a different story in Asia. Though Asian exchanges amended regulations last year to wave the way for SPACs, there have not been any blockbusters yet.

When it comes to the cryptocurrency policies of Asia’s regulators, it pays to not be overly sanguine. While most regulators in Asia are happy to let crypto evolve as a regulated asset class, payments are another story. Thailand is the latest Asian country to crack down on using crypto for payments.

On March 23, Thailand’s Securities and Exchange Commission on Wednesday banned the use of cryptocurrency for payments, effective April 1. That means no bitcoin or any other crypto can be used to purchase goods and services. Digital assets payment operators will be given a grace period through the end of April to cease providing payment services. Trading of digital assets for investment purposes will be not affected by the SEC’s ban on payments.

Assessing the coming GoTo IPO

Why now? That is the question many analysts and investors are pondering as Indonesian platform company GoTo is pushing ahead with an IPO that seeks to raise up to US$1 billion at a US$30 billion valuation despite the poor performance of loss-making companies' shares in recent months. Like its Singaporean counterpart Grab, GoTo began as an Asian answer to Uber but has morphed into a super app leaning heavily on digital financial services to secure its future. And like Grab, GoTo has yet to turn a profit, spends heavily subsidizing users, and made investors wait a long time for an exit.

Why is Sea Group in choppy waters?

The honeymoon period is over for Southeast Asia’s platform companies, even the venerable Sea Group. While boasting a strong ecosystem Sea is still consistently losing money in two of its three divisions. Being bullish on Sea means believing that the profitable gaming arm Garena can carry Shopee and Sea Money indefinitely. Investors appear to be having their doubts, especially as Garena’s growth has slowed recently. Sea’s share price has fallen 63% in the past six months and 43% over the past year and is now trading at about US$127.

Troubled times for Paytm

When it rains it pours, at least for super apps. Throughout Asia, platform companies are struggling as their capabilities often cannot match overly lofty investor expectations. The problem is especially acute for India’s Paytm, whose record-breaking IPO – it is India’s largest to date – nevertheless turned out to be a sign of worse things to come. Paytm’s stock fell 27% on its first day of trading and has fallen about 65% since the November IPO to 543.5 Indian rupees.

Nepal’s fintech opportunity

Home to about 70 fintech startups, Nepal is a nascent market for digital finance. That said, the pace of adoption in the Himalayan nation of 30 million is picking up amid the Covid-19 pandemic and with about 55% of the population unbanked, there is a need for fintech solutions that can boost financial inclusion. In the past few months, there have been several key developments that could speed up the digitization of Nepal’s financial sector.

South Korea's new president is bullish on crypto

South Korea’s people have long been more enthusiastic about crypto than the country’s regulators and politicians. By one estimate, in 2021 one in three South Koreans either invested in crypto or was paid in digital assets. A study by the Korean government’s Financial Intelligence Unit (FIU) found that South Korea’s cryptocurrency market value was estimated at 55 trillion won (US$45.6 billion) as of the end of last year, that 15.2 million Koreans have accounts and 5.6 million registered users of crypto actually trade. Yet heading into Korea’s recent presidential election, the country was tightening oversight of cryptocurrencies in a manner detrimental to market growth.

Retail investing heats up in Indonesia

Amid a general digital finance boom in Indonesia, the nascent retail investing segment is growing fast. A proliferation of investment apps, usually with low minimum investments, is allowing a much greater proportion of the population to invest. Historically, the wealthy have dominated the country’s stock market. Indonesia’s newbie investors are not only interested in equities though; they are also increasingly keen on crypto. Many of Indonesia’ new retail investors are young people, with about 70% between the ages of 17 and 30, according to Indonesia’s central securities depository.

Malaysia is ambivalent about crypto

Could Malaysia become a crypto hub in Asia? A recent CoinDesk article made that case, pointing out that some of the necessary ingredients are already there, such as a common law system and institutional use of English. Further, Malaysia's crypto ownership rate of 19.9% is above the global average of 15.5%, according to Finder’s latest Cryptocurrency Adoption Index.

Australia’s Zeller finds that it pays to bet on SMEs

The performance of Australian neobanks so far has been a bit underwhelming. Of the best known four (not to be confused with the big four), only Judo Bank has been an unequivocal success. Xinja collapsed about a year after receiving its banking license; 86 400 threw in the towel when it received an offer from National Australia Bank (NAB) it could not refuse, and Volt is pivoting to banking as a service. Given that it is targeting a similar SME customer demographic to Judo, the ascendant Aussie fintech Zeller could be more successful than the digital lenders focusing on the retail market.

Is the worst over for Kakao?

While Kakao’s fundamentals remain strong, the Korean super app has been struggling of late amid a perfect storm of regulatory travails, investor disappointment and awkward leadership changes. In the past six months, Kakao Bank and Kakao Pay’s shares have both fallen about 29%.

India’s BNPL market is still far from peaking

What goes up must come down, right? Usually, yes, but with fintech startups the "up" can sometimes go on for so long that one wonders if the "down" is inevitable. This holds especially true for the buy now, pay later (BNPL) segment, which is now ascendant in India. The scale of BNPL’s growth in the subcontinent is something to behold. Indian research firm Redseer predicts that the market will reach US$45 billion to US$50 billion by 2026, an exponential increase from US$3 billion to US$3.5 billion now.

Pakistan could become a big fintech market

Pakistan is the largest nascent fintech market in Asia, with an unbanked population of 100 million. About 70% of the population lacks a bank account. In absolute numbers, there are more unbanked people in both India and Indonesia, but those markets have much more developed fintech ecosystems than Pakistan. The investors and firms that are able to get in on the ground floor in Pakistan and establish strong business models will be able to reap substantial rewards.

Assessing Revolut’s latest APAC expansion

In mid-2021, Revolut became the UK’s most valuable fintech with a valuation of US$33 billion. Though the company lost US$280 million in the 2020 fiscal year, it has continued to spend heavily on expansion efforts in a bid to build a “global financial super app.” Revolut has long had its eye on the Asia-Pacific region and recently moved to strengthen its position in both the India and Australia markets.

Banking has been critical to Revolut’s ascendancy in Europe. However, the company’s origins do not lie in deposit taking and lending. Indeed, Revolut began as a multi-currency travel card offering favorable exchange rates. In India, Revolut is returning to its roots with a focus on cross-border payments, as seen in the company’s recent strategic acquisition of Indian international money transfer firm Arvog Forex for an undisclosed sum. This deal – which follows Revolut’s Indian arm raising US$45.5 million from its UK parent – will allow Revolut to launch a cross-border remittances service for Indian customers in the second half of the year.

Philippine digibanking sector continues to grow briskly

The Philippine central bank BSP decided in October 2021 to cap the number of digital bank licenses at six for the next three years. It awarded licenses to Overseas Filipino Bank, Tonik Digital Bank, UNObank, Union Digital Bank, GOtyme and Maya Bank. The BSP wants to see how the arrival of digibanks affects the country’s financial industry before it issues any new licenses. Thus far, the digital lenders appear to be stimulating a huge amount of market activity.

Assessing Capital A, the new AirAsia

Long before the pandemic disrupted the world, Southeast Asia’s preeminent platform companies began integrating financial services into their apps for practical reasons. Their cash-burning core services, like e-commerce, ride hailing and food delivery, were failing to make money. Fintech was seen as the answer. Struggling airline AirAsia, now rebranded as Capital A, sees similar promise in digital financial services, but it still needs travel to recover for its digital services ecosystem to thrive.

Akulaku eyes further Southeast Asia expansion

Ant Group-backed Akulaku is one of the more promising fintech startups to emerge from Indonesia in recent years. In mid-February, Akulaku secured a US$100 million strategic investment from Thailand’s Siam Commercial Bank, which followed a US$125 million investment in 2021 co-led by Hong Kong’s Silverhorn Group. Akulaku is now valued at US$1.5 billion to US$2 billion.

What’s going on with the digital yen?

With CBDC hype subsiding – at least in most advanced economies – Japan’s plans for a digital yen are coming into focus and unsurprisingly, Tokyo is in no rush to launch a digital fiat currency even if it sees some upside to the idea in the long term. Japan has no compelling policy reasons to quickly roll out a digital yen, regardless of what China is doing. And in fact, Beijing spent about six years getting the digital RMB ready and it remains in the pilot stage.

How can Cambodia fix its financial crime problem?

Lax anti-money laundering (AML) controls resulted in Cambodia being placed on FATF’s grey list once again in February 2019. Since then, Cambodia has been trying to improve its AML capabilities but running into one obstacle after another. In Nov. 2021, the United States Department of State cautioned businesses about the risks of doing business in the kingdom in a new report, citing risks for the financial, real estate, casino, and infrastructure sectors.

Indonesia will probably be the first country in Southeast Asia where the reality of digital banking lives up to the hype. The vast archipelago nation has everything online banks need to thrive: a huge market, amenable regulators, sufficient connectivity and eager deep-pocketed investors. Even the complex geography of the country, which is made up of 17,508 islands (6000 of which are inhabited), favors branchless banking.

Why is PayPal struggling?

For an aspiring super app, PayPal’s performance over the past six months has been underwhelming. There is nothing “super” about its 59% decline in its share price to about US$110.50 during that period, nor the revelation that it had removed 4.5 million fraudulent user accounts. Though they were just a fraction of the company’s 425 million overall accounts, they represented a significant potential fraud risk.

More...

China’s vision of crypto-free blockchain is coming into focus

Remember when more crypto was traded in China than any other country in the world? Though it was less than five years ago, it seems like a lifetime ago. In 2021, China accelerated a long-running crackdown on decentralized virtual currencies, banning just about everything crypto-related but possession. While some diehard crypto enthusiasts in China may carry on, Beijing has made crypto trading more trouble than it is worth for most Chinese. With crypto out of the way, Beijing can now concentrate on developing its own blockchain ecosystem.

Is Thailand finally ready for digital banks?

Thailand is late to Asia’s digital banking party, which formally began back in 2019 when Hong Kong and Singapore approved them – though South Korea had digital banks as early as 2017. Since Asia’s two main financial centers embraced digital banks, Taiwan, the Philippines, Indonesia and Malaysia have followed suit. Until now, middle-income and well-banked (85% of the population has a bank account) Thailand has been a hold-out. A recent announcement by the kingdom’s central bank suggests a change of direction.

Vietnam's fintech sector heats up

Vietnam is one of the last major markets in the Asean region where fintech remains at a relatively nascent stage. The payments segment accounts for the lion’s share of fintech investment, a whopping 93% as of late 2021, according to Statista. There have been several key investments in that segment of late, as well one in retail investing.

Kakao comes down to earth

Kakao seems to have a case of the super-app blues, notably in its two fintech units. Shares of Kakao Bank and Kakao Pay have fallen 39% and 32% since their respective August and November debuts. Between December and late January, the Kakao group lost roughly US$25 billion in market value.