With the increasing usage of mobile devices such as smartphones and tablet PCs, mobile internet is becoming a new traffic entry point for many internet players. Alibaba's free wifi deployment will facilitate their entry point.

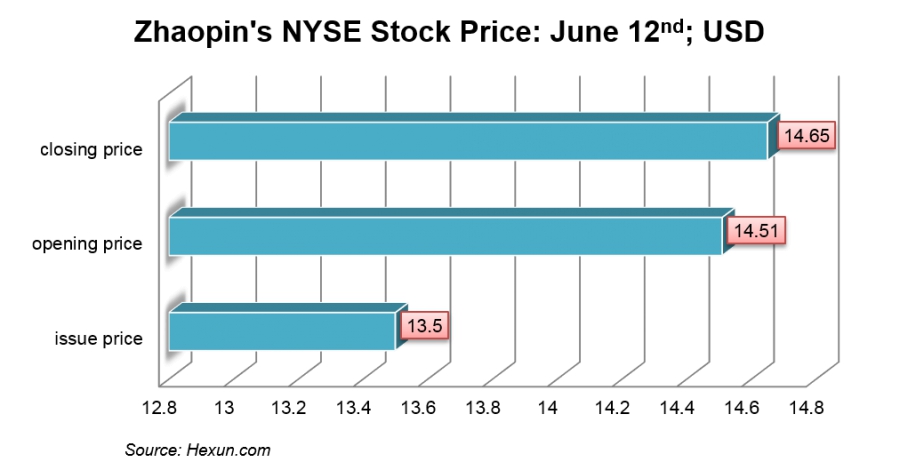

Zhaopin, a late comer to the NYSE

Shortly after Jumei Youpin, JD.com listed in US, Zhaopin, an online recruitment platform, listed on the NYSE on June 12th, 2014.

State Council is China’s main governing body and its opinions provide guidance for the financial industry and allow to peek into what the government has in mind for the markets in the coming years.

Consumer-brand companies in the Chinese IPO pipeline

Since the IPO hiatus last year many qualified mainland companies have been waiting for new capital. With banks traditionally more supportive of SOEs and PE not being able to invest since much of their capital have been locked already, many well-managed, fast-growing companies were starving of capital.

Macao Monetary Authority Regulating Bitcoin

After successive Bitcoin crackdown by mainland regulators, banks and online merchants, Bitcoin is left hanging in China.

The RMB continued its relentless march towards being a trade currency with over US$15 billion in RMB bond issuance in the city-state of Singapore - more than doubling the issuance of 10 years ago.

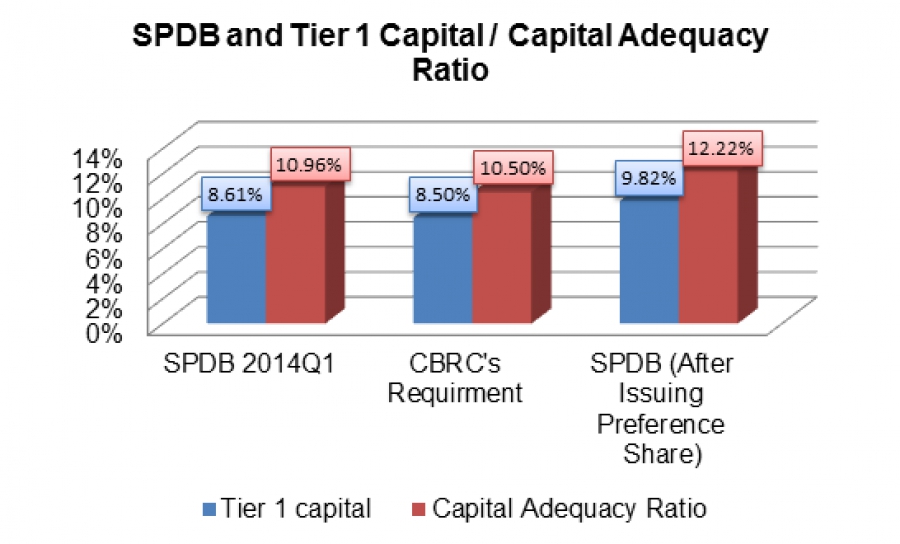

Chinese Banks Boost Their Tier 2 Capital

The 2014 year seems to be a year for banks to pad their capital base. Previous heated discussion was around Tier 1 capital sufficiency, after which additional capital has been supplemented via issuing preference shares by SPDB, Bank of China and Agricultural Bank of China.

China's Credit Card Market is far from Saturated

The latest payment report released by PBOC shows that by the end of 2014Q1, the cumulative number of bank cards issued reached 4.39 billion. Debit cards are still the most widely used card type, accounting for approximately at 3.97 billion.

The future of mobile payment in China

The latest payment report released by PBOC shows that in 2014Q1, electronic payments kept a steady growth with the most eye-catching performance being from mobile payments.

Why Did JD.com Suddenly Decide to List on NASDAQ?

On May 22nd, JD.com listed on NASDAQ, with the timing being somewhat of a surprise for many market observers.

Should you worry about the security issues in China?

People prefer to keep their information in a safe place, so do nations. After the PRISM scandal information security issues has become a concern for many countries.

After setting up its strategy as “All in Mobile E-Commerce” at the beginning of this year, Alibaba has been gradually building up its Online2Offline business - now focusing on healthcare.

According to the Chinese Financial Certification Association, in the major 35 cities of China only 3% of electronic (Internet and mobile) banking clients use Near Field Communication technology as a payment method. With all the convenience of the NFC technology it seems strange that the trend didn’t pick up yet.

With the introduction of regulations on preference shares by the CBRC and PBOC in this March and April, banks seem to be willing to explore the new financing option.

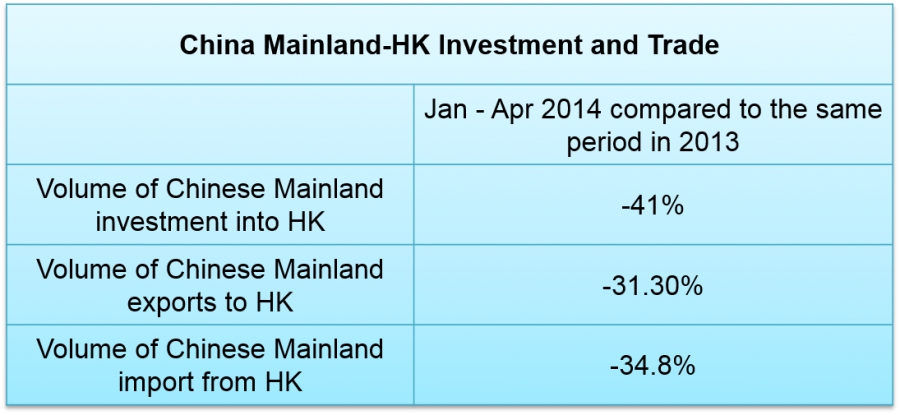

According to the latest numbers from Ministry of Commerce of PRC, in the first 4 months of 2014, the investment into Hong Kong from Mainland and exports from Chinese mainland to Hong Kong decreased largely.

The latest figure announced by the CSRC indicates that in early 2014, the number of Chinese securities investment funds registered increased, with the total turnover declined dramatically.

An update on Shanghai FTZ Financial Reform

In year 2014 we expect to see numerous new policy and regulation updates on the financial reform of Shanghai FTZ. Where are we today?

Shanghai local government and Chinese central government will endeavor to expand the market functions, deepen the opening of local financial markets to foreign investors, increase the number of financial institutions in the FTZ, encourage the financial business innovation and make Shanghai more of an international financial center.

Some of China's financial reforms are under consideration or have already been executed in 2014, such as setting up crude oil futures, international gold trading, financial asset trading, syndicated loan trading platforms and building nationwide trust registry service institutions. Besides, rules regarding foreign and FTZ-registered firms’ parent companies RMB bonds issuance are on the way. Moreover, Shanghai FTZ regulators will also consider introduction of free trade account management by allowing financial institutions to set up FTA (Free Trade Account) accounting units segregated for residents and non-residents. Furthermore, Shanghai FTZ regulators encourage direct investment abroad from local firms and private equity funds. The main contents of Shanghai FTZ’s reform could be described as a ‘1+4’ policy, where ‘1’ stands for risk control segregate account system; ‘4’ stands for interest rate liberalization, foreign exchange liberalization, RMB cross-border utilization and RMB capital account opening.

FX reform and FTA accounts

PBOC announced that, starting on March 17, 2014, the interbank RMB/USD spot price’s fluctuation spread increased from 1% to 2%. For commercial banks, the fluctuation range of RMB/USD spot price offering to the clients could be expanded from 2% to 3% from the mid-price calculated by Chinese interbank FX market. This is the third time for PBOC to expand the fluctuation range. Analysts say the expansion in RMB/USD spot fluctuation range is a clear signal that RMB will be internationalized in the near future and Shanghai FTZ is thought to be a test-bed for that. The most prominent aspect of Shanghai FTZ FX reform is the FTA (Free Trade Account). FTA is essentially a free trade bank account for Shanghai FTZ registered firms, very similar to an offshore bank account, which enables free capital flow inside the FTZ. FTA system allows both foreigners and local residents to get their money in and out through FTZ. Overall, there are mainly 3 types of FTA accounts. Local firms in the FTZ could open FTA accounts; individuals in the FTZ could open FTA accounts; foreign firms in the FTZ could open FTN accounts. As regulators are treading conservatively with hot money inflows and money laundering risks in mind, there is still no detailed timeline. However, we believe the FTA mechanism will be released in 2014 or 2015 as a momentous milestone in China's financial reform history.

Interest rate reform

In March, 2014, a PBOC official claimed that the sequence of Shanghai FTZ interest rate reform will be ‘liberalize interest rates for foreign currencies prior to RMB interest rates; free the loan rates prior the deposit rates’.

There were actions towards interest rate reform in Shanghai FTZ from the regulators. PBOC announced that from March 1st, 2014, the deposit rate of foreign currencies below the amount of USD3 million would be liberalized, which actually removed the ceiling for foreign currencies’ deposit rate. This is thought to be an important step on the road to fully liberalized interest rate reform. The next step could be liberalization of the deposit rates of the local currency, which may not only be applicable in Shanghai FTZ, but also the rest of China.

Cross-border RMB utilization

On Feb 21, 2014, PBOC released the detailed regulation on expanding the usage of RMB overseas, which simplified the process of RMB overseas usage under current and direct investment account. However, overseas RMB financial scale and usage range will still be restricted, as well as cross-border e-commerce transactions and RMB trading services.

Six banks constitute the first batch of firms applied for the cross-border RMB settlement licenses. ICBC and Bank of China helped their clients within the zone to make an overseas RMB loan; Bank of Shanghai, HSBC and Citi Bank launched cross-border RMB current account centralized collection and payment services; Bank of Communications signed the first overseas RMB borrowing service for the non-bank financial institutions.

Capital account liberalization (to be announced)

In the future, the capital account might be opened for local and foreign investors. As Chinese reformers are relatively prudent and conservative, the liberalization process of capital accounts have been advancing relatively slowly so far. One important step in the process will be a gradual opening of commercial futures market to foreign institutional investors.

2014 version of ‘negative list’ (possibly to be released in the 1st half of 2014)

In the 1st half of 2014, a new version of ‘negative list’ will be released to update the 2013 version. Although it is not clear what items this version may include, there are two aspects which are certain. One aspect is that the contents included in the negative item list will be shortened, which implies that the restrictions on types of companies to register in the zone will be reduced. The other aspect is that Shanghai FTZ might cooperate with Hong Kong to introduce advanced practices from the city.

We also have an in-depth report on Shanghai FTZ available here.

Cracks are starting to show in the once impervious armor of China's online finance platforms as yields have dropped 20% from their highs. Ranging from about 4.7-5.6%, the current highs are much lower than the 6-8% that we saw at the end of 2013 and beginning of 2014.

China's online finance platforms facing headwinds

Realistically though, this isn't surprising. As we have discussed before, these platforms were running on borrowed time. Whilst the business model made sense, the inter-bank lending rates and the negotiated deposits that the main China online finance platforms were able to negotiate were a bit of a perfect storm for the platforms.

Now as the banks have put limits in place on the amount of money that can be moved on and off the platform at any one time, we're starting to see the market's reaction to what has caught most banks and the regulators completely off-guard. This is unlikely to be the last push-back from the banks on these new financial products.

Unclear Regulation

Yet the platforms still have over 1.45 trillion yuan (US$230+ billion) on their platforms and this is unlikely to rapidly decrease anytime soon. 4-5% is still much better than the average retail consumer could get on a bank demand deposit in most of China's main banks and the convenience can't be beat - very easy to get money on and off the platforms, although within the limits set out by the PBOC.

This is far from the end of the story thought. We expect the growth of the platforms to certainly slow and although its still a bit unclear as to what the regulation will be, further regulation and requirements from the PBOC is inevitable as we go forward in 2014. This is all the more critical as Alibaba moves forward on the IPO plans. Can the company count on that part of the business to still drive revenue?

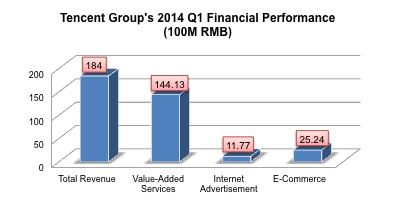

Tencent e-commerce challenges are surfacing

The latest financials from Tencent Group shows that overall growth stayed strong in the first quarter of 2014 as revenue hit RMB 18.4 billion, 78% of which were value-added services. E-commerce however suffered as revenues declined 24% as compared to Q4 2013. Tencent indicated that the lagging performance was a seasonal factor; in addition Tencent has recently re-focused its e-commerce strategy.

As known, Tencent setup a partnership with Jingdong this year, acquiring 15% of the online retailer which also holds QQ wanggou and Paipai. The acquisiton is an indication that Tencent is serious about e-commerce, but they still seem to be searching for the right business model. Yet with Alibaba listing soon, Tencent will have to show rapid returns on their investment in order to keep a increasingly impatient set of investors happy. Tencent's e-commerce challenges must now be confronted to stay ahead of the game.

The latest figures from online saving funds financial statements have shown that the BAT (Baidu, Alibaba, Tencent) online money funds continued expanding. The 2014Q1 data reveals that Tianghong Zenglibao, relying on the huge client base of Yuebao, lead the market and is the first online saving funds that exceeds RMB100 Billion.

Bitcoin in China, where to go?

Fiona Zhao, one of our analysts here at Kapronasia, has been covering bitcoin in China from the beginning. Here she lays out the reasons why bitcoin in China won't survive.

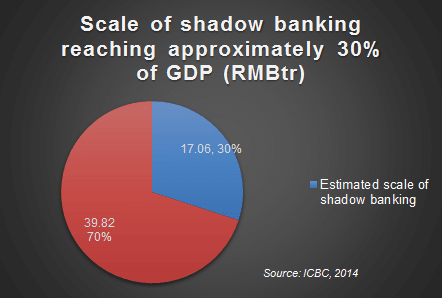

On April 20th, the CEO of ICBC, quoting data from internal sources, claimed that the estimated scale of shadow banking in China is around RMB15-20tn, which is relatively small in scale to GDP when compared to shadow banking in more developed countries.

In addition, the leverage used in the Chinese shadow banking industry is not as large as other countries, so he argued that it is not necessary to worry about systematic risks in the Chinese financial system, but he still admitted there are non-systematic risks caused by shadow banking industry.

However, many independent financial analysts say that the scale and risk involved of shadow banking are underestimated and there might be increasing number of events happened in 2014 around shadow banking in China.

Hong Kong-Shanghai Stock Market Connect

On April 10, 2014, the Chinese government approved the proposal for Hong Kong-Shanghai Stock Market Connect program, which will allow mainland investors to directly trade stocks in Hong Kong market and Hong Kong investors to trade equities in A-share markets.

In recent years China's mobile internet has been developing quickly and had a great impact on people’s lives. The official figures show that by the end of 2013, China had approximately 500 million mobile internet users, a 25% increase over 2012. With the penetration of smartphones in China more users prefer to use mobile devices to deal with many daily tasks.

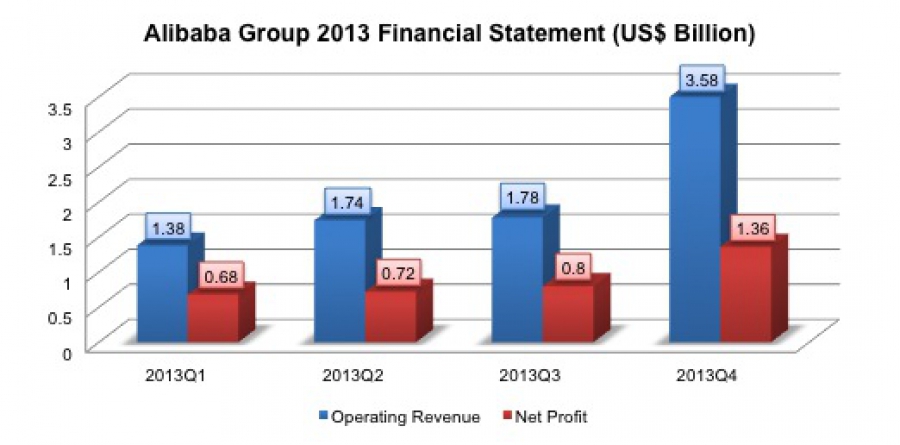

Over the next week, we'll be publishing a number of articles looking at the upcoming Alibaba IPO which could be the largest tech IPO ever. Today we look at the financials filed with the SEC.

On April 14, 2014, Shanghai Stock Exchange-traded *ST Changyou was delisted, becoming the first state owned company to be delisted in A-share markets.

As US SEC’s investigation on large investment banks recruiting Chinese governmental officials’ and SOE senior managers’ children is going further than any such probe before, the dark side of foreign companies operating in Chinese markets is gradually being exposed to the public. However, that probably doesn’t come as a surprise for the Chinese public which has known and suffered from the ‘unwritten rules’ for a long time.

Future of the rising government debt in China

Last month, Shanghai Chaori Solar Energy Science & Technology became the first company to default in China's bond market when it failed to make a full payment on the issued debt. This shows that the Chinese state is not going to back up even big private borrowers. Several other companies are also on the verge of debt insolvency, according to local media sources, with government debt also on the rise.

China's First Bitcoin 'ATM' - Our First Impressions

After couple of months of low trading volume and little news, BTC China, previously the largest and still one of the most prominent bitcoin exchanges in China has moved the goalposts for other exchanges (and the PBOC!) by launching the first physical Chinese Bitcoin 'ATM' at the IC Coffee Shop in Zhangjiang Hi-tech Park in Shanghai on Tuesday the 15th. In addition to the physical ATM, BTC China released a new mobile Web appcalled “Picasso ATM”, which is actually the main theme of the ATM launch.

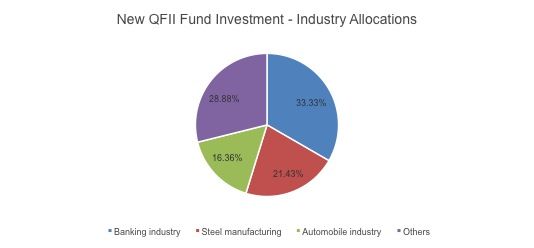

The latest statistics about the A-share markets illustrate the main industries that QFII funds invested at the end of 2013, according to data from 1334 listed firms’ 2013 annual reports. The banking industry is the most attractive industry for QFII investors, taking about 1/3 of the total new shareholding volume with the steel industry and automobile industry ranked the 2nd and the 3rd.

The banking industry makes sense because of the relatively low valuations. The steel industry is currently suffering in China, so QFIIs likely have confidence that Chinese urbanization and development of automobile industry will continue. For automobile industry, as Chinese government intends to push hardly on new energy vehicles especially electricity-powered vehicles, could pose an interesting QFII investment allocaction.

More...

On China's supposed bitcoin 'd-day', April 15th, BTCChina launches Shanghai ATM what could be the country's first bitcoin ATM. Kapronasia was onsite on launch day and will have an update tonight on our experience using the ATM.

Does the High Frequency Trading debate matter for China?

High frequency trading (HFT) has roughly been in existence since 1999 in the US as execution times have shortened from several seconds to millisecond or even microseconds due to advanced trading technologies and a general demand for increased speed. Figures from August 2013 showed that in the global FX market, HFT took approximately 40% of the total trading volume, within which, almost half of the volume happened in the spot market. For the global futures market, HFT volume represents about 40% of the total volume. In the equities market in the US, HFT volume took approximately 73% of all equity order volume. Typical strategies executed by HFT traders are trading ahead of index fund rebalancing, market making, ticker tape trading, event arbitrage, statistical arbitrage, news-based trading and low-latency strategies.

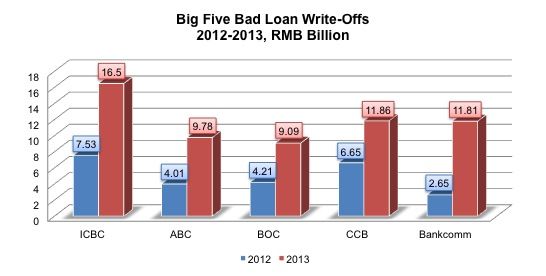

Accroding to the latest figures from the CBRC (China Banking Regulatory Commission), Chinese banks’ asset quality deteriorated as the balance of bad loans continued rising from RMB 492.9 billion in 2012 to RMB 592.1 billion in 2013. However, as banks wrote off significant amounts of bad loans in 2013, the bad loans ratio grew only slightly from 0.95% to 1%, leaving the asset quality in relatively good shape. The largest outstanding bad loans are from the big five banks, who have hit a 10 year peak of bad loans - in total, they have written off RMB 59 billion up significantly from 2012.

The large amount of write-offs prevent the bad loan ratio from growing fast. In addition, Chinese banks have a relatively higher provision coverage ratio, so they are able to write off more. As China is in the middle of an economic transistion, we estimate that banks’ bad loans will continue rising as exports continue to slow and industry shifts excess capacity. Further 2014 write-offs will be supported by the CBRC’s latest guidance.

You'd be forgiven for missing it, but in the buying spree that we've seen in the last couple of weeks from Alibaba, one of the most significant investments was for a controlling stake in Hundsun Technologies. The ~US$532M investment in the firm means that Alibaba now has control of nearly 95% of all domestic trading systems in China and continues to consolidate its position as a financial technology provider.