How China's P2P lending companies could “guarantee” a return

“I don’t really care about what are the investment projects on the P2P platform or the borrowers’ details. My attention is more on the investment return, since most of the platform provide guaranteed return rate.”

Mainland Chinese use Hong Kong life insurance policies as a new way of getting their money abroad

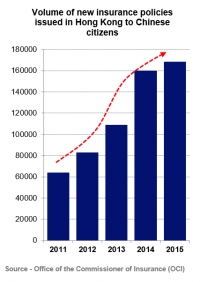

With an estimated USD 1 trillion worth of capital outflows from Mainland China in 2015, it is clear that a subset of Chinese citizens would rather keep their money outside of China. Following the country’s turbulent stock market and depreciating Yuan, an estimated 100,000+ Mainland Chinese citizens have been venturing out to Hong Kong in order transfer more than the stipulated USD 50,000 outside of China through the means of insurance policies.

Samsung Pay extends its global presence to allow South Koreans to make mobile payments in China and the US

The global payments market has seen a variety of challenges that have restricted payment systems from either successfully expanding overseas or gaining significant market share. Samsung Pay seems to have maneuvered itself around many of the challenges that overseas expansion brings, and has taken steps to increase its global merchant acceptance in the US and China for South Korean consumers.

The Perfect Partnership? India’s Paytm and Alibaba’s cloud computing arm enter into a commercial agreement

Many commercial partnerships result in a broader pool of knowledge, increased resources and the prospect for rapid market growth. This is certainly the case for India’s largest payment startup Paytm and Alibaba’s cloud computing division Aliyun who have just signed an agreement that should be a tremendous opportunity for both companies.

Last week China’s central bank announced the possibility of launching its own digital currency on its official website. What is behind the government's push to launch a digital currency? Control money outflow? Better monitor cash transactions?

China's PBOC revokes yet another prepaid card company license

In January 2015, Chang-Go, one of the more successful prepaid card companies operating in China, was ordered by China's Central Bank to stop operations. According to the bank, the company was not giving customers refunds in a full manner, misappropriated reserve deposits and even forged financial documents.

China’s Circuit Breakers ineffective against the market turbulence. Have the regulators implemented the right market measures?

It will come as no surprise to the avid watchers of the Chinese stock market that China’s start to 2016 has not been a success by any means. The CSI 300 index of blue chip stocks plummeted by 5% on Thursday 7th January, prompting the newly implemented circuit breakers to kick in and suspend trading for 15 minutes in order to remediate market volatility.

A recent announcement from China's central bank, the PBOC, now allows banks to remotely open bank accounts, which was previously not possible - there was at least a bank visit and some paperwork needed. The announcement allows customers to open new accounts via their mobile, which should increase competition significantly between the BAT and traditional banks.

Numerous Chinese media outlets are reporting on the latest moves by China's regulators to stop any new internet finance company registrations in China. The announcement is a bit vague as is expected from regulators, but indicates that no new fintech business license registrations will be allowed for the foreseeable future.

Recent development of the situation in the stock market presents opportunities for investors and regulators

The RMB-USD exchange rate has two different values: the onshore value, determined by the PBOC at markets opening, and the offshore value, which is market-driven and used in Hong Kong. These two rates were usually almost identical, until August 2015 when a surprise depreciation by the Chinese central bank caused an even deeper depreciation in the offshore value, with the spread between the two starting to become significant, especially towards the end of the year when the yuan continued to lose value in comparison to the US dollar.

New circuit-breaker rules have been tested already, but are they a solution for market volatility?

When the Shanghai Stock Market first opened after the New Year’s holiday, everything quickly turned for the worst: a fast, large rout emerged, with the CSI300 Index losing 5 percentage points by 1 am. Then it stopped for 15 minutes, as trades were paused. After the break ended, the index kept going down, down in fact 7% on the previous trading day in just two minutes. At this point negotiations stopped again, but this time for the rest of the day.

China’s Banking Regulation Commission (CBRC) has played with fire long enough, standing on the side and watching the story of online peer-to-peer lending unfold, as it started with a tremendous rise from 2013 to 2014 and to quickly turn into a machine of fraud and risk, potentially damaging countless individuals who were naïve enough to trust this system.

How China's mobile payment regulations fit into the broader strategy for the financial industry

On the 28th of December, China promulgated the next set of mobile payment regulations. Although some of the regulation was expected, how will the rest impact the mobile payment industry development in 2016?

2016 should be the year when finally Apple Pay manages to launch in China, as announced by the Cupertino-based company on its own website and as was already reported by the Wall Street Journal earlier this past autumn. This wasn't really a surprise as Apple had long talked about its China plans for Apple Pay. Less expected, Samsung Pay is also going through the same process and should also launch in 2016.

China UnionPay and the big banks make another push into the mobile payments market, but is it too little too late?

The 12th of December marked the official announcement by China UnionPay (CUP) of the launch of Cloud QuickPass, a mobile payment solutionbased on NFC (Near Field Communication) technology. Tests had been ongoing since May at franchises like McDonald’s, with the backing of the Industrial and Commercial Bank of China (ICBC) and builds on the existing QuickPass NFC technology deployed in many of the current CUP point-of-sale terminals around China.

Could China’s Yelp, Dianping be the international opportunity for China’s O2O business?

China’s digital travel landscape is a world in its own. Increasingly, globe-trotting Chinese are turning away from prepaid package tours and becoming more mobile savvy in applications from hotel booking to local entertainment. It is estimated recently by Dianping, a restaurant review and coupon website that Chinese outbound tourists are forecast to spend 250 billion yuan (US$39 billion) on food in 2015, 25% more than in 2014.

Alipay has made it to Macau. Hello gaming industry!

Early last month, in a statement released from the Monetary Authority of Macau, Alipay was approved for use in Macau's gaming market a fact confirmed by the industry that now macau residents and/or institutions can have an Alipay account and use it for payments.

Will China's crackdown on illegal offshore money transfer matter?

As China's economy slows and people push to move their money abroad for better returns, the government is now trying its best to keep money at home. The PBOC has estimated that outflows of the China’s foreign reserve attributed to illegal underground banks amounted to about 800 billion yuan ($125 billion) from April to October this year. Chinese police launched a series of crackdown on underground banking and illegal foreign-exchange network to continue the anti-corruption campaign. But will it matter? Can they actually stem the flow of money out?

Apple. Pay. Finally. Makes. It. To. China....well maybe...

After nearly a year and a half from its US release date and after long preparations and cancelled announcements it finally looks like Apple will be releasing its mobile payment system, Apple Pay, in China somewhere in Q1 of 2016, possibly before Chinese New Year rolls around.

Tencent's WeChat Pay ramps up international expansion; will directly challenge western incumbents

In a world where everything seems to be made in China there are still markets where China is no where to be found, but Western companies still dominate. One of those is the cashless payments market, with giant companies such as Visa, MasterCard and American Express owning the market for bank cards and payment networks.

On November 18th, Baidu announced that it was finalising its private bank plans and would be setting up a banking venture with China Citic bank called Baixin. This was the last of the 3 BAT (Baidu, Alibaba, Tencent) to setup a private bank and was widely expected, although potentially a bit later than originally thought.

The end of China’s one-child policy could bring more opportunities to education-oriented wealth management products

China officially dropped its one-child policy by announcing that all married couples would be allowed to have two children. The move had an impact on markets at home and abroad. Shares in companies that make baby products such as diapers, prams and infant formula were up on the day of announcement while shares of popular contraception brand fell. This economic wave travelled as far as New Zealand where the currency of the dairy exporting country surged. The market reacts for a good reason. It is estimated that the relaxed controls would result in an extra 3 million to 6 million babies born annually in the five-year period starting in 2017.

China arrests HK fund executives for an alleged $315 million gain

Shanghai police have arrested 2 executives from a HK-owned High Frequency Trading (HFT) fund for irregular futures trading. This is actually the first public arrest of a non-mainland fund since the crackdown of HFT started a few weeks ago. According to the authorities, the case is still under investigation and two foreign nationals are involved in the case.

Baidu the biggest winner in the Ctrip and Qunar's tie-up

Chinese largest online travel company Ctrip.com International Ltd announced a 45% tie-up with its competition Qunar Cayman Islands Ltd to create an absolute dominant position for China’s fiercely competitive online travel market.

The US ATM manufacturer Diebold is discussing a potential takeover with Wincor Nixdorf, a German ATM manufacturer. Wincor Nixdorf was offered approximately EUR 1.74 billion at EUR 52.50 per share, a price which includes a 30% premium over the stock price on the date of the offering.

The two companies are number 2 and 3 globally, but the ATM market is slowing down, as mature markets are already saturated and sales in the emerging markets are quickly reaching their peak. The industry is also feeling pressure from virtual payments as the shift away from cash and bank cards is happening across the world.

Swatch moves into payment-enabled smartwatches with a NFC watch

Earlier this week at The Swatch Art Peace Hotel on the Shanghai Bund, Swatch launched a new smartwatch called the Swatch Bellamy. The Swiss based company announced that it is teaming up with China UnionPay and the Bank of Communications to allow the device to be used for mobile payments at any UnionPay POS as it seems like the Bellamy is NFC-enabled.

Two days after the global transaction service provider SWIFT reported that in August the yuan overtook the Japanese yen to be the world's fourth-largest payment currency, accounting for 2.79% of the global market, yesterday the PBOC launched the Cross-Border Interbank Payment System (CIPS) in Shanghai.

Alibaba invests more in Paytm to drive further into India

Earlier this week, Alibaba announced it would be investing an additional estimated USD680 million in Paytm, India’s largest mobile payment platform and part of One97 Communications. The investment ups Alibaba's overall ownership to around 40% and shows the e-commerce giant's ambitions to further help develop the mobile commerce and payment industry in India. The money will primarily be used to strengthen the technological platform, customer acquisition and entry into new categories.

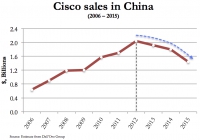

Facing hard choices in the midst of China's new banking cyber-security law, Cisco announces a $10 billion China initiative starting with a local JV with Inspur

With growing national security concerns surrounding imported western network equipment, China’s intensions have been to utilise homegrown network equipment to support its IT infrastructure. Tech giants like Cisco have been displaced to the sidelines with shrinking market share and deflating revenues in the Chinese market. It seems Cisco, who was once critical to the design and construction of China’s internet revolution in the 90’s will be marginalised if it does not take action to boost its sales in China.

Xiaomi take on market leader China Mobile with launch of mobile services

If you've ever been to China, you know how atrocious the mobile phone service can be. Previously, you could use any of a number of carriers...as long as it was China Mobile. You could move your number to a different carrier...as long as you had a different number. Users really had no choice as the market was controlled by the government and the 3 main state-owned carriers. Xiaomi is one of eight firms that will be trying to change this.

More...

Facing dampened consumer spending and low investor sentiment, Alibaba and JD.com seek to grow E-Commerce through rural consumption

Delivery of online orders to the rural parts of China is becoming more prevalent now that rural consumers' wealth increases and they gain access to internet connected devices. But how will delivery teams navigate the challenging tight pathways, rice paddies and unmarked housing to make successful deliveries?

Tencent expands WeChat payment services overseas to capitalise on the growing mobile payments industry

As mobile payments become increasingly abundant among global transactions and an increasing preference for mobile payments amongst Chinese consumers continues to develop both in China and overseas, it was only a matter of time for which mobile payment platform providers would see the opportunity to capitalize on the growing overseas demand for mobile payments.

As a national idol and a self-made billionaire in China, Jack Ma has already shown how he could change the e-commerce industry. He is now creating an internet entertainment empire with Alibaba's previous expansion into music and movies, and now sports.

A cinema in Beijing recently announced that it had become a 'smart movie theatre' by allowing moviegoers to book tickets on their phone which can then be read by a machine a the theatre. Not a completely innovative idea, but considering Alibaba is involved, this could be a big change in the way people consume the medium.