The long expected payment system of smartphone producer Xiaomi has finally entered the market. By cooperating with China’s dominant card-payment processor China UnionPay, users can now make purchases by using their phone and Xiaomi Pay through China UnionPays’ Quickpass system. The company’s latest offering comes as the third-party mobile payment market continues to grow tremendously. According to research firm Analysys Mason, the market valuation was set at 16 trillion yuan in 2015. This has attracted not only Chinese companies such as Huawei and Xiaomi, but foreign companies, as well.

The pie of banking services in India is well spread out amongst various types of banks, ranging from private sector, public sector, foreign banks, rural banks and even cooperatives. However, market forces are starting to whittle down the once varied field of payment service providers (PSPs), and it is starting to look more like a two horse race similar to other e-commerce markets in Asia.

India’s first small finance bank

Capital Small Finance Bank (SFB) was launched this Sunday (April 24, 2016) with much fanfare. This is the first of the ten small finance banks to become operational. The SFBs had received in principle approval from RBI last fiscal to start operations.

Gold benchmark contract launched in China

Shanghai Gold Exchange started trading a new gold contract on April 19th. The contract is meant to become a global benchmark similar to the gold fix originated in London and New York, but denominated in RMB.

Is Payments Association launching a clearing platform to streamline the payments industry or to compete with Alipay?

There's a clearing platform in development that might change the playing field of the payments industry in China. The Payment and Clearing Association of China had a member congress in April and has approved a proposal to build an Internet payment clearing platform for non-bank payment institutions.

Indian Startups are finding suitors in Indian Banks

And these are not Fintech startups alone. The banking sector is trying to woo this very important and growing ecosystem in the country. Some banks have resorted to novel ways of doing so. RBL (Ratnakar Bank Limited) has announced opening of a branch in Bengaluru dedicated exclusively to cater to the growing startup ecosystem in that city. This comes close on the heels of SBI recently announcing the establishment of its branch called InCube in Bengaluru recently. RBL bank plans to launch several such branches across the country in the future.

VDBS for financial inclusion in India

It is well understood that India continues to have acute challenges around financial inclusion. Only 40 per cent of the adults in the country have formal bank accounts, despite the country having 150 domestic commercial banks and over 2,700 co-operative sector banks operating in the country.

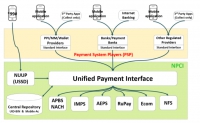

India’s UPI needs to work on another UPI

The financial services sector in India is at it again; at least the regulators and the mainstream business publications are. Talking up UPI (Unified Payments Interface) as a panacea for India’s challenges with financial inclusion, cash economy (read black money), plateauing digital ecosystem and you name it.

Alibaba vs Rakuten! Will India’s ecommerce be the new battleground for China and Japan?

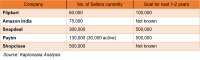

After a lull in investments and a lacklustre IPO, the Indian ecommerce market is heating up once again. While China-based Alibaba had earlier invested in Snapdeal (ranked #2 in India by market share) and Paytm, it recently announced a direct foray into the Indian market, making the entire ecommerce sector sit up and take notice. Now Japan’s Rakuten seems set to follow suit into India.

Recently DCB Bank became the first bank in India to introduce Aadhar based authentication at its ATMs, starting with its branch in India’s commercial hub- Mumbai. Aadhar provides a 12 digit number to every Indian resident that serves as a proof of identity as well as proof of residence, with biometric scanners being used for authentication.

Bank of America Merrill Lynch recently confirmed the application of the block chain-based technology to trade finance transactions. This is a clear indication from the traditional banking sector of their support for the disruptive technology. The bitcoin’s underlying technology finally is seeing practical use.

What’s the golden rule for investment? Don’t lose money. China’s middle class are thinking the same, and people are looking to P2P platforms for ‘safe and high return investment’ until the recent successive P2P company crisis from Jinlu to Zhongjin which has become a nightmare for the families who invested everything on them - the future of P2P products is uncertain.

Ecommerce companies in India embracing UPI for Payments

Ecommerce major Flipkart’s acquisition of UPI based startup PhonePe Internet Pvt Ltd shows that the payment space is heating up at a rapid pace. Incidentally PhonePe, the Bengaluru based startup was launched by three former Flipkart executives just four months back, and is focusing on peer to peer payments, bill payment and merchant payments- areas of interest for ecommerce companies.

E-commerce Regulations in India: More pain than power!

Earlier this week the Department of Industrial Policy and Promotion (DIPP) came out with guidelines allowing for 100 percent Foreign Direct Investment (FDI) in online retail of goods and services.

Official Fintech regulator set up by China government

China’s fintech sector has enjoyed significant development, but has recently been constrained by more active regulators who have increased their rate of regulation to try and stay ahead of the industry development. After two years of planning and industry development, a public-private body was established by the People's Bank of China - the National Internet Finance Association.

Last week saw the first ever IPO by an Indian e-commerce company. Infibeam’s IPO however, might not provide an accurate baseline for the booming Indian ecommerce industry.

JP Morgan recently joined a long list of foreign Financial Institutions (FIs) that entered India with a lot of enthusiasm only to exit in a few years. The last 5 years have seen over 9 exits from asset management companies (AMCs) alone. India was the largest promise for some of these businesses outside of their playgrounds in the western hemisphere. So what went wrong?

In early March Citibank announced that it would sell-off its 20% stake in China Guangfa Bank to China Life insurance for USD 3 billion, almost five times more than what the US bank paid for the stake in 2006.

Tencent was reporting its quarterly earnings on March 17th and for the first time the company disclosed its WeChat Wallet fees that the company pays to partner banks. Tencent CEO Pony Ma said the fees are 0.1% of each transaction and totalled more than RMB 300 million in January.

Integration is winning the payments race in India

The payments space in India is heating up. Smaller players are looking at exits through consolidation into bigger players. The bigger players have challenges of their own.

The recent move by the National Payments Corporation of India (NPCI) to initiate a ‘Unified Payment Interface (UPI)’ which aims to simplify and provide a single interface across all banking payment systems is a welcome decision. It is understood that 30 banks have evinced interest to commence UPI-based services in the new financial year (April 2016-March 2017) in India.

China’s mobile giant Huawei held a signing ceremony in Huawei's Shenzhen headquarters with Bank of China to co-develop next mobile based payment system Huawei Pay. This announcement was just released after Apple Pay and Samsung Pay claimed to make its entry in to China.

Can Indian IT companies ever win the blockchain race?

Currently Indian IT companies draw between 25-40% of their revenues from the Banking and Financial Services and Insurance (BFSI) sector. This revenue size of about $35-45 Billion implies that Indian IT continues to draw its sustenance from the BFSI universe.

Although UnionPay is known for its control of the domestic Chinese payment market, it also has over 50 million cards issued overseas. So in other words, a China UnionPay branded card issued by a foreign bank in a foreign country and a foreign currency. In its international push, UnionPay would like its cards to be used both online and offline. Foreign cardholders are increasingly using them for paying at POS and for ATM cash withdrawal, however, there was never a compelling case to use UnionPay cards online, where established card brands like Visa and MasterCard dominate.

China plans some new rules for the Qualified Domestic Institutional Investor program to further facilitate the cross-border investment and help the fundraising environment.

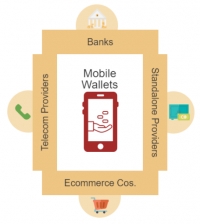

More eWallets in India - How many is too many?

The last few months saw some big announcements in the e-wallets space in India. Wallet adoption, particularly on mobile, has been quite rapid in India, with wallet based transactions doubling in both number of transactions (153 Million in 2015 vs 67 Million in 2014) and value ($820 Million in 2015 vs $329 Million in 2014) as compared to the previous year (Q4 comparison from RBI data).

Is Meituan a payments provider without a license?

Recently a lawyer in China caused a stir in the payments industry by filing a complaint with the People's Bank of China (PBOC) on Meituan, China’s major O2O platform which is worth tens of USD billions. The complaint alleged that Meituan is engaged in payment settlement without having a required payments license.

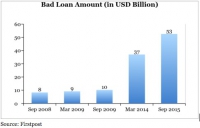

India taking banking NPAs head on

NPAs (non-performing assets) as a percentage of total banking credit in the Indian banking industry has increased to nearly 5% in 2015. This has essentially come from the public sector (state owned) banks (PSBs). 90% of the NPAs in the Indian banking industry are attributable to these banks.

Banks take center stage in India’s Union Budget

Finance Minister Arun Jaitley presented the Union Budget for 2016-17 and while India’s high economic growth rate of 7.6% was a bright spot, banking related allocations grabbed the most attention.

Indian payments banks come knocking! But wait…

The 11 applicants were given a go ahead last year by the RBI to start payments banking services in the country and are readying to start operations around the middle of this year. This will be the Indian central bank's first tryst with pure play fintech enabled service institutions in the country. This will also be a first for several of the licensees planning to operate in this space.

More...

For many years, the Chinese government has encouraged cross-border investment, both to support the domestic stock markets, but to also give domestic investors more choice in investment options and products. One such program was the QDLP program or Qualified Domestic Limited Partner scheme. Due to the renewed focus on controlling outflows, this program is now stopped.

Digital Payments and Tourism: Lakala bought out by Tibet Tourism

A tightening regulatory policy towards third party payment has driven China's payment industry into a period of consolidation and M&A. For some, this has been a great opportunity to get into other segments of the market like O2O (online to offline). We saw this in 2015 when Wanda bought 99bill. This time it's Lakala with a help of with a company called ‘Tibet Tourism.’

UnionPay's data arm collaborates with a global advertising network to combine card transaction and consumer behavior data

In January 2015, UnionPay Smart, a China UnionPay company specialized in business intelligence, customer profiling and online marketing, announced an agreement with Isobar China, a part of global Top-5 advertising conglomerate Dentsu Aegis. Together with Isobar China, UnionPay Smart will build a data management platform (DMP) targeting online advertising.

Why we believe Apple Pay can't beat Alipay in China

When talking about O2O (Online to Offline), we should keep in mind that the key to the O2O business success lays in the hardware and acceptance support from offline merchants. Eventually, it’s up to merchant’s willingness to accept a new digital payment method or not. Beyond the merchant fee and technology required, the key criteria for a merchant to decide is the user base of a particular payment method.