The Reserve Bank of India (RBI) has formed an inter-regulatory working group to address the regulatory issues relating to fintech and digital banking in the country. This is a welcome step in the right direction, in line with recommendations by Kapronasia in its recent report titled: ‘Fintech Regulation in Asia’.

The PBOC and CUP push for tokenization in China

China is pushing its card industry towards tokenization as it seeks to make digital payments more secure on the Mainland. Banks and payment service providers (PSP) are required to use tokenization to process transaction data by the end of this year, according to Chinese business publication National Business Daily, citing a notice from China’s central bank.

Fintech companies in China are raising investor eyebrows this year, with such firms breaking global fund raising records. Even as the amount of venture capital flowing into China has slowed from its peak in 2015, data compiled by KPMG Enterprise and CB Insights show investors are still bullish on the fintech industry. The money invested into China’s fintech sector reached a record high of $2.4 billion in the first quarter of the year, the consultancy said. This amount was boosted by deals into two of China’s so-called tech unicorns: Chinese P2P lender Lu.com and JD Finance.

China Internet Finance - what's in a name?

Fintech in China started as 'internet finance' or 互联网金融. As the first real China fintech giants tended to come from internet finance platforms, like P2P lenders or financial distribution platforms, the name seemed to make sense, so the term 'fintech' was rarely used. However, today, we're seeing an interesting phenomenon in China as more firms are transforming their businesses to be more 'fintech focused', but what does that actually mean? Is fintech different than internet finance? And more importantly, why now?

Automated advisory platforms, or Robo-advisors, have shaken up the finance industry in many parts of the U.S. and Europe. China's wealth management industry is now the next in line to receive such a boost.

Securities market regulator the Securities and Exchange Board of India (SEBI) has taken credit rating agencies to task after a spate of fiascos wherein a rating agency downgraded a certain paper from BBB+ to BB+ and finally D all within a span of month. In another case the credit rating agency suspended ratings on a certain stock citing non-availability of sufficient information. Interestingly, in both the cases the companies have been called out for debt servicing issues in the wake of the NPA process at major Indian banks.

The Department of Post (DoP) is all set to launch its payments bank by September this year after receiving the in-principle approval from the RBI to launch the same in August last year. With over 154,000 post offices of which 130,000 are operating in rural pockets of the country the new bank is expected to be a sure winner on account of the distribution strength. No wonder that some of the world's top 50 banks including Barclays of England, Deutsche Bank of Germany, Citi Bank of USA and the World Bank wanted to link themselves with the postal department for a piece of the action.

RBI to strengthen cyber security in Indian banks

The Reserve Bank of India (RBI) has proposed that commercial banks need to institute a Board-approved Cyber Security Policy no later than September 30, in a bid to address the growing number of cyber threats and reported incidents of cyber crime in the banking industry. The RBI set the rules in a letter to bank chief executives this month, with Regional Rural Banks exempt from the change. The use of technology in banks, already an "integral part" of operational strategy, has gained further momentum, hence the need for such guidelines, the RBI said.

The CIRC acts on internet insurance industry

Last week, the China Insurance Regulatory Commission (CIRC) issued a new scheme for evaluating risk in online insurance. Aimed at providing consistent development of the industry and ensuring proper risk management, the scheme is focused on the business model and operations of internet insurance companies. Companies offering life insurance, financial insurance, and other insurance areas are all covered by the new supervisory scheme. The review will take place in three steps, carried out over the course of five months.

Xiaomi enters the banking industry

Xiaomi has entered the finance industry, following in the steps of Chinese tech titans Alibaba and Tencent. On June 13th, Xiaomi, whose traditional strength is in the smartphone business, joined hands with Chinese conglomerates New Hope Group and Chengdu Hongqi Chain Co. to establish the New Hope Bank in the Western Chinese province of Sichuan.

Ant Financial will purchase 20 percent of Thai payments and online finance provider Ascend Money, with the right to increase its stake to 30 percent, China's Ministry of Commerce said in a statement on its website.

India’s insurance sector is worth $60 billion and has established some solid regulatory models that helped spawn an entire web and mobile driven industry. The main insurance regulator, the Insurance Regulatory and Development Authority (IRDA), played a proactive role by setting boundaries early on in the sector, such as clearly distinguishing between insurance brokers and web aggregators.

Rumours are swirling that Alibaba’s Taobao will collaborate with UnionPay. While details are still unknown, this partnership is noteworthy as Alibaba's online payments system Alipay and UnionPay have been fierce rivals for the past ten years.

Why Apple Pay is struggling to make an impact on China and the global market as a whole

Apple has turned to the mobile payments industry after the smartphone business has slowed down, as a way to increase revenue streams. Apple Pay, Apple’s mobile payment and digital wallet service, has been very successful in the United States. However, Apple Pay has been struggling to tap into international markets due to technical problems, the lack of user adoption, and resistance from banks.

Islamic Banking comes to India

The Islamic banking system, where neither the borrowers nor depositors are paid or pay any interest, is set to launch in India. It will completely function under the tenets of sharia law, where the bank doesn’t charge interest but the customers share a part of profit or loss of the bank. The idea is to encourage the economic and social development of the region the bank is based in.

As the 'India stack' becomes mainstream, what will banking look like in the future?

Alibaba's Ecosystem Expansion

Starting from only 18 employees and a small B2B platform, Alibaba has become an e-commerce giant in China and already expanded into many other industries. But Alibaba has no plans to stop, Alibaba is now working on an even bigger ambition: to insert itself into ever part of our everyday lives.

Samsung marries Alipay, Leaving UnionPay Heartbroken

On May 20th, Samsung Pay and Alipay announced their intention to merge their online payment businesses. Now, users can import their Alipay account into Samsung Pay and with just one swipe, users can enable Alipay’s QR code. The whole process can be completed within 2 seconds, even if your screen is locked. This is a huge step for Alipay, since the new user experience increases convenience and eliminates the normal steps of finding the app and waiting for it to load. Alipay’s new process drastically decreases the inconvenience of using the QR code as a payment method. But it begs the question, why would Samsung betray UnionPay to partner with Alipay?

WeChat receives warning from Thailand Central Bank, signaling a possible foreign markets dilemma

Over the past few years, Alipay, WeChat, and other mobile financial and non-financial platforms have become ubiquitous in China. This ubiquity has led to a fiercely competitive market, so increasingly these companies have begun to look overseas, expanding into foreign markets including Japan, Korea, and Southeast Asia. Although they are tremendously successful domestically, China's large tech players face multiple challenges when expanding abroad including regulation, which has become a real challenge for Tencent in Thailand as of late.

Even with over 40 Acts directly or indirectly pertaining to pertaining to insolvency and bankruptcy, banks in India are still under tremendous pressure due to rising non-performing assets (NPAs). Multiple agencies are involved in handling these situations, with overlapping jurisdictions that creates complexities and delays.

On May 27th, the People’s Bank of China (PBoC) released the implementation details that will govern foreign investment in China’s interbank bond market. The new rules make it much easier for certain foreign investors to participate in Chinese bond market activities, such as borrowing/lending, futures/forwards, and swaps, including interest rate agreements.

New regulations: End of the road for P-Notes?

India's main regulator for capital markets, the Securities Exchange Board Of India (SEBI), has started implementing recommendations from the Special Investigation Team (SIT) appointed by Supreme Court of India to regulate Participatory-notes (P-notes).

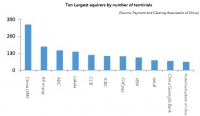

How do China's card acquirers rank? A new report published by a Chinese payments association tells us

The PBOC-backed 'Payments Clearing Association of China' published its annual report in May. We talked about some of the digital payments statistics from the report in our previous commentary, but the report also features ranking for China acquiring market, which is even more significant because such data has never been officially published before.

Payment and Clearing Association of China announces some very interesting 2015 statistics

The Annual Payments Report by the Payment and Clearing Association of China was published on May 19th and showed the continuing growth in payment transactions in China. The total amount of online payments reached RMB 2,042 trillion, spread between commercial banks and payment service providers (PSPs).

On May 6th, the People’s Bank of China (PBOC) changed its policy for investors in the interbank bond market. These modified regulations will open up the market to new types of investors including asset managers, housing provident funds, pension funds and charities.

Global payments operator Fortumo and India’s Reliance Communications (RCOM) have launched direct carrier billing where RCOM’s customers can purchase digital content and games by charging the payments to their mobile bill or mobile prepaid account. Reliance customers can now enjoy a host of digital entertainment content on the move on their mobile devices, across movies, music, games and live TV, starting from just Rs. 10 (15 cents) for 1 day of access, all by paying through their mobile postpaid bill and mobile prepaid account.

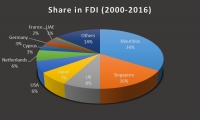

For nearly 30 years, India’s double taxation avoidance agreement (DTAA) with Mauritius came in handy for investors to route money through ‘shell’ companies based out of the island nation. These investors saved on capital gains tax liabilities in Mauritius which does not impose these taxes on off-shore entities. A similar treaty exists with Singapore. As a consequence, India receives half of its FDI from just two countries: Mauritius (34%) and Singapore (16%).

First batch of foreign banks allowed to access onshore Yuan on the mainland interbank FX market

Friday, May 20th was the first day when foreign commercial banks were allowed to trade yuan on the recently opened inter-bank forex market. The first batch of the banks will be able to trade both spot RMB and derivatives.

Last week in China, the China Securities Regulatory Commission (CSRC) prohibited listed companies from raising capital earmarked for investment in the following four industries: Internet Finance, Video Games, Film and TV, and Virtual Reality. The new prohibition is an attempt to steer money into the real economy, which is defined as industries producing tangible products and services. Permissions for mergers, acquisitions, and refinancing in those ‘unreal industries’ have been halted, as well.

Blockchain is a distributed, immutable ledger that records transactions using digital tokens. Its distributed architecture is much like P2P services such as Skype and bittorrent and it uses public key cryptography to ensure complete security for users. The immutability of entries on the blockchain is a key design feature that makes it particularly attractive to industries that lean heavily on trustworthy records, such as banks. But is India ready?

More...

India’s banking regulator, the Reserve Bank of India (RBI), recently released a consultation paper on P2P lending in India. This paper aims at regulating India’s fledgling P2P ecosystem, demonstrating that the RBI is positively besieged with the concerns and realities of this nascent industry.

China's April data is not as bad as it looks, the economy may actually be on the right track

Although China’s newly issued April export/import data may be worrying on its face, when examined from a different angle, it may tell a more positive story.

In China this year, over 3,700 billion RMB (about 570 billion USD) worth of domestic debt will expire, a record-breaking amount. Many companies will face difficulty in rolling the debt over because of the limited size of the whole bond market. Even if just a small percentage of the whole market defaults, the amount defaulting would still be so large, it could start a crushing storm for an already vulnerable Chinese economy. Many defaulting state-owned companies are from sectors in difficulty as China slows, such as mining and heavy industry. This makes the possibility of default more likely to happen. And in the environment of a slowing debt market, things will probably get worse.

For several years the Indian Government has been pushing larger Public Sector Banks (PSBs) to consolidate the market by acquiring smaller and weaker banks. After failing several times in the past, it seems at least the merger of India's largest bank with its five associate banks will be finalised during this fiscal year.