Latest Insight

- Why an expected APAC fintech consolidation wave has yet to come

- Why cash is still prevalent in Asia

- Japan steps up green finance efforts

- South Korea charts middle path on crypto

- Should Grab and GoTo merge?

- Singapore pushes ahead with fintech-driven sustainability

- Digital banks in South Korea continue to thrive

- Billease is the rare profitable BNPL firm

- Fintech sector in Pakistan faces mounting challenges

- Where digital banks in Asia can make a difference

Latest Reports

-

Breaking Borders

Despite progress in payment systems, the absence of a unified, cross-border Real-Time Payments (RTP) network means that intermediaries play a crucial role in facilitating connectivity. This report examines the ongoing complexities, challenges, and initiatives in creating a seamless payment landscape across Asia. Innovate to Elevate

Despite progress in payment systems, the absence of a unified, cross-border Real-Time Payments (RTP) network means that intermediaries play a crucial role in facilitating connectivity. This report examines the ongoing complexities, challenges, and initiatives in creating a seamless payment landscape across Asia. Innovate to Elevate In the dynamic and diverse financial landscape of the Asia-Pacific (APAC) region, banks are at a pivotal juncture, facing the twin imperatives of innovation and resilience to meet evolving consumer expectations and navigate digital disruption. Catalyzing Wealth Management In The Modern Era

In the dynamic and diverse financial landscape of the Asia-Pacific (APAC) region, banks are at a pivotal juncture, facing the twin imperatives of innovation and resilience to meet evolving consumer expectations and navigate digital disruption. Catalyzing Wealth Management In The Modern Era Hyper-personalized wealth management presents a paradigm shift from traditional models relying on static, generalized segments. Developing tailored investor personas based on psychographics, behaviours and fluid financial goals enables financial institutions to deliver rich and tailored customer experiences that resonate with next-generation priorities.

Hyper-personalized wealth management presents a paradigm shift from traditional models relying on static, generalized segments. Developing tailored investor personas based on psychographics, behaviours and fluid financial goals enables financial institutions to deliver rich and tailored customer experiences that resonate with next-generation priorities.

Events

| April 23, 2024 - April 25, 2024 Money 2020 Asia 2024 |

| October 21, 2024 - October 24, 2024 Sibos Beijing |

| November 06, 2024 - November 08, 2024 Singapore Fintech Festival |

Cracks are starting to show in the once impervious armor of China's online finance platforms as yields have dropped 20% from their highs. Ranging from about 4.7-5.6%, the current highs are much lower than the 6-8% that we saw at the end of 2013 and beginning of 2014.

China's online finance platforms facing headwinds

Realistically though, this isn't surprising. As we have discussed before, these platforms were running on borrowed time. Whilst the business model made sense, the inter-bank lending rates and the negotiated deposits that the main China online finance platforms were able to negotiate were a bit of a perfect storm for the platforms.

Now as the banks have put limits in place on the amount of money that can be moved on and off the platform at any one time, we're starting to see the market's reaction to what has caught most banks and the regulators completely off-guard. This is unlikely to be the last push-back from the banks on these new financial products.

Unclear Regulation

Yet the platforms still have over 1.45 trillion yuan (US$230+ billion) on their platforms and this is unlikely to rapidly decrease anytime soon. 4-5% is still much better than the average retail consumer could get on a bank demand deposit in most of China's main banks and the convenience can't be beat - very easy to get money on and off the platforms, although within the limits set out by the PBOC.

This is far from the end of the story thought. We expect the growth of the platforms to certainly slow and although its still a bit unclear as to what the regulation will be, further regulation and requirements from the PBOC is inevitable as we go forward in 2014. This is all the more critical as Alibaba moves forward on the IPO plans. Can the company count on that part of the business to still drive revenue?

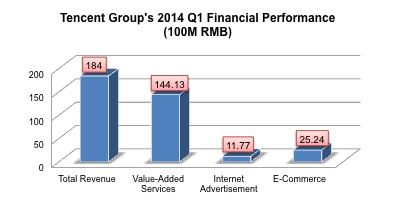

The latest financials from Tencent Group shows that overall growth stayed strong in the first quarter of 2014 as revenue hit RMB 18.4 billion, 78% of which were value-added services. E-commerce however suffered as revenues declined 24% as compared to Q4 2013. Tencent indicated that the lagging performance was a seasonal factor; in addition Tencent has recently re-focused its e-commerce strategy.

As known, Tencent setup a partnership with Jingdong this year, acquiring 15% of the online retailer which also holds QQ wanggou and Paipai. The acquisiton is an indication that Tencent is serious about e-commerce, but they still seem to be searching for the right business model. Yet with Alibaba listing soon, Tencent will have to show rapid returns on their investment in order to keep a increasingly impatient set of investors happy. Tencent's e-commerce challenges must now be confronted to stay ahead of the game.

The latest figure announced by the CSRC indicates that in early 2014, the number of Chinese securities investment funds registered increased, with the total turnover declined dramatically.

With the introduction of regulations on preference shares by the CBRC and PBOC in this March and April, banks seem to be willing to explore the new financing option.

Fiona Zhao, one of our analysts here at Kapronasia, has been covering bitcoin in China from the beginning. Here she lays out the reasons why bitcoin in China won't survive.

The latest figures from online saving funds financial statements have shown that the BAT (Baidu, Alibaba, Tencent) online money funds continued expanding. The 2014Q1 data reveals that Tianghong Zenglibao, relying on the huge client base of Yuebao, lead the market and is the first online saving funds that exceeds RMB100 Billion.

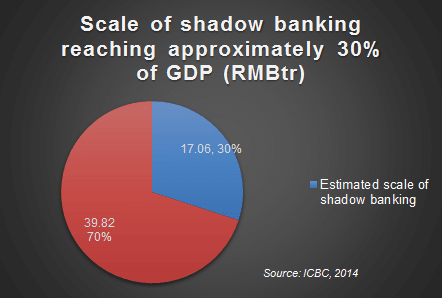

On April 20th, the CEO of ICBC, quoting data from internal sources, claimed that the estimated scale of shadow banking in China is around RMB15-20tn, which is relatively small in scale to GDP when compared to shadow banking in more developed countries.

In addition, the leverage used in the Chinese shadow banking industry is not as large as other countries, so he argued that it is not necessary to worry about systematic risks in the Chinese financial system, but he still admitted there are non-systematic risks caused by shadow banking industry.

However, many independent financial analysts say that the scale and risk involved of shadow banking are underestimated and there might be increasing number of events happened in 2014 around shadow banking in China.

In recent years China's mobile internet has been developing quickly and had a great impact on people’s lives. The official figures show that by the end of 2013, China had approximately 500 million mobile internet users, a 25% increase over 2012. With the penetration of smartphones in China more users prefer to use mobile devices to deal with many daily tasks.

Over the next week, we'll be publishing a number of articles looking at the upcoming Alibaba IPO which could be the largest tech IPO ever. Today we look at the financials filed with the SEC.

On April 14, 2014, Shanghai Stock Exchange-traded *ST Changyou was delisted, becoming the first state owned company to be delisted in A-share markets.

More...

As US SEC’s investigation on large investment banks recruiting Chinese governmental officials’ and SOE senior managers’ children is going further than any such probe before, the dark side of foreign companies operating in Chinese markets is gradually being exposed to the public. However, that probably doesn’t come as a surprise for the Chinese public which has known and suffered from the ‘unwritten rules’ for a long time.

Last month, Shanghai Chaori Solar Energy Science & Technology became the first company to default in China's bond market when it failed to make a full payment on the issued debt. This shows that the Chinese state is not going to back up even big private borrowers. Several other companies are also on the verge of debt insolvency, according to local media sources, with government debt also on the rise.

After couple of months of low trading volume and little news, BTC China, previously the largest and still one of the most prominent bitcoin exchanges in China has moved the goalposts for other exchanges (and the PBOC!) by launching the first physical Chinese Bitcoin 'ATM' at the IC Coffee Shop in Zhangjiang Hi-tech Park in Shanghai on Tuesday the 15th. In addition to the physical ATM, BTC China released a new mobile Web appcalled “Picasso ATM”, which is actually the main theme of the ATM launch.

On China's supposed bitcoin 'd-day', April 15th, BTCChina launches Shanghai ATM what could be the country's first bitcoin ATM. Kapronasia was onsite on launch day and will have an update tonight on our experience using the ATM.

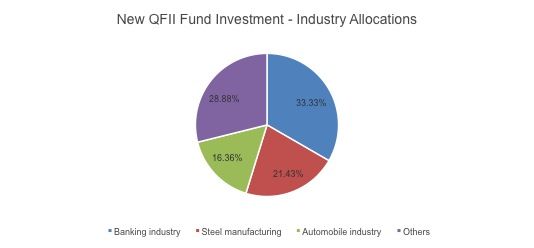

The latest statistics about the A-share markets illustrate the main industries that QFII funds invested at the end of 2013, according to data from 1334 listed firms’ 2013 annual reports. The banking industry is the most attractive industry for QFII investors, taking about 1/3 of the total new shareholding volume with the steel industry and automobile industry ranked the 2nd and the 3rd.

The banking industry makes sense because of the relatively low valuations. The steel industry is currently suffering in China, so QFIIs likely have confidence that Chinese urbanization and development of automobile industry will continue. For automobile industry, as Chinese government intends to push hardly on new energy vehicles especially electricity-powered vehicles, could pose an interesting QFII investment allocaction.