Latest Insight

- Why an expected APAC fintech consolidation wave has yet to come

- Why cash is still prevalent in Asia

- Japan steps up green finance efforts

- South Korea charts middle path on crypto

- Should Grab and GoTo merge?

- Singapore pushes ahead with fintech-driven sustainability

- Digital banks in South Korea continue to thrive

- Billease is the rare profitable BNPL firm

- Fintech sector in Pakistan faces mounting challenges

- Where digital banks in Asia can make a difference

Latest Reports

-

Breaking Borders

Despite progress in payment systems, the absence of a unified, cross-border Real-Time Payments (RTP) network means that intermediaries play a crucial role in facilitating connectivity. This report examines the ongoing complexities, challenges, and initiatives in creating a seamless payment landscape across Asia. Innovate to Elevate

Despite progress in payment systems, the absence of a unified, cross-border Real-Time Payments (RTP) network means that intermediaries play a crucial role in facilitating connectivity. This report examines the ongoing complexities, challenges, and initiatives in creating a seamless payment landscape across Asia. Innovate to Elevate In the dynamic and diverse financial landscape of the Asia-Pacific (APAC) region, banks are at a pivotal juncture, facing the twin imperatives of innovation and resilience to meet evolving consumer expectations and navigate digital disruption. Catalyzing Wealth Management In The Modern Era

In the dynamic and diverse financial landscape of the Asia-Pacific (APAC) region, banks are at a pivotal juncture, facing the twin imperatives of innovation and resilience to meet evolving consumer expectations and navigate digital disruption. Catalyzing Wealth Management In The Modern Era Hyper-personalized wealth management presents a paradigm shift from traditional models relying on static, generalized segments. Developing tailored investor personas based on psychographics, behaviours and fluid financial goals enables financial institutions to deliver rich and tailored customer experiences that resonate with next-generation priorities.

Hyper-personalized wealth management presents a paradigm shift from traditional models relying on static, generalized segments. Developing tailored investor personas based on psychographics, behaviours and fluid financial goals enables financial institutions to deliver rich and tailored customer experiences that resonate with next-generation priorities.

Events

| October 21, 2024 - October 24, 2024 Sibos Beijing |

| November 06, 2024 - November 08, 2024 Singapore Fintech Festival |

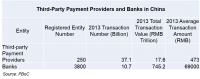

Mr. Li Xiaofeng, head of PBoC Financial IC Card Panel, believes that Chinese payment providers will not play a major role in payments in China's financial industry. “From the scale and channel perspective, Central Bank and commercial banks remain the main payment providers.”

Although Alibaba was in the first round of initial approvals to setup a private bank in China earlier this year, it was only at the end of September 2014 that they finally received approval to move forward on the project along with Juneyao, another large Chinese company who is also looking to setup their own bank.

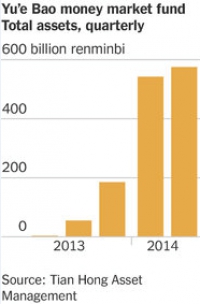

In the wake of the largest IPO in the U.S., there has been increased attention on China's innovation and its potential disruptive nature on global banking and e-commerce. Yue bao's future strategy is in the spotlight once again.

Tokenization seems have become a buzzword since the Apple Pay announcement. However, the technology itself is not new.

The launch of Apple Pay will likely have a profound impact on the payments industry in the US and potentially Europe, but what does it mean for China?

China's online banking and mobile banking continue to be the key channels for customers who interact with their banks through 'e-channels' as data from iResearch, a Chinese online customer survey service provider, shows.

Beating Apple by nearing a week, on September 2nd, 2014, Alipay and Huawei announced the launch of their fingerprint payment service. The technology will be first shipped on Huawei’s Ascend Mate 7 phone, which was presented by the electronics giant on September 3rd.

With Alibaba in the US for a one-week road show before what might be the biggest tech IPO that we've ever seen, Alibaba's competitors are battening down the hatches for an extended battle for the face of e-commerce in China.

According to Online Lending House, an internet finance news source, P2P transaction volume has reached RMB 81.84 Billion in 1H2014. The most active regions are Guangdong, Zhejiang, Shanghai, Beijing and Jiangsu.

On July 25th, Shang Fulin, the chairman of CBRC, disclosed three private banks that had been approved by the CBRC. Hua Rui Bank, planned to be set up by Fosun and Juneyao, was not on the list. Later the Shanghai branch of CBRC revealed that the Fosun and Juneyao partnership had broken up.

More...

Kapronasia's new report entitle "China Moving Abroad - A look at the legal...and not so legal ways Chinese nationals are moving their money abroad" is now available for download on Kapronasia.com. To view and download the report, please go to our research section here.

Earlier this year, we published our 2014 “Top-10 China Banking Industry Trends” report and predicted the advent of direct banks. We were right: in a month Minsheng Bank rolls out its Chinese direct banking institution.

QR code payment in China, suspended by PBOC on March 14th, 2014, have just been restarted by the Postal Savings Bank of China.

On July 22nd, 2014, Alibaba teamed up with seven banks including ICBC, CCB, CMB, Ping An Bank, Postal Savings Bank of China, Bank of Shanghai and Industrial Bank to roll out new internet business loan service.

China has been going through rapid urbanization during last decades and in the past ten years alone the percentage of population residing in cities has leapt from 40.5% in 2003 to 53.75% in 2013.