Latest Insight

- Why cash is still prevalent in Asia

- Japan steps up green finance efforts

- South Korea charts middle path on crypto

- Should Grab and GoTo merge?

- Singapore pushes ahead with fintech-driven sustainability

- Digital banks in South Korea continue to thrive

- Billease is the rare profitable BNPL firm

- Fintech sector in Pakistan faces mounting challenges

- Where digital banks in Asia can make a difference

- Cashless payments jump in Vietnam

Latest Reports

-

Innovate to Elevate

In the dynamic and diverse financial landscape of the Asia-Pacific (APAC) region, banks are at a pivotal juncture, facing the twin imperatives of innovation and resilience to meet evolving consumer expectations and navigate digital disruption. Catalyzing Wealth Management In The Modern Era

In the dynamic and diverse financial landscape of the Asia-Pacific (APAC) region, banks are at a pivotal juncture, facing the twin imperatives of innovation and resilience to meet evolving consumer expectations and navigate digital disruption. Catalyzing Wealth Management In The Modern Era Hyper-personalized wealth management presents a paradigm shift from traditional models relying on static, generalized segments. Developing tailored investor personas based on psychographics, behaviours and fluid financial goals enables financial institutions to deliver rich and tailored customer experiences that resonate with next-generation priorities. Navigating the Future of Fintech in Asia

Hyper-personalized wealth management presents a paradigm shift from traditional models relying on static, generalized segments. Developing tailored investor personas based on psychographics, behaviours and fluid financial goals enables financial institutions to deliver rich and tailored customer experiences that resonate with next-generation priorities. Navigating the Future of Fintech in Asia Although fintech has been a global phenomenon, nowhere has the combination of finance and technology been as impactful as in Asia. This report examines some of the key fintech trends that have been re-shaping Asia’s financial industry thusfar as well as examine the trends that will shape the future.

Although fintech has been a global phenomenon, nowhere has the combination of finance and technology been as impactful as in Asia. This report examines some of the key fintech trends that have been re-shaping Asia’s financial industry thusfar as well as examine the trends that will shape the future.

Events

| April 23, 2024 - April 25, 2024 Money 2020 Asia 2024 |

| October 21, 2024 - October 24, 2024 Sibos Beijing |

| November 06, 2024 - November 08, 2024 Singapore Fintech Festival |

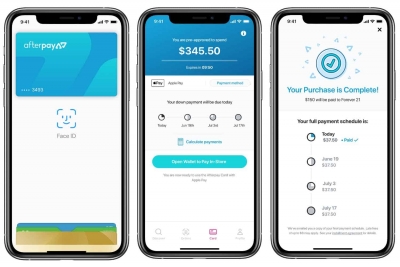

Australia is a key market for PayPal in Asia Pacific. The U.S. payments giant has 9 million accounts Down Under - not too shabby for a country of 25 million people. It has a 17% share of what JP Morgan calls the "alternative payments market (essentially non-cards), ahead of Google Pay, Apple Pay and Samsung Pay. But there is a new payments game in town led by firms like Afterpay and Zip. To maintain its competitive edge in Australia, PayPal needs to enter the buy now, pay (BNPL) segment.

Japan's Line has super app potential. Its messaging app is popular in Japan, Taiwan and Thailand. It has content, e-commerce and a growing portfolio of fintech services, with Line Bank set to launch in Taiwan by the middle of the year. And a recent merger with SoftBank affiliate Z Holdings brings an additional US$4.7 billion in capital to the table. The new entity, which integrates Line with Yahoo in Japan, projects that it will post revenue of 2 trillion yen and operating profit of 225 billion yen by fiscal year 2023. It is the brainchild of SoftBank founder Masayoshi Son, who aims to build a Japanese tech juggernaut able to compete with Google, Amazon, Facebook and Apple in Japan.

Fintech is the magic glue that holds startup ecosystems together in Asia. One after another, the region's biggest platform companies have pivoted to fintech, and then declared themselves super apps, usually in that order. Indonesia's Traveloka is expanding its fintech offerings from Indonesia to Thailand and Vietnam as it eyes going public in the U.S. this year through a blank-check company.

When South Korea introduced a peer-to-peer (P2P) lending law last year, it seemed regulators had paved the way for the industry to grow stably. Seoul recognized that P2P lending could promote financial inclusion. The industry just needed proper supervision to minimize fraud and loan delinquency. However, the loan delinquency rate is rising, Korea's fintech giants are cutting their ties with P2P lenders and many of the firms are struggling to meet the law's requirements.

Sea Group's latest earnings report is packed with good news. Its gaming and e-commerce businesses grew expeditiously in 2020 as people stayed home, shopped online and played online games. EBITDA surged to US$107 million, compared to a loss of US$178.6 million in 2019. Gross profit doubled to US$1.3 billion from US$604 million a year earlier. Net income, however, remained negative. In fact, net losses widened to US$1.62 billion from US$1.46 billion. The question for Sea and investors is, does it matter?

Stripe may be the biggest fintech to fly under the radar in Asia Pacific. In private markets, its valuation is reportedly close to US$100 billion, up from about US$35 billion in April 2020. The San Francisco-based merchant payments provider saw its fortunes soar during the pandemic as its many North American customers moved online. It is now looking east to fuel its next stage of growth, including China, India, Southeast Asia and Australia. In 2020, Stripe increased its staff in the APAC region by 40% to more than 200.

South Africa’s TymeBank has big plans for Southeast Asia. The South African neobank plans to launch a digital bank in the Philippines and may also apply for a digital bank license in Malaysia. Measured by account numbers, Tyme is one of Africa’s most successful digibanks, claiming to have signed up almost 3 million customers since its launch two years ago. In late February, Tyme announced it had raised US$109 million from investors for expansion in Southeast Asia, one of the largest deals ever by a fintech in South Africa.

Hong Kong's status as a global financial center and lack of capital controls have long exposed it to certain financial crime risks. In 2020, the former British colony faced an unusual convergence of a recession, political tension and a once-in-a-century pandemic that upended society. Under that tough scenario, Hongkongers were scammed out of a record HK$8.33 billion, of which authorities managed to recuperate about HK$3 billion.

PayPal is a payments giant with super app ambitions but a small footprint in Asia. Indeed, although PayPal has been present in many Asian markets for ages, it is not a market leader in any of them. In fact, to date, it is more notable for reducing its presence - exiting the domestic payments business in both Taiwan and India, for instance - than scaling up. Becoming a bigger player in Asia will not be easy for the US$340 billion company, despite its vast resources.

Afterpay is the world's foremost buy now, pay later rising star. The Australian company has been on an unmatched hot streak, its share price surging by about 300% in 2020. At roughly AU$134, Afterpay is trading 27 times its price-to-earnings ratio. In the six months to December 31, Afterpay's overall income rose 89% to AU$420 million, even as losses reached AU$76.5 million. Merchant growth in North America was 141%. The company's active users rose 80% year-on-year to 13.1 million. It seems that nothing can slow the company's ascent, with the possible exception of tighter regulation.

More...

Gojek and Tokopedia are Indonesia's two most valuable startups and preeminent tech firms. Merging the two unicorns, with their mostly complementary services, makes a lot more sense that combining Gojek with its arch-rival Grab. While Grab-Gojek talks dragged on for months, Gojek and Tokopedia will not waste any time. They do not want to fall farther behind high-flying Sea Group, which is outperforming the Indonesian companies on their home turf.

Once upon a time, super apps began as e-commerce platforms or free messaging services. They tapped the network effect to build giant user bases. Because their overhead was low, they could afford to be patient about monetization. Transportation companies do not have the same luxury, especially airlines reeling from the pandemic's effect on air travel. Yet Malaysia-based AirAsia is doubling down on its super app strategy first announced last year. In March, AirAsia will expand its food delivery service airasia food from Malaysia to Singapore.

Since the advent of the internet, technology startups have disrupted one industry after another. It was only a matter of time before they set their sights on financial services.

As it turns out, banking is harder to disrupt than retail, transportation, entertainment or almost anything else. The reason is simple: Trust is paramount in banking and takes time to build, while most digital banks have yet to develop compelling value propositions.

A few of Asia's platform companies have defied this conventional wisdom. The most notable is WeChat, the Tencent-owned app that bundles messaging, digibanking, e-commerce and entertainment under the same umbrella. WeChat was not the first platform company to thrive as a fintech - Alipay was - but it was the first to harness messaging's network effect for that purpose.

It seems that almost every plucky fintech in the cross-border payments space seeks to challenge SWIFT these days. Airwallex is perhaps the best known. The Hong Kong-headquartered (but Australia-founded) unicorn boldly proclaims that it wants to rejig global payments rails at SWIFT's expense. Then there is Lightnet, which is only slightly less ambitious. Lightnet aims to dominate B2B remittances in Asia with none other than cryptocurrency, which it says will render obsolete traditional global payments methods like SWIFT and Western Union. Lightnet is focused on making cross-border payments more economical by trimming the number of intermediary parties from about five to just the sender and receiver. The company expects costs to be further trimmed as its network grows.

P2P lending is one of the fastest growing fintech segments in Indonesia. Demand for credit in Southeast Asia's largest economy is strong while its availability to most Indonesians through the traditional banking system is limited. Indonesia has tens of millions of people who are either underbanked or unbanked. Either way, they cannot easily get a bank loan. P2P platforms offer a convenient alternative. As of October 2020, Indonesia's online lenders had disbursed Rp 56.16 trillion in new loans, up 24% year-on-year, while the NPL ratio was 7.58%, according to data compiled by the country's Financial Services Authority.