Latest Insight

- Why an expected APAC fintech consolidation wave has yet to come

- Why cash is still prevalent in Asia

- Japan steps up green finance efforts

- South Korea charts middle path on crypto

- Should Grab and GoTo merge?

- Singapore pushes ahead with fintech-driven sustainability

- Digital banks in South Korea continue to thrive

- Billease is the rare profitable BNPL firm

- Fintech sector in Pakistan faces mounting challenges

- Where digital banks in Asia can make a difference

Latest Reports

-

Breaking Borders

Despite progress in payment systems, the absence of a unified, cross-border Real-Time Payments (RTP) network means that intermediaries play a crucial role in facilitating connectivity. This report examines the ongoing complexities, challenges, and initiatives in creating a seamless payment landscape across Asia. Innovate to Elevate

Despite progress in payment systems, the absence of a unified, cross-border Real-Time Payments (RTP) network means that intermediaries play a crucial role in facilitating connectivity. This report examines the ongoing complexities, challenges, and initiatives in creating a seamless payment landscape across Asia. Innovate to Elevate In the dynamic and diverse financial landscape of the Asia-Pacific (APAC) region, banks are at a pivotal juncture, facing the twin imperatives of innovation and resilience to meet evolving consumer expectations and navigate digital disruption. Catalyzing Wealth Management In The Modern Era

In the dynamic and diverse financial landscape of the Asia-Pacific (APAC) region, banks are at a pivotal juncture, facing the twin imperatives of innovation and resilience to meet evolving consumer expectations and navigate digital disruption. Catalyzing Wealth Management In The Modern Era Hyper-personalized wealth management presents a paradigm shift from traditional models relying on static, generalized segments. Developing tailored investor personas based on psychographics, behaviours and fluid financial goals enables financial institutions to deliver rich and tailored customer experiences that resonate with next-generation priorities.

Hyper-personalized wealth management presents a paradigm shift from traditional models relying on static, generalized segments. Developing tailored investor personas based on psychographics, behaviours and fluid financial goals enables financial institutions to deliver rich and tailored customer experiences that resonate with next-generation priorities.

Events

| October 21, 2024 - October 24, 2024 Sibos Beijing |

| November 06, 2024 - November 08, 2024 Singapore Fintech Festival |

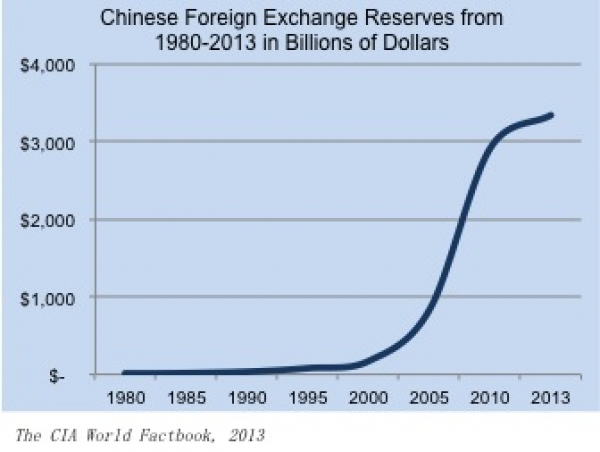

Over the last few decades, the Chinese Central Bank has accumulated massive foreign exchange reserves making it the world’s largest holder at $3.44 trillion. Furthermore the expansion of these reserves, which has accelerated dramatically since 2000, has shown no signs of slowing. Figure one shows foreign reserve levels in China compared with Japan, the world’s second largest holder, along with the United States. Figure two shows the trajectory of China’s foreign reserve levels over the last three decades, which is now over 300 times larger than in 1980.

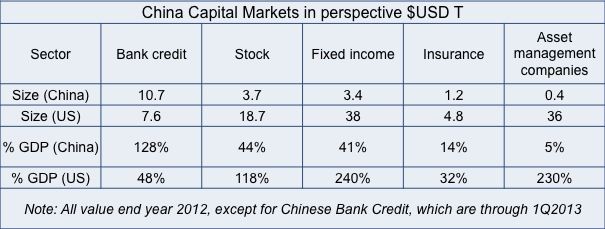

According to a 2013 publication by Goldman Sachs, there are still major differences between US and Chinese capital markets. The most prominent difference is that capital markets in the US are much larger than China’s in all sectors except for bank credit as shown in the figure below.

The Chinese banking credit sector has expanded in recent years which is now at 128% of China’s GDP compared with 48% in the US. Thus the Chinese economy is highly dependent on bank credit, which can be dangerous for the country in the coming years.

In other sectors, there are large gaps between the size of Chinese and US capital markets with the former still lagging behind the latter. Thus, there are many opportunities for China to develop its stock and fixed income markets, along with its insurance and asset management industries. Among these, the asset management industry seems to have the greatest growth potential.

On August 6, 2013, Chinese securities companies received ‘the notice of preparing the initiating stock options full simulating trading works’ sent by the Shanghai Stock Exchange. This information implies that SHSE is already fully prepared for the launching of stock options. Although there is no clear timetable for launching the stock options, it is likely that they will appear in Chinese capital markets in 2013 or 2014.

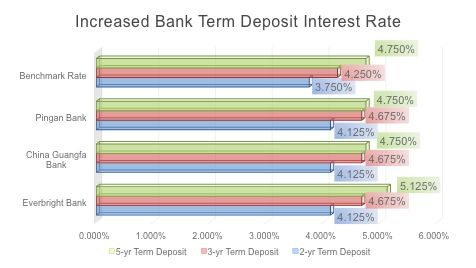

China’s Central Bank has been rapidly shifting towards full interest rate liberalization. On July 20th, 2013, The People’s Bank of China (PBOC) announced liberalizing the loan interest rate. With this announcement, the deposit interest rate ceiling is the last variable waiting to be liberalized in China.

With interest rates liberalization now on the horizon, competition in deposit interest rates is heating up. Many joint-stock banks have recently increased their long term deposit interest rates about 10%. Everbright Bank increased its 2-year term deposit interest rate from 3.75% to 4.125%, 3-year term deposit interest rate from 4.25% to 4.675%, and 5-year term deposit interest rate from 4.75% to 5.125%. It will be effective until the end of 2013. Since 2012, many city commercial banks have increased their deposit interest rate. We can see the interest rate liberalization trend, and it is currently affecting China’s banking sector from local banks to joint-stock banks, and maybe state-owned banks in the near future.

Throughout the history of capital markets in China, public listings, or IPOs in the Chinese A-share market have been suspended 8 times; we are currently in the 8th suspension period. The modern Chinese stock market is only about 23 years old and of that, IPOs have been suspended for nearly four and a half years, which makes up almost 20% of the market's history. There is still no actual timetable to reopen the IPO market, but according to some market information, it could be possible at some time in August or September, 2013.

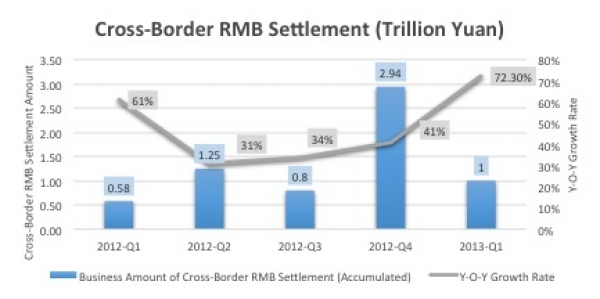

China is already the second largest economy in the world, however, RMB has really not been fully accepted as a payment currency internationally, which most view as a prerequisite to 'RMB internationalization'.

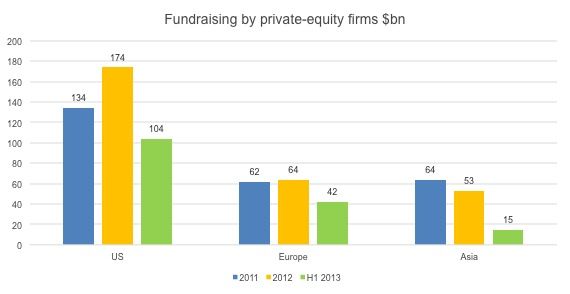

According to The Wall Street Journal, the fundraising of PE funds in Asia continued to drop in the first half of 2013. Compared to the US and European markets, the amount of funds that Asian private equity funds raised was the smallest among the three regions, while the percentage decline is the largest. The slowing Chinese economy is thought to be one of the biggest reasons for the decline in fundraising figures as well as the IPO suspension in China; only US$16 billion in public listings were completed in the first half of 2013.

On 4 July, 2013, The China Securities Regulatory Commission (CSRC) announced that the state council of the People’s Republic of China (PRC) had approved the Treasury bond futures’ return to trading, specifically on the China Financial Futures Exchange (CFFE). Currently, the T-bond futures are under the final preparation stage and it will take approximately two months for this preparation period before they officially are released and start trading. So the most likely time for T-bond futures to be released is in early September.

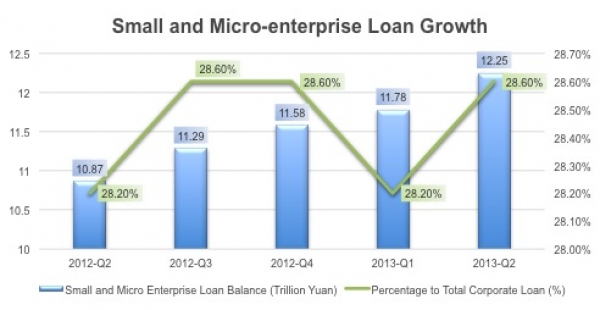

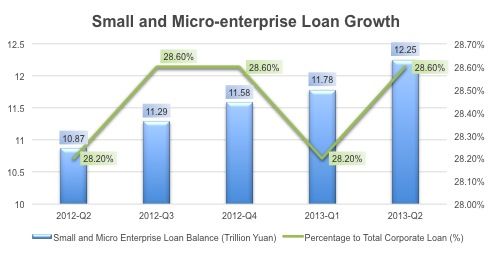

In respond to Chinese national policy, Chinese banks have been actively advancing and cooperating with small and micro-enterprises in the lending business. The total small and micro-enterprise loan balance keeps climbing, and the proportion of small and micro-enterprise loan to total corporate loan remains on a stable level. Recently, the small and micro-enterprise loan balance reached to 12.25 trillion Yuan, and 28.6% of corporate loan belongs to small and micro-enterprises. The increase in small and micro-enterprise loan not only effectively relieves the constraint of funding issues for the companies, but also promotes the transformation of small and micro enterprises in China.

More...

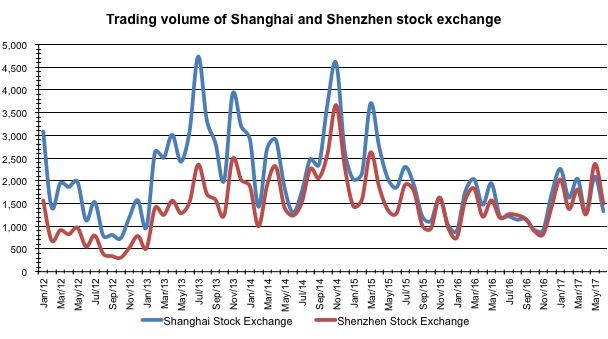

As seen from the chart below, the trading volume of Shanghai and Shenzhen stock exchanges since August, 2011, the trading volume has fluctuated in a relatively low level, compared to the previous few years’ performance. We see this being a result of retail investors' lost confidence in a stock market that hasn't performed well recently, or at least not to the same levels as a few years ago.

This may be very temporary however as a number of the recent Chinese economic announcements and regulatory changes will likely have impact on the country as a whole and more specifically in the financial sector.

Watch this space.

On July 6th, People’s Bank of China (PBOC) issued 27 third party payment licenses to 27 companies bringing the total of 3rd party payment licenses up to 250. What catches our attention this time is the internet giants Baidu and Sina have both obtained licenses and will focus on online payment and mobile payment as their business scope and likely planning to leverage their huge existing user base.

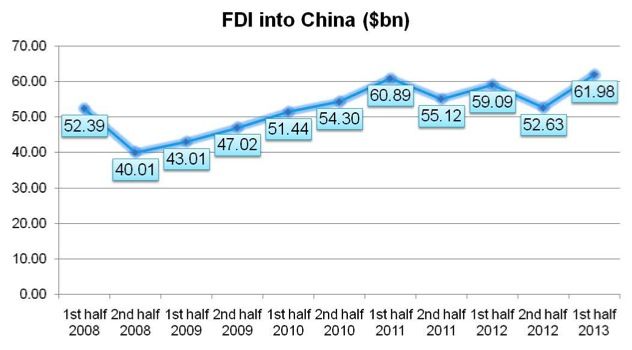

The latest figures showed that in the first 6 months of 2013, the amount of FDI in China increased to US$61.98bn, a 4.9% increase compared to the first 6 months in 2012. Although the future of Chinese economy is under the threat of slower GDP growth, the figure illustrates that foreign investors are still interested in China as an investment destination.

The latest figure showed that in the first 6 month, 2013, the amount of FDI in China increased to $61.98bn, a 4.9% increase compared to the first 6 months in 2012. . Although the future of Chinese economy is under the treat of slower down GDP growth rate, the figure illustrated that the foreign investors’ passion of investing in China remained at a high level in the first half of 2013.

The latest figure showed that in the first 6 month, 2013, the amount of FDI in China increased to $61.98bn, a 4.9% increase compared to the first 6 months in 2012. . Although the future of Chinese economy is under the treat of slower down GDP growth rate, the figure illustrated that the foreign investors’ passion of investing in China remained at a high level in the first half of 2013.

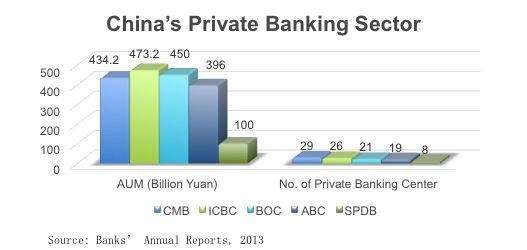

Considered one of the best retail banks in China, China Merchant Bank (CMB) has started their private banking business in 2007. At the end of 2012, CMB's pre-tax profit from their private banking business reached 2.3 billion yuan. Other major banks in China have similarly increased their wealth management profit since 2010, when growth of the market really accelerated.

ICBC and BOC still have the largest private banking AUM among the top 5 while CMB has the most private banking centers to serve its HNWI customers. The high net worth customer segment (over 10M RMB in investable assets) is growing at 18% growth rate and reached to 700,000 by the end of 2012. It seems that banks have finally cracked the code and wealth management is set to grow in China.

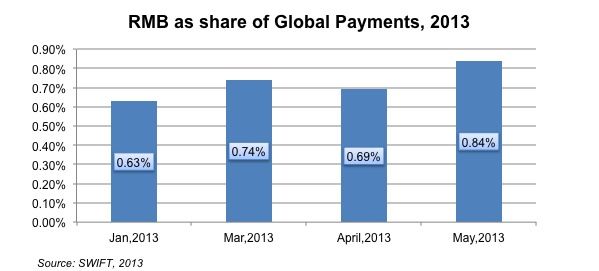

According to SWIFT (the Society for Worldwide Interbank Financial Telecommunication), the Chinese Yuan (or RMB)'s share of global payments hit a new record high of 0.84% in May 2013, after the total value of yuan payment around the world increased sharply by 24% last month, compared with the average growth rate of 1.9% across other currencies. SWIFT also pointed out that China yuan is still the 13th most-used currency in the international trade. The growing demand for RMB settlement will continue to increase the use of yuan in future.