Latest Insight

- Why cash is still prevalent in Asia

- Japan steps up green finance efforts

- South Korea charts middle path on crypto

- Should Grab and GoTo merge?

- Singapore pushes ahead with fintech-driven sustainability

- Digital banks in South Korea continue to thrive

- Billease is the rare profitable BNPL firm

- Fintech sector in Pakistan faces mounting challenges

- Where digital banks in Asia can make a difference

- Cashless payments jump in Vietnam

Latest Reports

-

Breaking Borders

Despite progress in payment systems, the absence of a unified, cross-border Real-Time Payments (RTP) network means that intermediaries play a crucial role in facilitating connectivity. This report examines the ongoing complexities, challenges, and initiatives in creating a seamless payment landscape across Asia. Innovate to Elevate

Despite progress in payment systems, the absence of a unified, cross-border Real-Time Payments (RTP) network means that intermediaries play a crucial role in facilitating connectivity. This report examines the ongoing complexities, challenges, and initiatives in creating a seamless payment landscape across Asia. Innovate to Elevate In the dynamic and diverse financial landscape of the Asia-Pacific (APAC) region, banks are at a pivotal juncture, facing the twin imperatives of innovation and resilience to meet evolving consumer expectations and navigate digital disruption. Catalyzing Wealth Management In The Modern Era

In the dynamic and diverse financial landscape of the Asia-Pacific (APAC) region, banks are at a pivotal juncture, facing the twin imperatives of innovation and resilience to meet evolving consumer expectations and navigate digital disruption. Catalyzing Wealth Management In The Modern Era Hyper-personalized wealth management presents a paradigm shift from traditional models relying on static, generalized segments. Developing tailored investor personas based on psychographics, behaviours and fluid financial goals enables financial institutions to deliver rich and tailored customer experiences that resonate with next-generation priorities.

Hyper-personalized wealth management presents a paradigm shift from traditional models relying on static, generalized segments. Developing tailored investor personas based on psychographics, behaviours and fluid financial goals enables financial institutions to deliver rich and tailored customer experiences that resonate with next-generation priorities.

Events

| April 23, 2024 - April 25, 2024 Money 2020 Asia 2024 |

| October 21, 2024 - October 24, 2024 Sibos Beijing |

| November 06, 2024 - November 08, 2024 Singapore Fintech Festival |

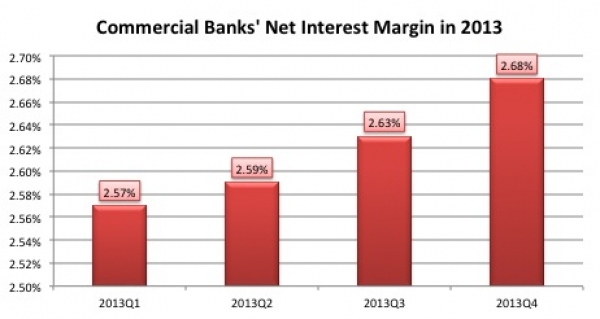

The latest figures from the China Banking Regulatory Commission (CBRC) shows that China commercial banks’ deposit net interest margin has been increasing from 2.57% in 2013Q1 to 2.68% in 2013Q4, despite of the pressure from the interest rate liberalization.

The Basics

If you haven’t been following Chinese online finance innovation industry, here’s a quick brief: leveraging mainly underlying high-yield interbank deposits as assets, China’s main internet giants including Tencent, Alibaba and Baidu have launched online finance products where users can quickly and easily move money out of their banks accounts onto these platforms. Tencent uses their nearly ubiquitous Wechat app as the main user interface which Alibaba uses their Alipay platform to distribute the products; the underlying funds are managed by an external asset manager.

The typical returns of Chinese online finance innovations are between 5-8% and greatly eclipse traditional bank deposits, which yield less than 1%. With this kind of return, it’s not surprising that consumers are moving assets over to the platforms at an astonishing rate with some funds accumulating over 400 billion RMB (~US$66B) in AUM in less than a year making the asset managers some of the largest in China.

At the same time, taxi booking apps are growing incredibly rapidly in in China’s eastern coastal cities – some with the support of the internet giants as well. Over US$40 million of investment has gone into the taxi booking apps over the past two years and it’s not uncommon to ride in a taxi where the driver will have 3-4 phones all running the apps on his/her dashboard.

Bring it together

A key part of the internet giants’ strategy has been to bring everything together in one platform. Tencent, already with a significant user base through it’s ‘whatsapp on steroids’ Wechat app allows you to invest in their online finance product called Licaitong and they have integrated a taxi booking app called Didi Taxi where you can ‘tip’ taxi drivers a pre-selected extra amount to come and pick you up.

Money for nothing and your taxi for free

So, all of the above is well and good. Where it gets interesting is the level of competition in the marketplace and what companies are doing to gain marketshare. A Chinese friend related her experience:

She initially called a taxi via Didi taxi. Didi is running a promotion where you can get 12 RMB (~US$2) back on your taxi ride when you use the app. Base fare in a taxi is 14 RMB (~US$2.33), so she paid 2 RMB (~US$0.33) for the taxi ride. But wait, there’s more…

The taxi driver then asked if she could pay using Alipay and she said yes. Why? Because Alipay is running a promotion where she could get 13 RMB (~US$2.15) back and the taxi driver then likely also received some reward. The taxi driver then gave her the 14 RMB in cash and she sent him 14 RMB via Alipay.

So let’s do the math:

|

Rider |

Taxi Driver |

Internet Giant |

||||

|

Change |

Balance |

Change |

Balance |

Change |

Balance |

|

|

Initial Ride |

-14 RMB |

-14 RMB |

+14 RMB |

+14 RMB |

0 |

0 |

|

Bonus for using Didi |

+12 RMB |

-2 RMB |

0 RMB |

+14 RMB |

-12 RMB |

-12 RMB |

|

Driver pays rider cash |

+14 RMB |

+12 RMB |

-14 RMB |

0 RMB |

0 RMB |

-12 RMB |

|

Rider pays driver w Alipay |

-14 RMB |

-2 RMB |

+14 RMB |

+14 RMB |

0 RMB |

-12 RMB |

|

Bonus for Using Alipay |

+13 RMB |

+11 RMB |

?? |

?? |

-13 RMB |

-25 RMB |

|

Net |

11 RMB |

14+ RMB |

-25 RMB |

|||

So basically, my friend was paid to ride the taxi. She can then take that 11 RMB and instantly put it on her online finance account where she’ll earn about 6% and the internet giants are out a combined 25 RMB.

Of course in the internet space, we’ve seen plenty of companies providing products or services for free or nearly for free, but the scope with which this is happening in China is amazing. And it’s happening more and more.

Take your lessons to go

Time is compressed here. Group buying developed over years in the US and took another couple to fade away. In China, it was started and finished in less than 3 years. Will taxi booking and online finance be similar?

Although both products are essentially in the middle of a ‘perfect storm’ of a huge potential user base, very tight liquidity (giving high overnight lending / fixed deposit rates) and tremendous mobile and internet penetration and momentum, the winds are shifting in terms of innovation and it has put fear into the financial industry.

Both banks and securities firms are feeling the pinch from internet finance. Banks are facing eroding deposits in the face of gradually liberalizing interest rates, while brokers and asset managers are seeing their customers move to relatively high-return products that carry very few fees.

Although the same ‘perfect storm’ may not be happening in the west, paying attention to how things are developing in China is important as more Walmarts and Tescos move into the banking space. Not that banks were ever really known for innovation, but here in China, it's clear that the innovation is certainly not - which is putting them in an increasingly tight position.

February 2014, represented another month of decreasing commission fees in China's capital markets as the entrance of China's technology giants in internet finance starts to affect not just banks, who are losing deposits, but securities brokers whose fees are being squeezed.

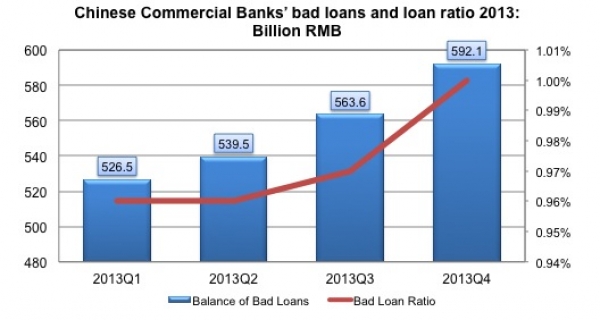

According to the latest figures from the China Banking Regulatory Commission (CBRC), both commercial banks' balance of Chinese bad loans and the ratio of bad loans increased throughout 2013.

The continuing increase of bad loans is an indication of the challenges in China's economy currently. With an economic transition happening and increased lending on bad loans, this is not likely to decrease in 2014 which will pose even more of a challenge for banks as they face increased interest rate liberialization and other financial industry reform.

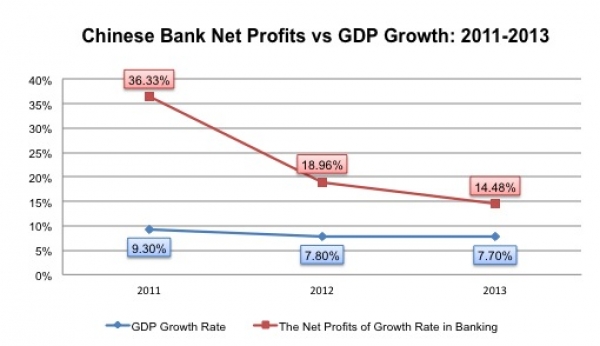

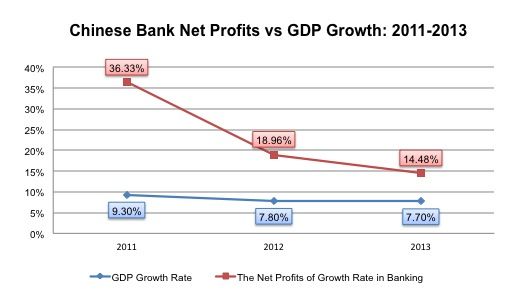

According to the latest figures from the China Banking Regulatory Commission (CBRC), Chinese commercial banks’ accumulated net profits reached 1.4 Triliion RMB in 2013, up 179.4 Billion RMB from 2012. However, the growth rate of net profits has been decreasing in recent years. In 2011, profits grew 36.33%, then dropped dramatically to 18.96% in 2012, and again in 2013 to 14.48%.

Research shows that the decreasing trend of Chinese commercial banks’ profitability growth rate seems to be in line with China’ declining GDP growth rate, shown in the chart below. It reflects that with the acceleration of interest rate reform and the influence from internet finance, China’s commercial banks profit margin faces continuing pressure.

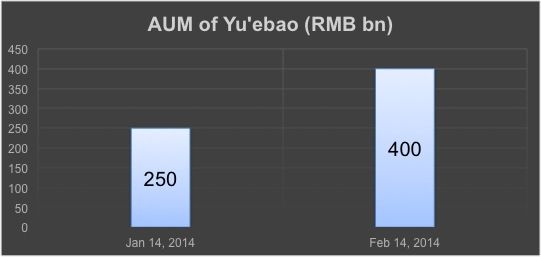

Yu’ebao had already made Tianhong Asset Management the largest one in the public fund industry in China in early 2014. However, the scale of Yu’ebao has continued to grow with the latest figures showing the AUM of Yu’ebao reaching RMB400bn on Feb 14, 2014, a leap of 60% compared to only one month ago. The speed of capital inflow is still accelerating in 2014. We may witness Yu'ebao becoming the largest money market fund in the world soon.

The fast expansion of  Yue bao AUM data of Chinese money market funds, especially the ones leveraging Internet Finance, reflects the large wealth management demand potential of Chinese market and new innovative finance forms that will appear in the Chinese market in 2014.

Yue bao AUM data of Chinese money market funds, especially the ones leveraging Internet Finance, reflects the large wealth management demand potential of Chinese market and new innovative finance forms that will appear in the Chinese market in 2014.

After what seems like forever, on February 18th, the regulators gave us a milestone reform for cross-border trade.

Not satisfied with just taking deposits from banks, online finance platforms are facing more competition from each other.

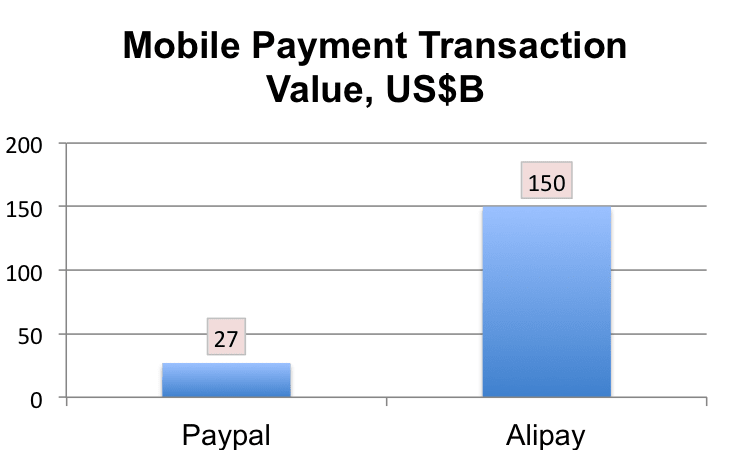

Over the past weekend, Alipay announced that it processed about US$150 billion in mobile payments in 2013 which is potentially more than PayPal and Square combined. PayPal cleared US$27 billion in 2013 and Square's number is not public, but likely far less than even PayPal's.

That's a huge number and makes Alipay the largest mobile payments platform in the world. It wasn't really a question of if it would happen, but when. With over 300 million users and 100 million mobile users, Alipay's mobile payment growth has tremendous market scale which is part of the reason for the success of their Yu'ebao investment product that just seems to keep growing and growing...

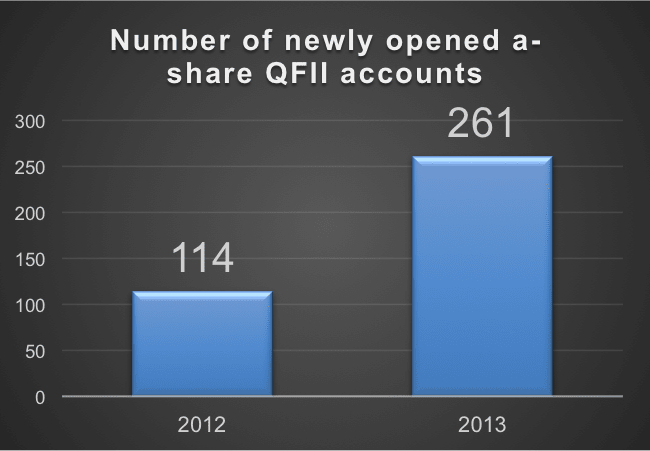

According to data from the China Securities Depository and Clearing Corporation Limited (CSDC), there were 261 new Qualified Foreign Institutional Investor (QFII) accounts opened in 2013 which represents about 43% of the total QFII account number from 2003 to 2013. Compared to 2012 figure. Number of QFII accounts rises by 129%.

So why are foreign investment institutions so interested in opening up accounts to trade the Chinese market when returns are so low? One reason is that the mainland regulators have been pushing towards more open markets and lowering the QFII requirements with the intent of introducing foreign capital to provide better liquidity in an anemic a-share mainland market. In addition to new accounts, more than $49.7 billion in QFII investment quota was approved in 2013.

The potential second reason is that foreign investors see potential opportunities in the mainland market either with current relatively low valuations or in the anticipation of future market growth if the market does pick up.

More...

As Chinese New Year wraps up and people (very!) gradually come back to work in mainland China, we wanted to take a step back and look at where we are with Bitcoin in China for the year of the horse.

Thank you to everyone who attended the Top-10 China Financial Technology trends webinar just over a week ago.

The sheer size of China's population and geography means that you get some pretty amazing statistics out of it. Couple that with increasing internet and mobile penetration and you have some pretty sizable numbers.

For decades, China has been known as the imitator and not the innovator. The argument goes that the West came up with social networking, mobile payments, group-buying, etc. and China imitated it, sometimes better, sometimes worse. C2C – copy to China. R&D – rob and duplicate. There are numerous terms to describe it.

The Shanghai Stock Exchange has been in the doldrums for the past couple of years and was the worst performing Asian exchange of 2013.