Displaying items by tag: india

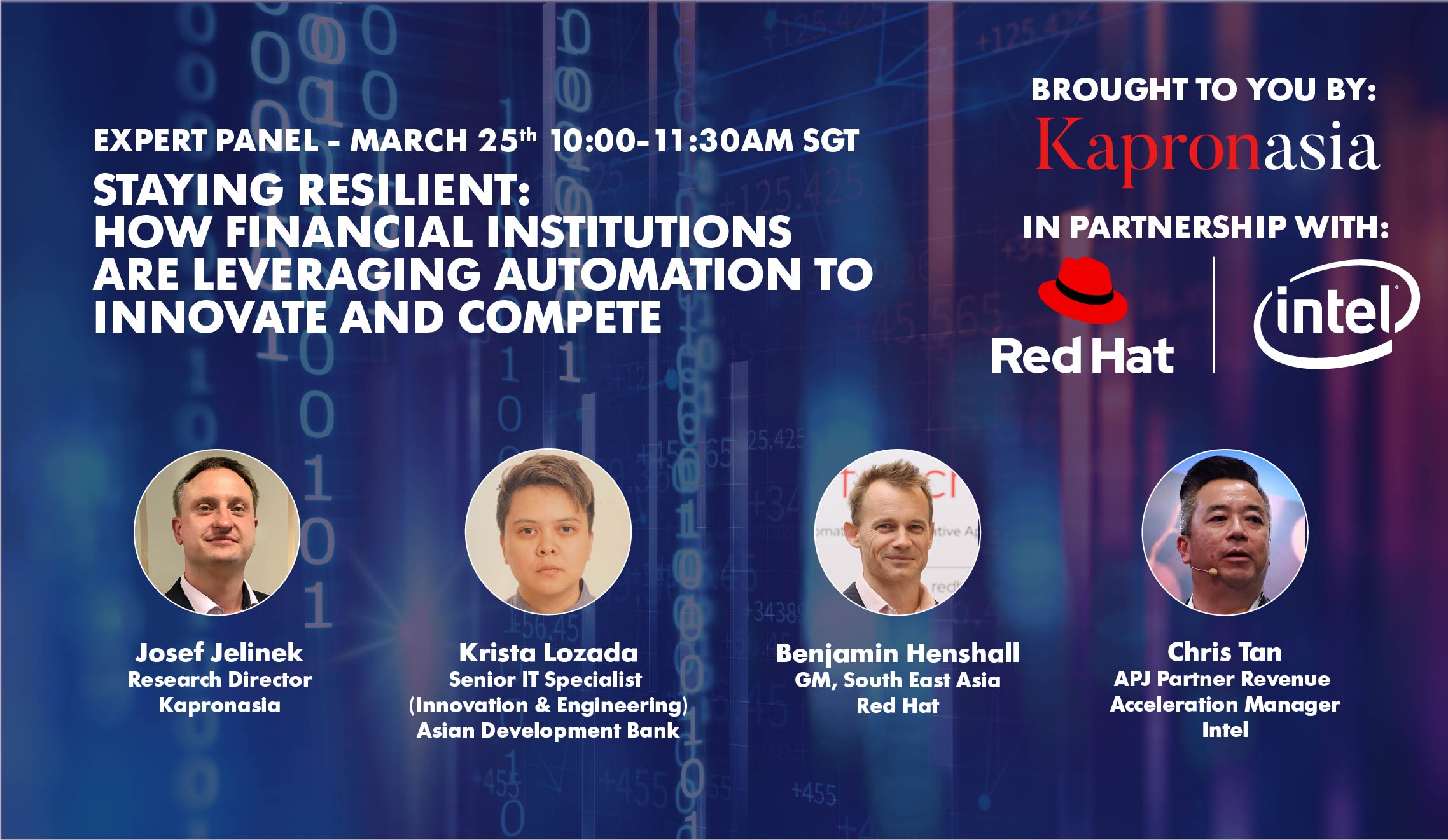

Webinar - Staying Resilient: How Financial Institutions are Leveraging Automation to Innovate and Compete

What went wrong at India's Yes Bank?

Yes Bank, one of India's largest private lenders, posted a US$2.5 billion loss in the October-December period as non-performing assets surged to 19% from just 2% a year earlier. To stymie further deterioration, the Reserve Bank of India (RBI) stepped in and took over Yes Bank in February. The bank's founder, billionaire Rana Kapoor, was arrested and accused of money laundering and taking kickbacks. Kapoor denies the charges.

Yes Bank's downfall is a cautionary tale of what can happen when a lender in an ascendant emerging market gets too big too fast, while taking on excessive risk. Yes Bank was the most gung-ho of India's non-public lenders established in the past two decades. Deep-pocketed foreign investors liked its focus on growth, which helped Kapoor and his colleagues ensure a steady flow of funding.

2020 Top Ten Asia Fintech Trends #8: Competition intensifies in India's digital payments market

India was one of the world's hottest fintech markets in 2019 with related venture-capital investment in the first half of the year reaching $286 million. Investors are especially keen on the payments segment, which an Assocham-PWC India study predicts will more than double to $135.2 billion in 2023 from $64.8 billion in 2019.

Chinese investment in India has flourished over the past decade, reaching a $8 billion as of December 11, 2019, as compared to $200 million a decade earlier in 2009. A significant amount of that investment is coming from China’s two tech giants, Alibaba and Tencent, which have been aggressively investing in Indian start-ups. Many of these start-ups have crossed the $1 billion valuation threshold to become unicorns.

Alibaba and Ant Financial have invested resources in five unicorns out of the six companies they’ve invested in, while Tencent has done the same for seven out of twelve startups they’ve funded. This would mean that Alibaba and Tencent have invested in approximately half of the 31 unicorns in India, according to a report from Iron Pillar. A six-fold increase of Chinese investment in India was recorded between 2013 and 2014, coinciding with the strategic restructuring of Alipay to Ant Financial. Experts believe that a majority of Chinese capital in India come from Alibaba and Tencent, or its subsidiaries.

Paytm’s payments bank (PPB) has become India's first profitable business of its kind, posting a net profit of Rs19 crore ($2.7 million) in fiscal year 2018-19. PPB says that it accounts for nearly a third of all mobile banking transactions in India and processes over Rs3 lakh crore worth of digital transactions per year, second only to India's top lender State Bank of India. With over Rs 500 crore deposits in its savings account, PPB is the top payments bank in India in terms of deposits.

India's fintech giants roll out credit cards

India's fintech giants Paytm and Ola are both entering the credit-card business, a move that should boost cashless transactions in an ascendant payments market estimated to reach $1 trillion by 2023. Digital wallet Paytm is cooperating with Citibank while ride-hailing juggernaut Ola is working with State Bank of India and Visa. Credit cards could offer Paytm a way to better compete with the U.S. tech giants who recently entered India's payments segment. For Ola, credit cards are a new way to generate revenue from its huge userbase. Visa and SBI hope to tap Ola's massive userbase to grow their own customer pool.

Ironically, both fintech giants are turning to a traditional financial platform to grow their businesses. Perhaps there is some truth after all to bromides about how financial incumbents and upstarts have more reasons to work together than compete with each other.

India plans to establish a fintech regulatory sandbox

India's fintech sector has surged over the past few years, with deal value reaching $2 billion in 2018. India now has more than 2,000 fintech startups, compared to less than 750 in 2014. Most Indian fintech startups are in the payments and lending segments, a boon for the subcontinent's under-banked population. Given the importance of fintech to financial inclusion in India, Delhi is preparing to launch a regulatory sandbox that would ensure that the industry develops stably. In late March, Reserve Bank of India (RBI) governor Shaktikanta Das said that the RBI would publish the guidelines for the creation of a fintech regulatory sandbox in the next two months.

Has China hit peak smartphone?

In 2017, the Chinese smartphone market saw its first ever decline, with -4% YoY growth in smartphone shipments and -4.9% YoY growth in smartphone sales.