Many of these payment providers entered the market with pure play wallets, with a plan to aggressively offer discounts and cashback when users sign up or transact for mobile recharges, utility bills and money transfer. The motivation was three fold- shift the user away from cash (behavioural change), ensure transactions happened on their app/website (build an ecosystem) and finally recoup the costs later by upselling financial services (profits!). However, that remained a mere pipedream as most consumers were simply not interested in financial services or didn’t trust these new age channels for core financial services. Some takeways from this whole journey-

- Wallet architecture affects adoption- Closed loop wallets are falling out of favour, while semi-closed ones and open loop wallets will remain in demand. Semi closed wallets allow use of the wallet at other online merchants. By offering discounts most closed wallet providers were able to get transactions, but most users would rather take the ability to interface with a third party payment gateway. In fact, adding an extra layer only added to more arbitrage costs and failure points in the transaction.

- The user chooses his own convenience- Mobile wallets built their offering by pitching ‘convenience to the user’ as a major feature. The wallet providers hoped that users will load their wallet with a generous amount of money and avoid frequent top ups, which ends costing the wallet provider as they have to pay the interbank charges. Most users opted to rather save their card details, and started using the wallet as a payment gateway of sorts. Reports indicate that now most PSPs are pitching their payment gateway to their rival wallet providers.

- Offline is key- The Indian government is heavily pushing for e-payments in the offline realm- such as toll collection and travel cards. Some time ago Paytm integrated Delhi Metro’s smart card recharge into its services, a win-win situation for both entities. PSPs should look to integrating such value added services which have high transaction volumes on a daily basis and represent a genuine pain point.

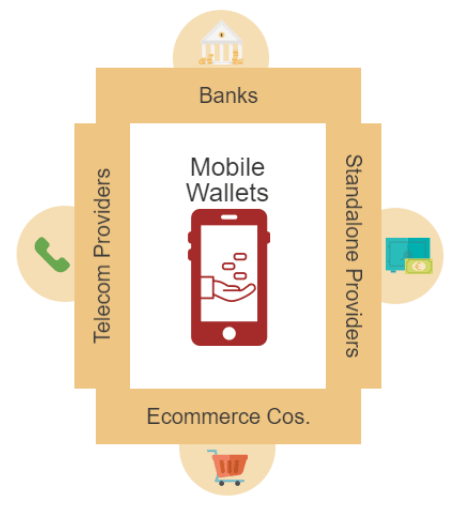

Most mobile wallets are front end (B2C) services for PSPs, however as e-commerce has shown, the online B2C space doesn’t stay fragmented for long. Most of the companies facing low adoption of wallets are the ones that started out with a B2B service such as a payment gateway backbone. Even telecom providers and closed loop e-commerce wallets are struggling to differentiate themselves from a payment gateway. Given an environment where profitability is returning as top consideration for investors, payment companies would do well to pick a niche that offers stable revenues than attempt a land grab in unknown territories.