Paytm's move is opportunistic but reasonable in the context of a wider push to move beyond thin margin-payments, where by some estimates it trails Google Pay and Walmart-backed PhonePe. Stock trading is red hot in India, with 4.5 million trading accounts opened by individuals through July, compared to less than 3 million in all of 2019, according to Central Depository Services Ltd. Retail investors are eager for attractive returns amid record low yields on bank deposits.

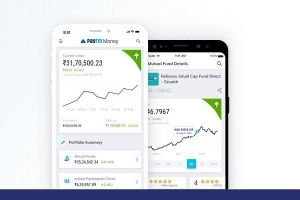

Paytm Money, the name of Paytm's wealth management division that operates its retail brokerage service, allows customers to invest in mutual funds and pension schemes as well as equities. Varun Sridhar, Patym's chief executive officer, told The Economic Times that Paytm Money hopes to stand out from the competition by offering investor education and including features that allow users to automate various steps in the securities investment process. At present, Paytm money allows users to automatically invest in individual stocks on a monthly basis.

Given its large user base (150 million), Paytm is willing to play the long game on its stock trading service. It is unlikely that Paytm Money will be a major revenue driver right away. Paytm is trying to build up its stock trading customer base by offering ultra-low fees on intraday trade of just Rs. 10 per trade. In September, Paytm Money said it had reached 6.6 million customers, pulling ahead of Zerodha, one of India's largest retail brokerage firms, which has 3 million customers and claims to handle 5 million orders daily, about 15% of India’s daily equity transaction volume.

Paytm's launch of stock trading could provide some momentum to the company as it pushes towards its goal of profitability in 2022. Paytm's losses fell 40% annually to Rs 3,629 crore In the fiscal year ended March 2020, buoyed by rising transactions and the success of its point-of-sale devices.

"Paytm is also moving its efforts to become a dominant digital financial services platform with Paytm Postpaid, Paytm Money and Paytm Insurance services contributing an increased turnover in the coming fiscal years," Paytm President Madhur Deora said in a statement.