P-notes are derivative instruments issued by registered foreign portfolio investors to overseas investors to enable them to trade in Indian stocks without having to register with the regulator. The users of the P-Notes are mostly overseas HNWIs (High Net Worth Individuals), hedge funds and other foreign institutions. P-Notes allow such investors to invest in Indian markets through registered Foreign Institutional Investors (FIIs).

This saves time and costs for investors, but the flip side is that the route can also be used for round tripping of black money.

The SEBI gave its approval to increase disclosure requirements for issuance of P-notes, which would enable the regulator to know the beneficiary and owner of these instruments at any point of time. SEBI also said that any suspicious transaction reports should be filed by the P-Note issuer with the Indian Financial Intelligence Unit on the notes issued by them. On a semi-annual basis P-Note issuer has to reconfirm the P-Note position and also carry out KYC review at the time of boarding each year. The regulator has asked investors to follow the Indian KYC and AML standards to bring about uniformity in such declarations.

Earlier it was not necessary for the P-Note subscribers to have permission from the P-Note issuer to transfer it to another investor offshore. This new KYC rules would enable the regulator to know the complete transfer trail of P-notes on a monthly basis.

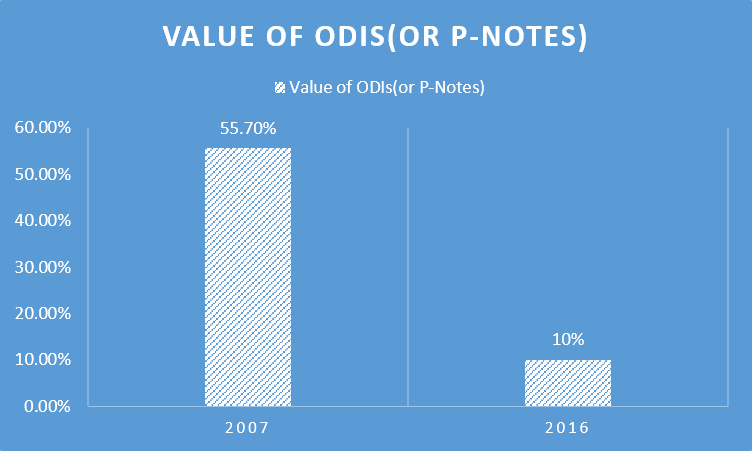

The effect of this move will be clearly visible in the market as well as on the FIIs. The total national value of Overseas Derivative Instruments (or ODI/P-Notes) has dropped drastically over the years from a high of 55.7 per cent in June 2007 to 10 per cent in March 2016, according to figures from the regulator. Out of the national value of ODIs on March 2016, $32.91 Billion, the share of equities through ODIs is $20.37 Billion.

The banking regulator Reserve Bank of India (RBI) has been opposed to P-Notes ever since the instrument's introduction in 1994, as the regulator felt that they led to concealment of identity of the investor and allowed multi-layering that made it impossible to determine who the actual beneficiary was. Incidentally, whenever there has been attempt to regulate the P-Note norms, the markets have always fallen. The same thing happened at the time of the announcement when the BSE’s benchmark Sensex fell 0.4% to 25,301.90 points.

It is anticipated that the new norms for P-Notes will ensure transparency, but will also gradually make the product irrelevant. The SEBI’s strategy seems to make the product less attractive while avoiding a complete clampdown on P-Notes. This move is in line with steps such as the India-Mauritius Treaty, aimed at curbing black money and money laundering.