India Banking Research

Oxygen for Public Sector Banks in India: Enough?

Last week, the government injected Rs 22,915 Crores or approximately $ 3.14 billion in 13 public sector banks in India. Of this one third of the allocation went to the State Bank of India. The capital infusion is expected to help banking institutions clean up their books, increase lending activity and also raise additional funds. However, not everyone is celebrating the move.

The Reserve Bank of India (RBI) has formed an inter-regulatory working group to address the regulatory issues relating to fintech and digital banking in the country. This is a welcome step in the right direction, in line with recommendations by Kapronasia in its recent report titled: ‘Fintech Regulation in Asia’.

Securities market regulator the Securities and Exchange Board of India (SEBI) has taken credit rating agencies to task after a spate of fiascos wherein a rating agency downgraded a certain paper from BBB+ to BB+ and finally D all within a span of month. In another case the credit rating agency suspended ratings on a certain stock citing non-availability of sufficient information. Interestingly, in both the cases the companies have been called out for debt servicing issues in the wake of the NPA process at major Indian banks.

The Department of Post (DoP) is all set to launch its payments bank by September this year after receiving the in-principle approval from the RBI to launch the same in August last year. With over 154,000 post offices of which 130,000 are operating in rural pockets of the country the new bank is expected to be a sure winner on account of the distribution strength. No wonder that some of the world's top 50 banks including Barclays of England, Deutsche Bank of Germany, Citi Bank of USA and the World Bank wanted to link themselves with the postal department for a piece of the action.

RBI to strengthen cyber security in Indian banks

The Reserve Bank of India (RBI) has proposed that commercial banks need to institute a Board-approved Cyber Security Policy no later than September 30, in a bid to address the growing number of cyber threats and reported incidents of cyber crime in the banking industry. The RBI set the rules in a letter to bank chief executives this month, with Regional Rural Banks exempt from the change. The use of technology in banks, already an "integral part" of operational strategy, has gained further momentum, hence the need for such guidelines, the RBI said.

India’s insurance sector is worth $60 billion and has established some solid regulatory models that helped spawn an entire web and mobile driven industry. The main insurance regulator, the Insurance Regulatory and Development Authority (IRDA), played a proactive role by setting boundaries early on in the sector, such as clearly distinguishing between insurance brokers and web aggregators.

Islamic Banking comes to India

The Islamic banking system, where neither the borrowers nor depositors are paid or pay any interest, is set to launch in India. It will completely function under the tenets of sharia law, where the bank doesn’t charge interest but the customers share a part of profit or loss of the bank. The idea is to encourage the economic and social development of the region the bank is based in.

As the 'India stack' becomes mainstream, what will banking look like in the future?

Even with over 40 Acts directly or indirectly pertaining to pertaining to insolvency and bankruptcy, banks in India are still under tremendous pressure due to rising non-performing assets (NPAs). Multiple agencies are involved in handling these situations, with overlapping jurisdictions that creates complexities and delays.

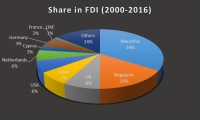

For nearly 30 years, India’s double taxation avoidance agreement (DTAA) with Mauritius came in handy for investors to route money through ‘shell’ companies based out of the island nation. These investors saved on capital gains tax liabilities in Mauritius which does not impose these taxes on off-shore entities. A similar treaty exists with Singapore. As a consequence, India receives half of its FDI from just two countries: Mauritius (34%) and Singapore (16%).

More...

Blockchain is a distributed, immutable ledger that records transactions using digital tokens. Its distributed architecture is much like P2P services such as Skype and bittorrent and it uses public key cryptography to ensure complete security for users. The immutability of entries on the blockchain is a key design feature that makes it particularly attractive to industries that lean heavily on trustworthy records, such as banks. But is India ready?

India’s banking regulator, the Reserve Bank of India (RBI), recently released a consultation paper on P2P lending in India. This paper aims at regulating India’s fledgling P2P ecosystem, demonstrating that the RBI is positively besieged with the concerns and realities of this nascent industry.

For several years the Indian Government has been pushing larger Public Sector Banks (PSBs) to consolidate the market by acquiring smaller and weaker banks. After failing several times in the past, it seems at least the merger of India's largest bank with its five associate banks will be finalised during this fiscal year.

India’s first small finance bank

Capital Small Finance Bank (SFB) was launched this Sunday (April 24, 2016) with much fanfare. This is the first of the ten small finance banks to become operational. The SFBs had received in principle approval from RBI last fiscal to start operations.