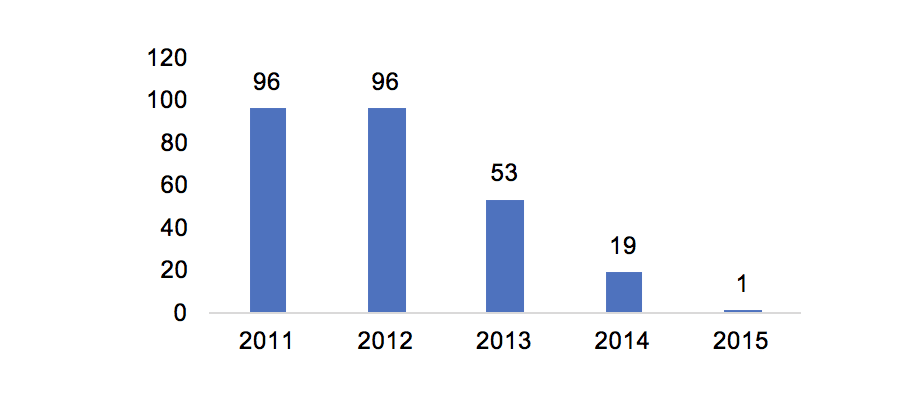

Chart 1: Number of Payment Business License Issued per Year

The Payment Business License in China was issued for non-financial institutes to operate part or all of the following business:

- Online payment, including

a) internet payment

b) telephone/mobile phone payment

c) digital television payment

- Offline payment, including

a) merchant acquiring service

b) value-stored card

Other companies wanted the license

Since March 2015 the PBOC has suspended issuing new licenses. In addition to stopping the process of any new license applications, the PBOC equally pays close attention to existing license holders and can cancel their qualification should they be found guilty of illegal operations. There are subsequently now only 247 licenses on market.

Despite to the fact that the government has seemingly quelled the likelihood of any new licenses being issued, many companies are still desperate to move into this area. This circumstance has led to license values reaching thousands of millions of RMB and in 2016 the highest transaction was reached at over RMB 3 billion or USD 461 million.

Buyers were mainly e-commerce companies or listed companies. (Those companies hold consumption businesses, which includes the payment process. Getting a license to conduct the payment process themselves helps in saving costs. For big e-commerce players, e.g. JD.com, their cash flow can reach hundreds of billions per quarter however if they were to use 3rd party payment services, their fees would set them back hundreds of millions of RMB. As well as saving costs, keeping all customer information and data private is another key factor. Especially when there are competitors using the same 3rd party’s payment service there is a potential risk for a company’s customer information to fall into the hands of a competitor.

The situation becomes more difficult for small and medium players

According to Analysys’ estimation, total transaction value done by the third-party payment companies reached RMB 39.5 trillion in the 2nd Quarter of 2017. Alipay, Tencent and China Union Pay, as the three biggest players, together took over 80% of the third-party payment market and the top 8 players dominate with over 96% of transactions in the quarter. Considering the fact that there are about 247 license holders in the market, there is very limited market space for the remaining 239 companies.

- Strict monitoring

There are a few companies that try to conduct business in a grey area for more profit but the PBOC keep a very close eye on their business. In the month of August 2017 alone, the PBOC published penalty decisions to over 10 third-party payment companies as they broke the payment regulations. Sandpay (杉德支付) was fined RMB 850,000 (USD 130,000) and their illegal income of RMB 349,100 (USD 53,000) was confiscated. Other companies received up to a RMB 60,000 penalty.

- Hard conditions to make a profit

As stated above the license holder can conduct part of all of the online and offline payment related business. Most of the licenses allow holders to conduct online payment and merchant acquiring service. Companies earn different levels of profit from those services but in both areas, it becomes more difficult to acquire market share and register capital gains.

Online payment service is considered to be the most profitable business as this can bring a lot of customers in at a low cost, however this only works when the company reaches a scale effect. If the company does not have a certain high threshold of customers, the costs would outweigh the profits.

In the offline market, providing merchant acquiring service creates less profit after the fee change carried out since September 9th 2016. The new policy lowers service fees and clearing fee, leading to smaller profit margins for license holders.

- Less potential buyers

Potential buyers of the licenses are mainly e-commerce companies or internet finance companies. When looking into the current landscape of Chinese e-commerce companies, most of the players are already fully equipped with their licenses.

Traditional retailers who try to move online may consider buying an existing license holder. This can be the chance for the license holders to sell their business and make money. However, since creating a payment system and adding it to their existing services takes a long time and costs a lot, it is really difficult to estimate the number of potential buyers that are willing to undertake such a heavy investment.

Integrative Stage

In the foreseeable future, there will be no new licenses, if anything the license number may be even be smaller as the PBOC cracks down on companies operating illegally with a license. On the other hand, over 95% of the third-party payment market is tightly held by the top 8 players. The current number of licenses is then arguably more than necessary. It would therefore be no surprise to see many licenses get revoked or the smaller players merging or being acquired in order to survive.

Survival in this intensely competitive market is a real challenge for all the existing license holders and it will be interesting to see how this market unfolds going forward.