Displaying items by tag: risk management

Regulation on Barcode Payments to Solve E-payment Scams and Facilitate Fair Market Competition in China

In China, bar code payments (including QR codes) dominate the mobile payment market. Using a bar code to pay is easy, but comes with risks. In 2017, about RMB 90 million ($14 million) was stolen due to fraud. On December 25th, 2017, the People’s Bank of China (the PBOC) released new regulation to standardize bar code payments. The regulation will come into effect from April 1st, 2018.

Government clampdown spurs micro lending reshuffle in China

Since Chinese online micro lending companies Qudian and Paipai Dai have gone public on the New York Stock Exchange (NYSE), the government has been closely following the development of the micro-credit industry. Scrutiny has fallen not only their business model but also on their high revenue, which specifically caught people’s eyes. The Ningbo Jinzhou Financial Office already shut down two micro lending institutions. On November 21, 2017, the General Office of the State Council issued an urgent notice on suspending approval on the establishment of internet small loan companies. With the arising attention around financial risks, could this be the end of the industry?

Anti-money laundering activities are taking the center stage in Indian financial markets. The recent crackdown on shell companies, and brokerages helping them, by the Securities and Exchange Board of India (SEBI) is part of a concerted effort by the Government to clean up the financial markets in India.

Scaling back Dodd-Frank and the impact on Asian financial services

The new US President Donald Trump has made clear his intention to roll back, and possibly repeal, the Dodd-Frank Act of 2010. This will have wide-reaching repercussions for Asia.

Recent announcements in the personal credit scoring market in China show that both global established giants and smaller, but cutting-edge companies are carving out niche markets for themselves in the country.

PBOC drafts outline for long-awaited deposit insurance scheme

The PBOC has announced it will be introducing a deposit insurance system in China, which will have a profound impact on banks’ behaviour. Liberalizing the banking sector may put it on a more sustainable path but short-term risks should not be ignored.

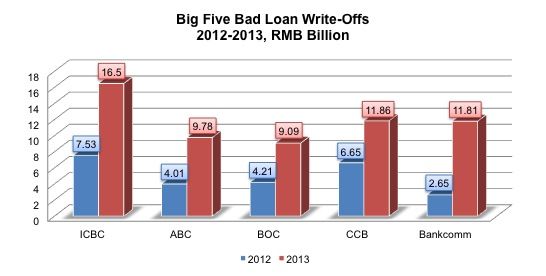

Accroding to the latest figures from the CBRC (China Banking Regulatory Commission), Chinese banks’ asset quality deteriorated as the balance of bad loans continued rising from RMB 492.9 billion in 2012 to RMB 592.1 billion in 2013. However, as banks wrote off significant amounts of bad loans in 2013, the bad loans ratio grew only slightly from 0.95% to 1%, leaving the asset quality in relatively good shape. The largest outstanding bad loans are from the big five banks, who have hit a 10 year peak of bad loans - in total, they have written off RMB 59 billion up significantly from 2012.

The large amount of write-offs prevent the bad loan ratio from growing fast. In addition, Chinese banks have a relatively higher provision coverage ratio, so they are able to write off more. As China is in the middle of an economic transistion, we estimate that banks’ bad loans will continue rising as exports continue to slow and industry shifts excess capacity. Further 2014 write-offs will be supported by the CBRC’s latest guidance.

Bad loans rise in both amount and proportion in China

According to the latest figures from the China Banking Regulatory Commission (CBRC), both commercial banks' balance of Chinese bad loans and the ratio of bad loans increased throughout 2013.

The continuing increase of bad loans is an indication of the challenges in China's economy currently. With an economic transition happening and increased lending on bad loans, this is not likely to decrease in 2014 which will pose even more of a challenge for banks as they face increased interest rate liberialization and other financial industry reform.