Displaying items by tag: china

The Impact on China of the U.S. Government Shutdown

The U.S. Government Shutdown and Its Impact

The shutdown of the U.S. government ended as the two U.S. political came to an agreement to delay the decision to January-February of 2014. This means that the global market instability will likely still be on-going until the beginning of next year. This also means that the U.S. market may not be as lucrative and attractive as before, as critical decisions regarding the debt ceiling and government funding are still not solved.

It is important to figure out the impacts of the incident on Chinese economy, as the U.S. and China are the world’s number 1 and 2 economies with strong ties. The index trends in East Asia, oil consumptions and imports by China, and geo-political status of China are all important aspects to consider to understand the impact.

Market Change after the End of Shutdown

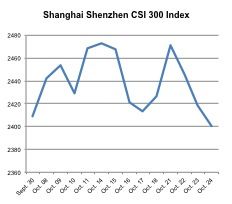

The Chinese stock index fell right after the announcement of the end of the government shutdown, while other East Asian and Southeast Asian market indexes rose. Although, it is hasty to conclude that China had served as a ‘refugee market’ or as an alternative to the U.S. market just from that factor, one could draw certain implications that people were shifting their investments in and out of the US / China as a the appeal of each market shifted.

U.S. – China Relations from multiple angles

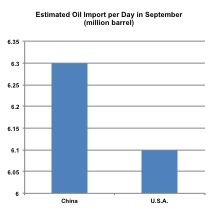

According to the U.S. Energy Information Administration’s latest report, China surpassed the U.S. in terms of oil imports in September, due to oil consumption surpassing production. Part of the reason behind this is that the U.S. has been decreasing the total import of crude oil – China is replacing the U.S. demand. If this trend continues, and the decrease of oil price also continues, China will benefit from the outcome by stabilizing the export production cost, but at the same time become more susceptible to the oil price. The economic ties with the U.S. has to be a factor here, as crude oil imports to China are used for the refined oil products and the production of manufacturing goods that go to other nations around the world. Since the U.S. is the biggest individual nation in terms of absorbing Chinese exports, the susceptibility will only be counterbalanced when Chinese exports are sold with minimum hindrance.

The ultimate factor, however, is the sovereign debt of the U.S. held by China. In 2011 China already became the top

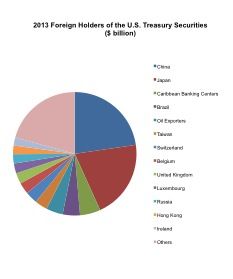

The ultimate factor, however, is the sovereign debt of the U.S. held by China. In 2011 China already became the top  U.S. government debt holder, accounting for the 8 percent of total U.S. public debt. Even in percentage terms the figure is very high. As long as the U.S. has the economic power to pay back the interest and return the principal for the matured bonds, both the U.S. and China have little to worry about. However, the current talks on debt ceiling and budget talk have changed the atmosphere. For the U.S. when a single country has such high debt in time of financial instability is one more thing to worry about. For China, it is now holding a potential time bomb – even though the chance of the U.S. default is very low, the lessened credibility of the U.S. government bonds means the future investment channel is narrowed. The portfolio of Chinese government requires changes, and the currently-held debt needs to be reevaluated in terms of the possibility of return. Chinese government needs to diversify its risk coming from the U.S. instability.

U.S. government debt holder, accounting for the 8 percent of total U.S. public debt. Even in percentage terms the figure is very high. As long as the U.S. has the economic power to pay back the interest and return the principal for the matured bonds, both the U.S. and China have little to worry about. However, the current talks on debt ceiling and budget talk have changed the atmosphere. For the U.S. when a single country has such high debt in time of financial instability is one more thing to worry about. For China, it is now holding a potential time bomb – even though the chance of the U.S. default is very low, the lessened credibility of the U.S. government bonds means the future investment channel is narrowed. The portfolio of Chinese government requires changes, and the currently-held debt needs to be reevaluated in terms of the possibility of return. Chinese government needs to diversify its risk coming from the U.S. instability.

Geo-Political Movements of China

As China is a well-known politically stable country with one party system, at the moment of the U.S. instability, the characteristic is clearly a benefit to China. However, in modern economy, nations maintain close political and economic relationship. This means the U.S. instability will have a likely negative impact on China.

Then the question we have to ask is how much impact the U.S. instability will have on Chinese economic growth. It is possible that China would not be able to enjoy high growth rates it used to for the next 3 to 4 months, as the U.S. is one of the top 3 markets for China. If the U.S. market is not able to consume as many goods as it used to be due to the instability, China will face further reduced exports. These exports alone represent about one fourth of the total GDP, and the net export is about one eighth of the total GDP. Therefore, if China export to the U.S. slows by a considerable amount because of the instability, the consequence for China will not be great. Whether it was done to counter such consequence is not clear, but the president Xi and the premier Li’s meetings with the leaders of ASEAN nations can be seen as a type of insurance for China. This will not only increase the geo-political strength of China, thus further stabilizing regional politics, but also create more economic ties with the region to divert exports and investment channels.

However, so far the “magnet of economy” is still at the U.S. market, and the power of the magnet is very strong. In other words, the determinant of global market trends is the U.S. and that fact will be the key to the Chinese economic prospects. The geo-political factor of Southeast Asia is not yet strong enough to counterbalance the current instability formed in the U.S. market and politics.

Possible “Next Steps” for China

The Chinese market may not show a sudden change, but the prolonged instability will certainly diminish the economic strength that China has been showing for a couple of decades. This means China has to prepare for certain changes that could affect its future growth. Before the shutdown, there had been worries on the U.S. Federal Reserve’s (the Fed) tapering on quantitative easing. Now the concern on the U.S. budget and debt ceiling talks adds more worries to developing nations. Nations including China will have to worry about whether to focus on development as they have been doing, or to focus on stabilizing the domestic economy and strengthening the weak links within their own economy. As the government shutdown caused economic instability, the Fed will most likely continue its quantitative easing to secure economic conditions for now. That does not mean the instability of the Fed’s tapering is removed, because it is like the status of the U.S. budget talk: the quantitative easing is only a temporary solution.

Even though China has a huge domestic market, in time of economic instability, the driving force of economy is hard to find. Export is not going to help China go through this hard time as the whole world is suffering together, and domestic consumption growth is still up in the air. In September, Chinese exports faced an unexpected year on year drop. When looking at the income of Chinese people, that does not seem to help increase domestic consumption. Other possible economic boosts such as government spending or investment are still viable options, but the question is “how long and how much the Chinese government and corporates are willing to put money into it?”

Not only that, China also faces the question of liberalization of the market. China has shown strong commitment to liberalize and open up further to the global market, especially in financial and trade sectors. The recent interest rate reform and Shanghai Free Trade Zone were two of the examples that have shown Chinese commitment through action. Since there is instability in the global market, the economy will not be as energetic enough as Chinese government expected it to be for its liberalization process. This means that China can cut its effort down to open up the market and slow down the pace of economic expansion. This could be a problem if the investors around the world, who think China will still show strong growth, find out about the policy changes in China. Even if the investors have anticipated the slowdown, the actual impact of Chinese slowdown will be massive, considering the size of Chinese economy.

Also, Chinese government external debt has increased significantly in recent 10 years, more than tripling since 2002. China has funded many projects through debt, and if the economic expansion diminishes, it will adversely affect the debt / deficit balance in China. The Chinese government will have a harder time borrowing money at the same interest rate, and have a harder time paying back debts as the profit from projects diminishes due to the domestic economic slowdown and the global economic recession. Then the government projects will have to face the new consequence of either reduction in size or complete shutdown, and overall investment and financial inflow will diminish, which can be a vicious cycle. Even though Chinese government will put extra effort to prevent such cycle, the diminishing trend is inevitable.

However, It could be a good opportunity for China in terms of restructuring its domestic economic design. Rather than focusing too much on expansion and growth, China can restructure its economy through strengthening small and medium enterprises, or increase the consumers’ purchasing power. The latter might be a harder task for China, as it includes increased welfare, restructuring of wage systems, and implementation of social safe-nets – this is even hard for other developed nations. However, strengthening SMEs is achievable through several banking reforms that would either guide banks to give more access for SMEs to capital, or allow more commercial and private banks to open up and target SMEs as major customers.

China’s Possible Direction

Overall, China is facing a key decision-making period as the U.S. economic power is in question due to the prolonged debt ceiling and budget talks. With strong economic ties to the U.S., China faces trade-offs: whether to continue its economic expansion policies or to restructure its economy. It will be detrimental for China to continue the expansion as there will be no country to be able to support such moves economically. Especially when the world’s number 1 economy is unstable, the scenario is highly unlikely. Hence China will stay low and withhold any further reforms that can tip off the balance. Possible policies could be to strengthen domestic markets, but even then, the implementation of policies will not come fast, as the instability from the U.S. is not predicted beforehand. Nevertheless, this can be the valid option for China at this moment – the restructuring is an inevitable process for a developing nation.

Chinese ATM Manufacturers continue to gain domestically

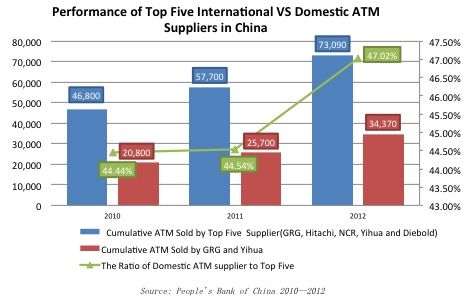

According to the latest figures from the People's Bank of China, the aggregate number of ATMs sold by top five international suppliers, including GRG, Hitachi, NCR, Yihua and Diebold, increased dramatically from 46,800 ATMs sold in 2010 to 73,090 sold in 2012, a roughly 56% growth.

What is interesting though is that the sales performance of Chinese ATM manufacturers including GRG and Yihua, has also been robust as well and in fact taking a larger percentage of overall ATM sales in mainland China. With a 20%+ increase year by year, Chinese ATM manufacturers have increased sales from 20,800 ATMs in 2010 significantly to 34,370 ATMs in 2012, a nearly 65% increase in 2 years. This is also reflected in the % of domestic ATMs sold as compared to the whole, which went from 44.44% in 2010 to 47.02% in 2012.

As the Chinese government starts encouraging the purchase of domestic ATMs, GRG and Yihua will likely continue to gain market share in the next few years to the detriment of the international players.

Should international banks move into The Pilot Shanghai FTZ?

Over the past few weeks, the Shanghai Free Trade Zone (FTZ) has captured business headlines here in China and abroad as discussion continues about the impact that the zone will have on reform in China. As of October 30th, 208 companies have registered in the zone in just under one month, notably 36 in the asset management sector.

One of the early announcments was the commitment from Citibank and DBS to enter the zone. When we initially heard that these banks were so committed, we were a bit skeptical. Often foreign companies in China support government programs to better their relationship with the government. However, in the past couple of weeks, we have changed our view.

The FTZ itself, although the future reforms are somewhat unclear, will open up a number of immediate near-term opportunities for international banks in the shanghai free trade zone. These opportunities primarily revolve around non-reform related products and services:

Chinese Yuan / RMB fungibility – One of the key aspects of the zone will be what happens to Chinese Yuan (also known as RMB) fungibility or the ability to exchange RMB freely for other foreign currencies. Although it is a bit unclear exactly what exchange will be possible, the feeling is that some reforms to help open up convertibility will happen. At a minimum, a RMB system somewhat similar to the Hong Kong CNH where the RMB currency is held offshore and is essentially treated as a completely separate currency – although still limited by exchange restrictions.

Trade – Interestingly, although this is a fairly obvious one, as the Shanghai Pilot FTZ is currently setup somewhat like a mini-HK or offshore port, trade services for companies setup in the FTZ will either need to come from international banks within the FTZ or overseas banks. So if you think about this, currently, if you are a manufacturer in China, you would likely either be using a domestic bank or the domestic branch of a foreign bank for LCs, Loans, Bank Guarantees, etc.. If you are a manufacturer in the free trade zone however, you will need to have a bank either also in the free trade zone or overseas as the FTZ is essentially an offshore market.

Interest rate exposure – As a few industry experts have pointed out, interest rates in the FTZ do not have to necessarily be the same as those outside of the zone. While this may bring some somewhat challenging issues for corporates who are setting up in the zone to manage interest rate risk both in the zone and outside, it does offer banks an opportunity to provide interest rate related services and risk management tools to the corporates they serve in the zone. It will take some time before we can really determine what these might be, but certainly will be an opportunity.

Experience with reforms – Finally, by being in the zone, banks will learn through first hand experience how any reforms will change their industry. Although there is some debate as to how lined up the Chinese government is behind real reform, especially with the November plenary on the near horizon, but certainly any of the near-term reform will happen in the Shanghai FTZ at least as a test and then for further roll-out through-out the country. Banks that are there now will be able to test and try reform.

Good relations and good opportunities

So overall, it would be remiss to say that banks and companies like Microsoft, Citi and DBS are not entering the zone to better their relationships with the government, there certainly is some of that involved in their decision-making process. It is also clear that first movers will likely have better advantages in the long-term. What the examples above do show as well is that there are additional product and service opportunities for banks in what will be a relatively open and uncompetitive market – at least in the short term.

Opportunities for Foreign Banks in China

In a heavily regulated market like China, it’s easy to point out what can’t be done, but sometimes difficult to identify what can be. Many banks look at the market and see it as being too difficult or as you might say in Chinese ‘mafan’ or troublesome. It is easy to look at any industry in China being like this, but what’s critical in the market is to find a unique opportunity and take advantage of it. For western banks, that could be the slow but steady internationalization of the RMB.

The most recent Bankcard Consumer Confidence Index (BCCI) in China numbers show a continuing increase in consumer confidence since March 2013. According to the data released by China UnionPay (CUP) and Xinhua News Agency, the BCCI peaked at 86.69 in September; the BCCI has stayed high level for three months. It increased 0.89 compare to the same period in 2012 which is a positive sign that the macroeconomic environment is growing steadily in China, at least in the minds of consumers.

Chinese Shadow banking AUM reached a new high at the end of 2012

According to the figures from Chinese Academy of Social Sciences’ ‘Chinese financial industry supervision report’, the official figures show the shadow banking industry reached an AUM at the end of 2012 of about CNY14.6tn, but other research shows that the actual market is much larger, about CNY20.5tn. The number is so large that it even takes 40% of GDP according to the numbers and 2013 is expected to be even higher.

The shadow banking system in China is not sufficiently regulated and often many of the products created are carry high risks which are not explained clearly to the investors. In general, a more regulated shadow banking system should be beneficial to the banks and investors in long-run. If the current issues were not solved effectively, then the dramatic volume increase could be a financial time bomb that might severely damage the Chinese economy and financial stability.

|

Year 2012 |

Scale of Chinese shadow banking (CNYtn) |

Proportion of GDP |

Proportion of total asset of banking industry |

|

Official data |

14.6 |

29% |

11% |

|

Actual Market |

20.5 |

40% |

16% |