China Payments Research

Kapronasia will be hosting a webinar on August 8th, 2012 looking at China's Online Payments market.

For more information on the webinar, please see the webinar description here or to register directly, go here.

The webinar is complimentary and will be looking at aspects of Kapronasia's soon to be released Online Payments Market in China report.

Pre-paid Card Webinar Recording now available

A recording of Kapronasia's Prepaid Cards in China webinar is now available for viewing on Kapronasia.com. To access the recording, click on the webinar link at the top of the website.

WTO Dispute May Accelerate China’s Liberalization

Recently, a WTO dispute panel, in response to the recent US complaint, said China is breaking the WTO rules by maintaining CUP as a monopoly supplier for the clearing of certain types of RMB-denominated payment card transactions. The specific areas where the panel determined that China had discriminated against foreign bank card suppliers are that 1) China requires all payment cards issued in China to work with the CUP network and to carry its logo, and 2) China forces all payment terminals to accept CUP network.

Top-5 Current Trends in China's Payments Industry

Trend 1: Fourth Round of Payment Licenses

If you remember from our previous commentaries, in 2011, the People’s Bank of China (PBOC) mandated that any company providing payment products or services be licensed in order to operate. This brought a much needed dose of regulation to what was previously quite an unregulated industry. Since then, 4 rounds of payment licenses have been approved, the last being on June 28th, when another 95 payment companies qualified to provide payment products and services in China.

According to PBOC (the People’s Bank of China), driven by the proliferation of online banking in China, in 2011 the total online payment transaction value reached 700 trillion RMB, with a 33% growth rate.

On June 16th, 2012, China Telecom, one of three mobile network operations in China, announced that its total mobile payment transaction value in 2012 researched 17 billion RMB, already exceeding the total amount of last year.

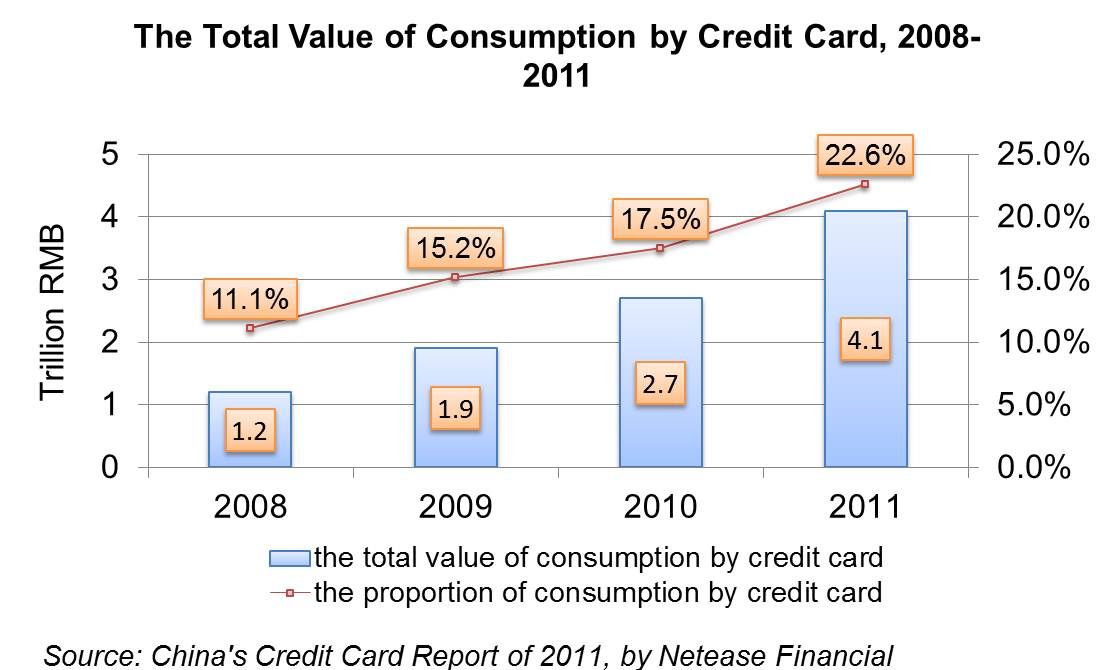

According to China’s Credit Card Report of 2011, the total number of credit card reached 290 million and the total value of consumption by credit card was 4.1 trillion RMB in 2011, accounting for 22.6% of China’s total retail sales of consumer goods. In recent years, credit card consumption has experienced rapid growth benefiting increased consumer consumption as well as improvements in convenience and security.

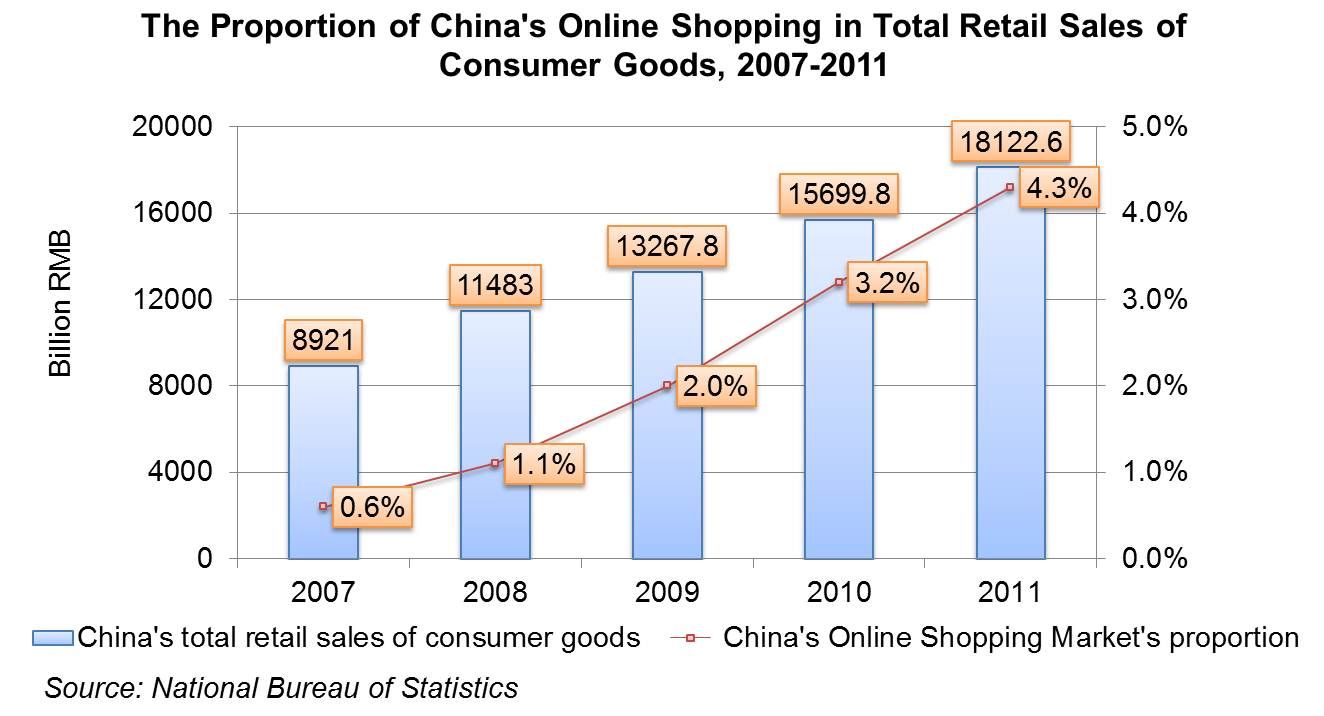

Proportion of online retail sales as percentage of total retail sales in China continues to increase

According to the National Bureau of Statistics, China’s total retail sales of consumer goods reached 18 trillion RMB and the number of online Shopping users reached 194 million. At the same time, in 2011, China’s Online Shopping Market reached 773.6 billion RMB, with a year-on-year growth of 55.3%. The transaction value of China’s Online Shopping Market contributed 4.3% to the total retail sales of consumer goods, continuing to grow in importance to the overall retail sales market.

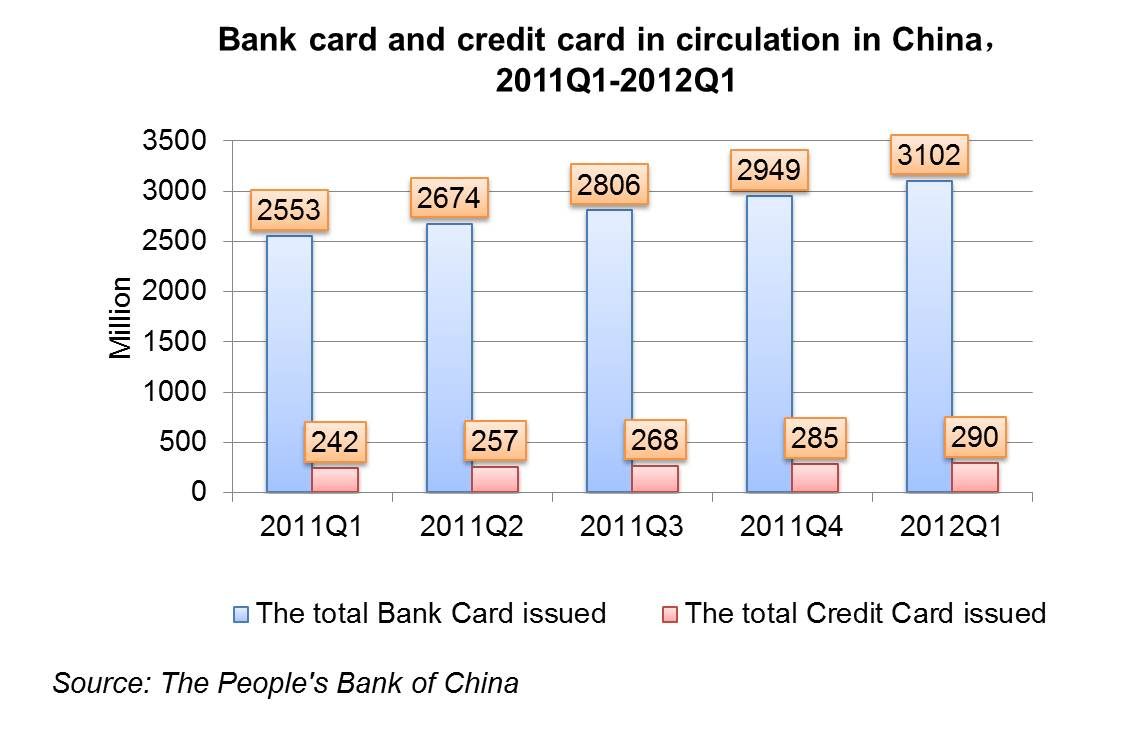

According to the latest China’s Payment Report from People’s Bank of China, up to 2012 Q1, the total number of bank card in circulation grew 5.2% quarterly to 3.1 billion, reaching about 2 bank cards per person. Among them, the total number of credit cards reached 290 million, an increase of 1.8% from end of 2011Q4.

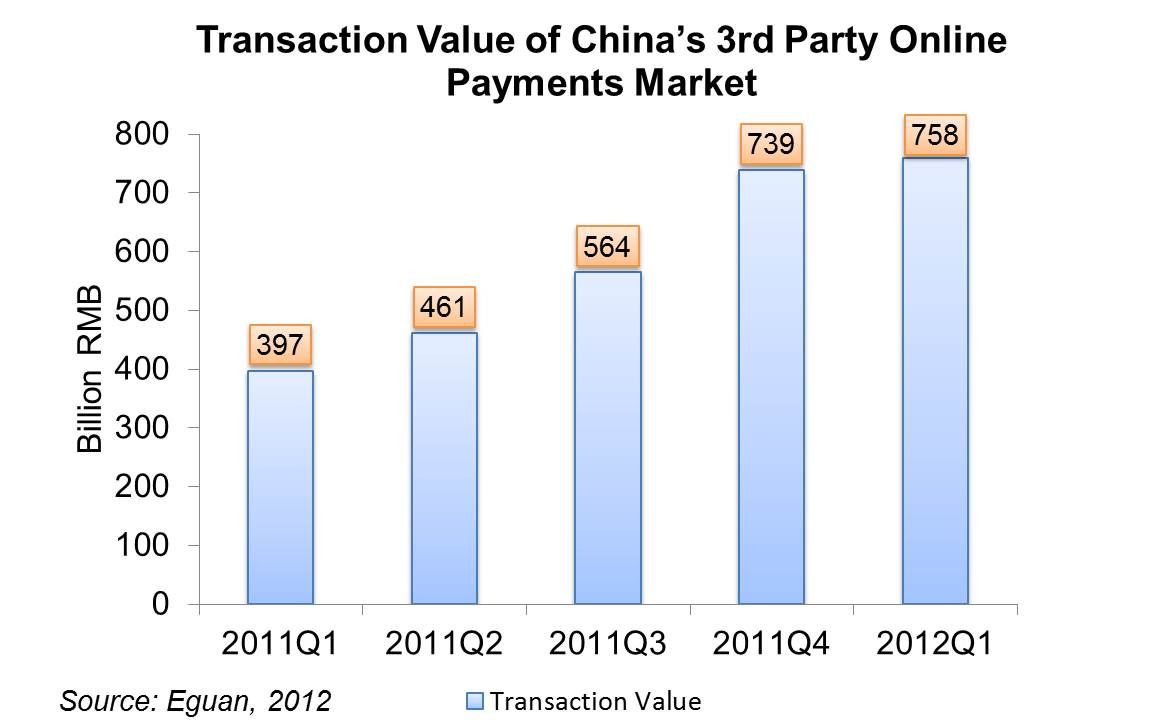

According to Eguan, a China-based consulting company, the total transaction value of China’s 3rd Party Online Payment market reached 758.3 billion RMB in the first quarter of 2012.

The quarterly growth rate declined because of seasonal factors and the influence of the holiday - especially because online shopping and air travel which accounts for the largest part of the total online payment market; both declined rapidly in the first quarter.

More...

China's Mobile payments market to be worth USD 80 billion by 2015; largest in the world

The Chinese mobile payment market is virtually doubling in size every year and is expected to be worth more than US$80 billion with 441 million active users by 2015, according to the latest report from Kapronasia. China has already overtaken the US as the largest smartphone market in the world; the number of mobile payment users will dwarf other markets worldwide.

Trunkbow and CUP partner to offer online to offline (OTO) payment services, but is it value add?

On March 28, 2012, Trunkbow, a provider of Mobile Payment services in China, announced that it has teamed up with CUP (China Union Pay, the only bankcard switch in China) for the development and deployment of a mobile online-to-offline payment system which will be launch in Q2 2012.

Q4 2011 online payments in China reached USD 117.3 billion

According to a study released by research firm Analysys International, in Q4 2011 online payments in China reached USD 117.3 billion, up by 30.9 percent from Q3 2011. The growth was largely down to an increasing demand for online shopping, travel booking and gaming. Alipay, an affiliate of Alibaba Group, took 46 percent of the total online payments, while internet company Tencent took about 25%. Government support for new market participants also helped growth as the People's Bank of China (PBOC) granted over 70 new licenses to non-financial organizations engaged in payment and settlement businesses in 2011 bringing the total to more than 100 licensees.

A Happy New Year for China’s third-party payment companies

On December 31st, New Year’s eve, the PBOC finally issued another 61 third-party payment licenses which probably were the best holiday gifts for the third-party payment companies who had been waiting for the new licenses.