China Payments Research

The future of mobile payment in China

The latest payment report released by PBOC shows that in 2014Q1, electronic payments kept a steady growth with the most eye-catching performance being from mobile payments.

According to the Chinese Financial Certification Association, in the major 35 cities of China only 3% of electronic (Internet and mobile) banking clients use Near Field Communication technology as a payment method. With all the convenience of the NFC technology it seems strange that the trend didn’t pick up yet.

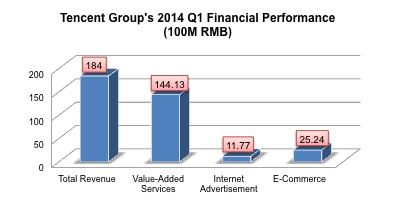

Tencent e-commerce challenges are surfacing

The latest financials from Tencent Group shows that overall growth stayed strong in the first quarter of 2014 as revenue hit RMB 18.4 billion, 78% of which were value-added services. E-commerce however suffered as revenues declined 24% as compared to Q4 2013. Tencent indicated that the lagging performance was a seasonal factor; in addition Tencent has recently re-focused its e-commerce strategy.

As known, Tencent setup a partnership with Jingdong this year, acquiring 15% of the online retailer which also holds QQ wanggou and Paipai. The acquisiton is an indication that Tencent is serious about e-commerce, but they still seem to be searching for the right business model. Yet with Alibaba listing soon, Tencent will have to show rapid returns on their investment in order to keep a increasingly impatient set of investors happy. Tencent's e-commerce challenges must now be confronted to stay ahead of the game.

After the PBOC’s suspension of QR code payments and virtual credit cards, they have begun soliciting comment on draft guidelines on “Payment Institutions Network Payment Business Management Approach” (provisional).

Shanghai Free Trade Zones showing signs of payment activity

After what seems like forever, on February 18th, the regulators gave us a milestone reform for cross-border trade.

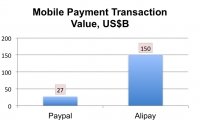

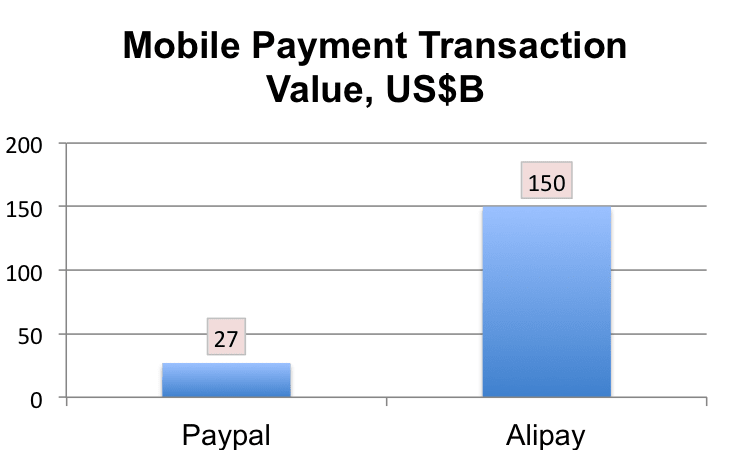

Alipay's mobile payment business dwarfed PayPal's in 2013

Over the past weekend, Alipay announced that it processed about US$150 billion in mobile payments in 2013 which is potentially more than PayPal and Square combined. PayPal cleared US$27 billion in 2013 and Square's number is not public, but likely far less than even PayPal's.

That's a huge number and makes Alipay the largest mobile payments platform in the world. It wasn't really a question of if it would happen, but when. With over 300 million users and 100 million mobile users, Alipay's mobile payment growth has tremendous market scale which is part of the reason for the success of their Yu'ebao investment product that just seems to keep growing and growing...

Alipay Wallet 7.6 – so what? A Look at features

The Alipay Wallet 7.6, which was rolled out on October 29, 2013, provides over 30 functions and services. It is reported that the launch of this new Alipay Wallet has extended its services in new areas and provides some significant benefits to consumers. Among these services, the most innovative are “payment with soundwave technology”, “transferred payment with emotional feelings”, “payment by snapping payment cards”, “Official Accounts” and “loading money into on-purpose campus card”.

Payment with Soundwave Technology

The application of soundwave technology in Alipay Wallet with smartphones allows consumers to make payments conveniently even when there is no 3G or Wi-Fi signal, such as at subway vending machines. By holding the phone close to the payment receiver on the vending machine, the phone can authenticate and authorize payment via sound.

Alipay has already setup relationships with eleven vending machine operators that cover about 90% of the Chinese market. At the end of 2013, this soundwave technology will be used in over 50% subway vending machines.

In addition, soundwave technology can also be used to purchase movie tickets. After paying for movie tickets from Alipay wallet, consumers can get tickets by releasing noise generated by smartphones which will be recognized by ticket machines in the cinema.

“Transferred Payments with Emotional Feelings”

To provide a more ‘humanized experience’, the Alipay Wallet 7.6 allows users to use personalized icons and voice messages when transferring payments. Unlike a payment that might come across saying ‘You have received 100RMB’, users can now choose from abundant personalized icons or leave voice messages with the receiver when conducing payment transmission. This may not seem that interesting, but in China, a lot of business is conducted over instant messenger and phone chat where emoticons and electronic signals of feeling are important, it does add an interesting element. However, it should be noted that the new function only supports payments within Alipay.

Payments by Snapping Bank Payment Cards

The new Alipay Wallet has an enhanced “code scanning” function. In addition to existing scanning QR codes, bar code, tracking numbers, it offers service of scanning bank payment cards. This new function can distinguish information automatically including issuing banks, types of banks, card numbers, which make it convenient for users to transfer money. In addition, it adds function to pay off credit card bills automatically. Currently users can use Alipay Wallet to inquire credit card bills of 14 different banks. In addition, as long as the automatic payments function is active, Alipay Wallet will pay off credit card bills automatically 5 days before the deadline and will inform users by free text message.

Official Accounts

Official Accounts connects consumers directly with merchant accounts through the app for services. Basically the “Official Accounts” includes around 10 banks, such as Industrial Commercial Bank of China (ICBC), China Merchant Banks (CMC), Agriculture Bank of China (ABC) and etc; three most famous telecom operators of China Unicom, China Mobile and China Telecom; and other merchants such as, McCafe, One Foundation, hospitals etc.

Within banking accounts, Alipay Wallet offer users’ inquires into balance, inquiries on account transaction details and inquiries on bank outlets. From telecom operators’ accounts, customers can inquire their bills and alternate mobile phone packages. Moreover, Alipay Wallet’s cooperation with McCafe, hospitals and other merchants, make it convenient for customers to recoup the coupons, pre-register, register in hospitals, as well as enjoy other services.

Loading Money into single-purpose Campus Card

Another new feature of Alipay Wallet is for university students. Instead of finding a recharge machine, students can load money into their 'on-purpose' campus card directly by Alipay Wallet. There are currently around 20 universities in Beijing, Shanghai, Guangzhou and Suzhou, cooperate with Alipay for this service.

Key Thoughts

The new Alipay wallet 7.6 is an interesting development. Many of the functions make a lot of sense to just about anyone around the world - like the soundwave technology. The others, like the 'emotional payments', might seem a bit different, but are very tailored to meet the needs of the local users which has been one of Alibaba's keys to success across all of its platforms and it's where foreign players have often struggled in the past.

The most recent Bankcard Consumer Confidence Index (BCCI) in China numbers show a continuing increase in consumer confidence since March 2013. According to the data released by China UnionPay (CUP) and Xinhua News Agency, the BCCI peaked at 86.69 in September; the BCCI has stayed high level for three months. It increased 0.89 compare to the same period in 2012 which is a positive sign that the macroeconomic environment is growing steadily in China, at least in the minds of consumers.

Untangling China's Mobile Payments Ecosystem

A look at the key players and relationships in China’s mobile payments space

China’s expanding mobile payment market

By the end of 2012, there were more than 1.1 billion mobile phone users, and 360 million smartphone users in China representing both strong mobile phone penetration as well as a significant increase in smartphone penetration. With smartphones in the hands of more Chinese consumers, the mobile payment industry in China is nearing its watershed moment – as consumers increasingly use their mobile phones not only as communication devices, but payment tools.

RMB Settlement countries increased to 47

China is already the second largest economy in the world, however, RMB has really not been fully accepted as a payment currency internationally, which most view as a prerequisite to 'RMB internationalization'.

More...

China's Internet Giants and Payments

On July 6th, People’s Bank of China (PBOC) issued 27 third party payment licenses to 27 companies bringing the total of 3rd party payment licenses up to 250. What catches our attention this time is the internet giants Baidu and Sina have both obtained licenses and will focus on online payment and mobile payment as their business scope and likely planning to leverage their huge existing user base.

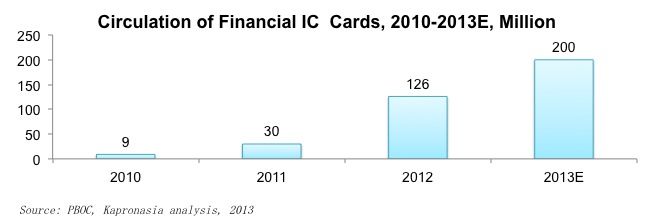

According to the specific targets for China’s EMV migration set by the PBOC, from January 1st 2015, all RMB settlement cards issued in economically advanced regions should be in the form of financial IC cards; most banks have sped up the issuance of financial IC cards since 2012.

By the end of 2012, the total circulation of IC cards exceed 100 million, growing by 320%, and right now 98% of total POS terminals and 96% of ATMs in the market have already been upgrade to support the financial IC cards. It is expected that the total number of financial IC cards in China will hit 200 million in 2013 and continuously surge to 600 million by the end of 2015.

Recently, Google managed to beat its rivals including Apple and Facebook to buy Waze, an Israeli mobile-navigation startup. Google will pay for more than $1 billion for this relatively unknown company. Similarly in China. One month ago, Alibaba, a global B2B giant, invested about $3 billion into Amap, China’s leading map and local based services provider which made Alibaba Amap’s biggest shareholder. Other China’s internet giants, Tencent and Baidu have also been focusing on their mobile map offerings.

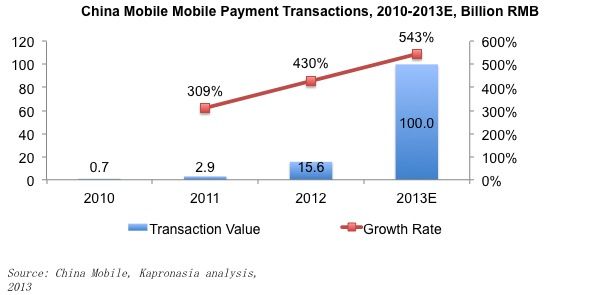

According to China Mobile, China’s largest mobile network operator, its monthly mobile payment transaction value, for the first time, exceeded 10 billion RMB, reaching 11 billion in May – even larger than the total transaction value of 2011.

Since China Mobile launched its mobile payment business in 2009, the number of transaction has rocketed at a staggering rate and it is expected that by the end of 2013 the total transaction value will hit 100 billion RMB. In the future, China Mobile will emphasize more on product innovation and customer services to reinforce its leading position in China’s mobile payment industry.