Displaying items by tag: blockchain

Why CBDCs still have limited appeal

At the Singapore FinTech Festival last week, IMF managing director Kristalina Georgieva made the case for central bank digital currencies (CBDCs) in her keynote address. She succinctly highlighted most of the key reasons central bankers like the concept of a digital fiat currency: the potential for improved financial inclusion where it is most needed, replacing cash, enhanced efficiency, speed and transparency in cross-border payments.

How will FTX’s implosion affect the crypto market in Asia Pacific?

The bigger they come, the harder they fall, especially in an industry like crypto that has rapidly become colossal yet still operates largely in the shadows. The abrupt implosion of crypto exchange FTX might be a Lehman moment, or it might be an Enron moment, or it might be something else entirely. It is hard to say at this point.

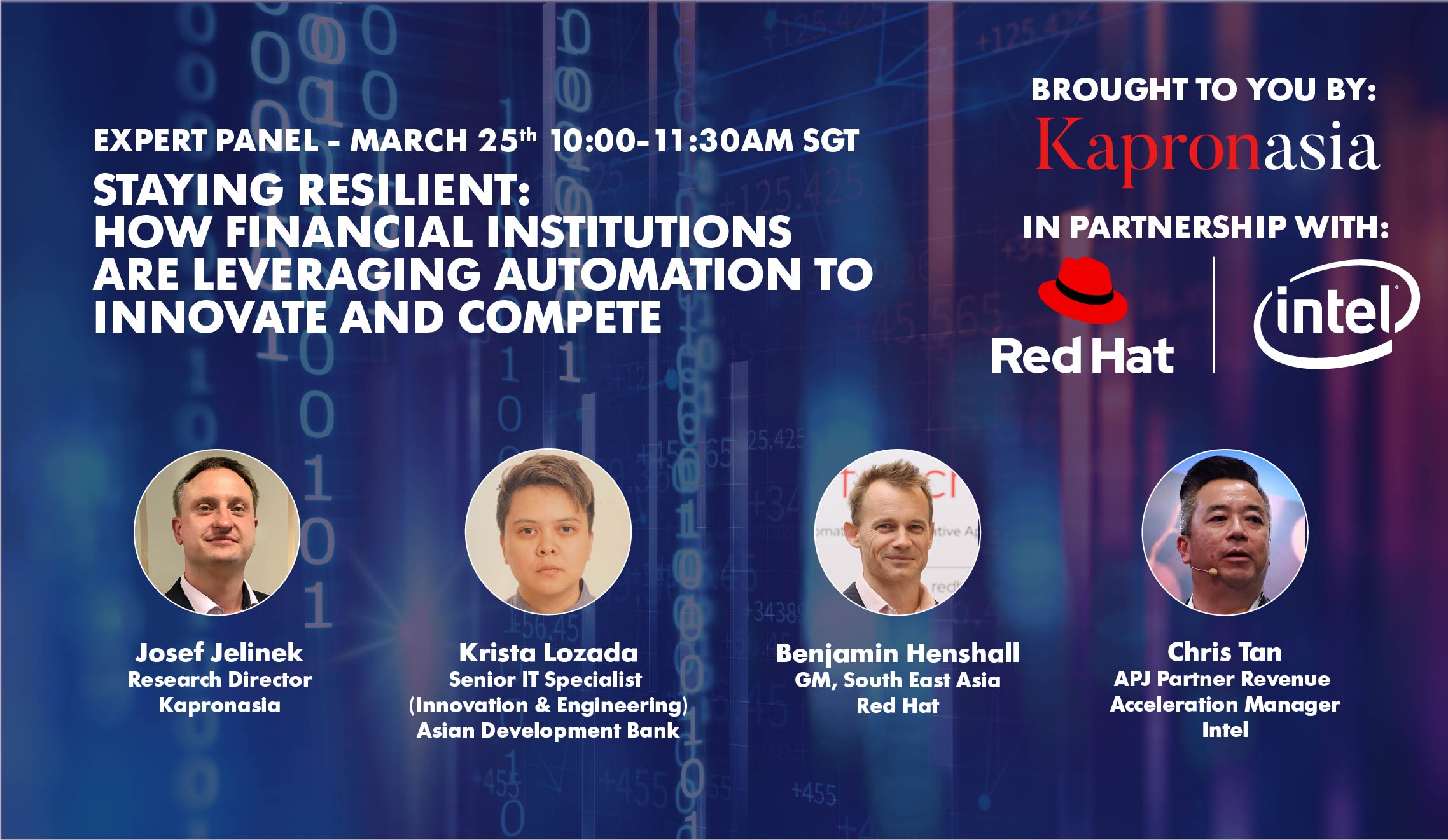

Webinar - Staying Resilient: How Financial Institutions are Leveraging Automation to Innovate and Compete

2020 Top Ten Asia Fintech Trends #4: China's digital payments giants expand across the Belt and Road

The fintech arms of Chinese internet giants Alibaba and Tencent have fought each other to a standstill in their home market. Together, Ant Financial (through its e-wallet Alipay) and WeChat Pay each hold about 90% of China's US$25 trillion mobile payments market, each with roughly an equal share. The duopoly looks stable for now.

2020 Top Ten Asia Fintech Trends #3: Blockchain with Chinese characteristics blossoms

Much like its anti-corruption campaign, China's crypto crackdown is relentless. Beijing views decentralized digital currency as a conduit for money laundering and capital flight. In contrast, Beijing sees crypto's underlying blockchain technology as useful. Blockchain can help China boost its tech prowess, improve supply-chain integrity and surmount bottlenecks across many industries, particularly financial services.

Revisiting the prospects of a digital renminbi

China has a complicated relationship with blockchain technology. Until the fall of 2017, China was the largest market for Bitcoin. But Beijing ultimately couldn't tolerate the decentralized nature of virtual currency and its utility in allowing Chinese citizens to evade capital controls, or in some cases, launder money. The ensuing crypto crackdown may turn out to be much like President Xi Jinping's anti-corruption campaign: never-ending.It's now clear that China will not allow decentralized digital currency in its financial system.

National Bank of Cambodia to harness blockchain

The National Bank of Cambodia will become one of the first banks in the world to integrate blockchain technology into its national payments system in the second half of the year. The Cambodian government aims to use distributed ledger technology to strengthen banking system efficiency and boost financial inclusion in what is still one of Asean's poorest countries.

Is China the world's blockchain leader?

China may be the only country in the world able to stamp out cryptocurrency while repurposing its underlying blockchain technology. Decentralization becomes centralized under this scenario, as private enterprises implement blockchain solutions in line with central government directives. It's a bit like the "socialist market economy." The key to success here is acceptance of seemingly contradictory principles, one of Beijing's specialties.