Although there were a number of mentions of Chinese regulators commenting on Bitcoin in the press over the past few months, it wasn’t until early December that the Chinese government officially released formal comments on the currency.

On December 5th 2013, the People’s Bank of China (PBOC) released a statement containing several comments and policies on the virtual currency, among which was one that clearly stated that Bitcoin is a “virtual commodity”, does not hold any attributes of currency and should not be used as such. We wanted to take a look at merchant acceptance after this policy was released to see how acceptance of Bitcoin for payment was affected.

How accepting are you?

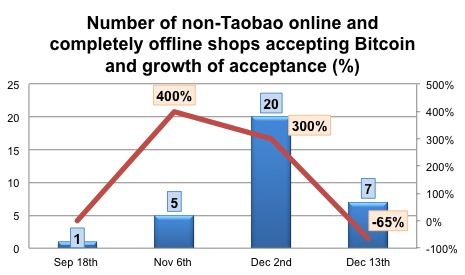

Since August, we have looked at merchant acceptance of Bitcoin in China four times including the latest time on December 13th. As the chart below illustrates, since we first started counting the number of merchants in September, and gradually, more merchants were accepting Bitcoin as payment.

What we found post-PBOC announcement is that many online and offline shops that used to support Bitcoin as a payment method are now no longer accepting it. From our research and the interviews with have had with merchants, this seems to be because of the PBOC’s comment that we mention above that Bitcoin is not a currency. Although the comment was a bit vague, this seems to have scared off some of the merchants who, like Baidu, might just be looking to avoid any potential future conflicts with regulators. However, through the research, we did find that some other shops are still confident in Bitcoin and have found alternative ways of accepting Bitcoin.

To measure merchant acceptance, we grouped merchants into two categories: Taobao (online) and other non-taobao online, off-line.

Taobao - Online

In September, when we first looked, there were only 10 merchants on Taobao accepting Bitcoin. Over the course of the next couple of months, this number increased dramatically, to almost 5 times to 56 on December 2nd. It is worth remembering that at this point, BTC China had overtaken Mt. Gox to be the world’s largest exchange and China surpassed the world with a phenomenal 150,000+ downloads of the Bitcoin wallet.

However, the PBOC’s notice on bitcoin seems to have taken a lot of the wind out of the sails. On December 13th, we went back to those 56 merchants that were accepting Bitcoin on December 2nd and asked them whether they were still accepting it. We found that the number of merchants accepting Bitcoin dropped 25%; currently on 42 Taobao merchants are accepting Bitcoin as payment.

Although this is a significant drop, the remaining 75% of the 56 original merchants are still supporting Bitcoin and were very positive about the future of the currency. Many merchants that we spoke to believed that as long as foreign countries such as America and Germany consider Bitcoin legal currency, Bitcoin will still have a positive future.

Non-Taobao Online & Offline

For the second grouping, we looked at non-Taobao online and then completely off-line merchants. They were grouped in this way as we didn’t see much difference in the acceptance rates between the two types of merchants at any of the times we checked with them. However, the reaction to the PBOC announcement was less than positive.

When we initially checked in September, we only found one merchant in this group accepting Bitcoin. Over the course of the next couple months up until December 2nd, 19 more accepted for a total of 20 merchants.

We checked with the merchants again on December 13th and found that the number dropped significantly. Just over one-third for the original 20 merchants still accepted Bitcoin. Most of the reasons we heard from the merchants were similar to the Taobao merchants: caution to avoid regulator attention. In addition, some stated that accepting Bitcoin previously was only to attract customers and actually they had not used Bitcoin in an actual transaction.

Among the 35% of merchants that still accepted Bitcoin as payment, Kapronasia found that they were relatively small merchants and because of the relative anonymity of Bitcoin transactions, as long as two parties are willing to exchange in Bitcoin, the payment functionality of Bitcoin is still feasible for them as they were unlikely to attract any regulatory attention.

Barter here than there

With the PBOC regulations stating that Bitcoin shouldn’t be used as a currency for transactions, many merchants were using the idea of bartering to explain their decisions. In other words, they were willing to exchange Bitcoins, which were previously explicitly defined by the PBOC as a virtual commodity, for some other goods, i.e. barter for them.

We strongly support this view as well and have discussed it before in our Chomping at the Bit report: there is nothing to stop a person trading a sheep for a basket of corn or some other similar physical transaction, so why should it be different here? (This email address is being protected from spambots. You need JavaScript enabled to view it. – would love to debate this point).

Will Bitcoin be home for Christmas?

In our opinion, what we are seeing in the market now is not negative, but just represents the early stages of Bitcoin merchant acceptance. Although acceptance is slowing in China because of regulation, in nearly every other country it is growing as more merchants and solution providers work to enable POS / online acceptance. The comments from China’s regulators (see our other blog entry later this week) certainly indicate caution and are surely designed to keep Bitcoin from destabilizing what is already a somewhat unstable banking system in China. In the long-term though, these views may change as understanding increases.