ICO Became Popular in Few Months’ Time

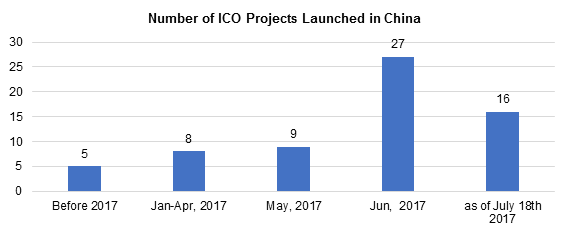

The idea of ICOs appeared in China late 2016. As blockchain became more popular, ICOs gradually came into the public’s eye and developed rapidly. The National Experts on Internet Financial Security Technology Committee issued a report on ICO Development for the first half 2017 based on their monitoring of 43 ICO related platforms. As of July 18th, 65 ICO projects had been launched, over 90% of which only accepted Bitcoins or Ethereum. The report shows that just in the first 6 months in 2017, in total RMB 2.6 billion (USD 397 million) has been raised and over 100,000 people hours of work was involved.

Source: National Committee of Experts on the Internet Financial Security Technology

The development seems cheerful for a new rising industry. However, serious problems appeared in China.

1. At least 90% of the projects are fraudulent

ICOs should be based on the issuers’ own blockchain system and actually represent a future application leveraging the new technology. But it is not the case for over 90% of the existing projects. Cryptocurrency issuers pay tens of thousands and get a whole copy of a whole set of ICO code. With a name for the coin, a catchy name, and boom, you're almost ready to go. Add in a whitepaper, a blockchain luminary for support, marketing and selling on an ICO platform, issuers are ready to get funds.

‘High and quick return’, ‘new technology’, ‘famous and rich investors’ attracted high attention. The situation became a ‘Tulip mania’ and even project without a whitepaper can get support. ICO project founder/consultant Li Xiaolai (李笑来), launched his project PressOne in July, valued at US 200 million (over 1.36 billion RMB). For such a big project, he did not even have a whitepaper, claiming that nobody would really understand the paper and trusting him was enough. Even though, he still received support from many people. Those people believed Li would bring them high return and knew little about the project, which is blind and unwise.

2. Doubts around ICO platforms

Top three ICO project launch platforms are ICOAGE, ICOINFO and ICO365. ICOINFO helped launched 22.9% of the ICO projects. But this website did not even have a clear clue of the business operator. Only an individual’s name is shown as the owner of the website, no company name, no address or contact number.

Regulation Was in the cards, but Is the ‘One-size-fits-all policy’ the Right Answer?

ICOs in China attracted a certain group of people with the returns, but there was no guarantee on information disclosure, or future details from founders. Under this circumstance, it is right to put a strict ‘pause’ to the industry.

The Chinese government took quick action this time. As stressed in the announcement, ICOs in mainland China are defined as a way to illegally raise funds. All platforms or projects were stopped right after the announcement and the whole industry was in panic. Platforms stopped trading and token prices dropped significantly.

However, this ‘One-size -fits-all Policy’ left problems. How could the investors get their original money back? How do real meaningful ICO projects survive? Also with the convenience of the internet, some ICO projects claimed that they are considering moving abroad and people can still follow their updates. It will create new challenges for the government to entirely stop ICOs, or at least slow the investment.

On the other side, with fintech development, the efficiency of financing has increased significantly. ICOs are an application of blockchain technology and provide an efficient way to raise funding. With blockchain technology underlying many of the projects, it should bring enough trust to everyone involved and finally lead to a win-win between investors and project founders. So ICOs should be a useful tool if implemented in the right way and provide a positive role in funding development.

With the current industry focus on ICOs, we will work to keep you up to date on the latest ICO news and insight.