T-bond futures are a category of mature and simple interest rate derivatives in mature western markets, which are treated as a basic tool for managing and hedging the fluctuation of treasury bills. For Chinese market, the release of T-bond futures is meaningful, as it is thought to be a sign of continued commitment to deepen China’s financial market reform and innovation.

Government Bond Futures with Chinese Characteristics

Based on CSRC’s guidance, there are four key rough guidelines or considerations surrounding the trading of T-bond futures: Firstly, traders of T-bond futures will mainly be large institutions such as commercial banks, insurance companies, securities companies, funds and other professional investment institutions, which is quite different to the current Chinese A-share market which is predominantly retail. This may be somewhat because the complexity of government bond futures might be beyond the average retail/small investor.

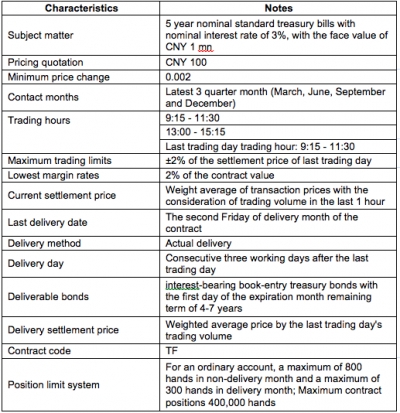

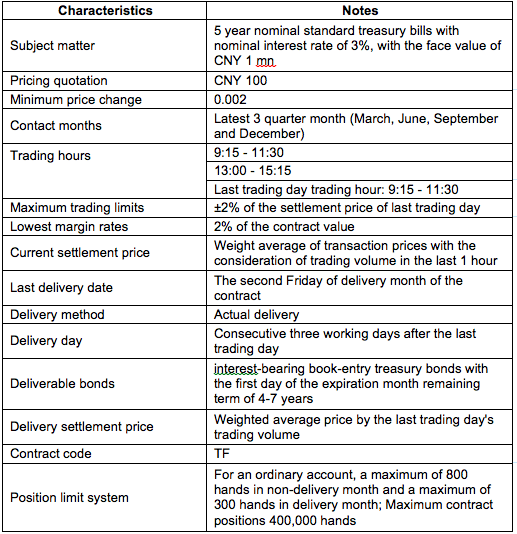

Secondly, from the perspective of daily price limits and the risk involved, the allowed fluctuation of T-bond futures’ price will be very small: for 5 year T-bond futures, the fluctuation will be restricted to +/- 2%, which is more suitable for institutional investors.

Thirdly, T-bond futures investors will consider more on the supply of underlying treasury bills, the changes in interest rate and the macro-economic trend for their analysis. Some analysts have expressed concern about the negative effect that T-bond futures might have on the stock market, CSRC claimed that the release of T-bond futures won’t affect investment in the stock market or the level of the market.

Fourthly, the margin rate of T-bond futures could be even lower than stock index futures, which means the leverage could be larger than stock index futures.

Not the first time

Actually, T-bond futures are not something new to the Chinese capital markets. The earliest trial of T-bond futures started in December, 1992 on the Shanghai Stock Exchange. However, the trial ended in May, 1995 due to some well-known over-speculation, which is called the famous ‘327’ Event, as well-known as the Chinese ‘Barings Bank’ Event.

The standard contract of 5-year T-bond futures has changed a lot to the contracts that were typical 18 years ago. For example, the face value of T-bond futures was CNY20,000 in the 1990s while the current one is CNY1mn. The trading band is also different. The T-bond futures in 1990s did not have trading band limits while the current T-bond futures have the trading band of ±2% that we mentioned above. In addition, there is position limit system for the current T-bond futures which the former system also did not have. In general, all these modifications are aiming at reducing the risk involved in T-bond futures to prevent the possible repeat of ‘327’ Event.

The table below shows some basic information of possible T-bond futures’ contract.

For investors, especially institutional investors, T-bond futures are good financial derivatives that could be important component of their portfolio to hedge risk of T-bonds that the investors may hold. And for foreign investors, although it is still not announced whether they could be allowed to participate in the trading of T-bond futures, under the current situation, it is highly likely that they might be allowed to participate through QFII and RQFII.