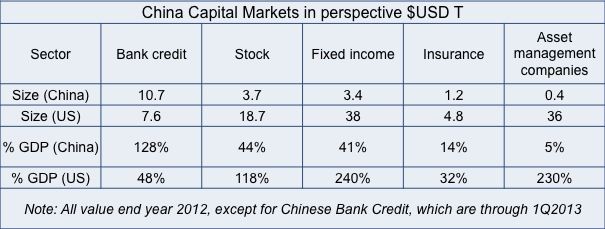

According to a 2013 publication by Goldman Sachs, there are still major differences between US and Chinese capital markets. The most prominent difference is that capital markets in the US are much larger than China’s in all sectors except for bank credit as shown in the figure below.

The Chinese banking credit sector has expanded in recent years which is now at 128% of China’s GDP compared with 48% in the US. Thus the Chinese economy is highly dependent on bank credit, which can be dangerous for the country in the coming years.

In other sectors, there are large gaps between the size of Chinese and US capital markets with the former still lagging behind the latter. Thus, there are many opportunities for China to develop its stock and fixed income markets, along with its insurance and asset management industries. Among these, the asset management industry seems to have the greatest growth potential.