The bank was accused of the underground fund transfer and money laundering via its Youhuitong product. According to a CCTV report, the product was aimed at individuals wishing to move abroad.

However, the bank was quick to point out the legality of the service, which was started after introduction of little-known pilot scheme by Guandong branch of State Administration of Foreign Exchange. The scheme allowed individuals, normally confined to RMB50 000 annual quota, to transfer money abroad for buying property and immigration purposes. Several banks were participating in the trial, including Citic Bank.

First, the product was not famous enough, if it was more famous, more individuals would use Youhuitong to transfer money abroad. Current legal ways to overcome the limit like using multiple persons’ accounts are cumbersome, illegal ways like using underground money transfer agencies are risky and often pricey.

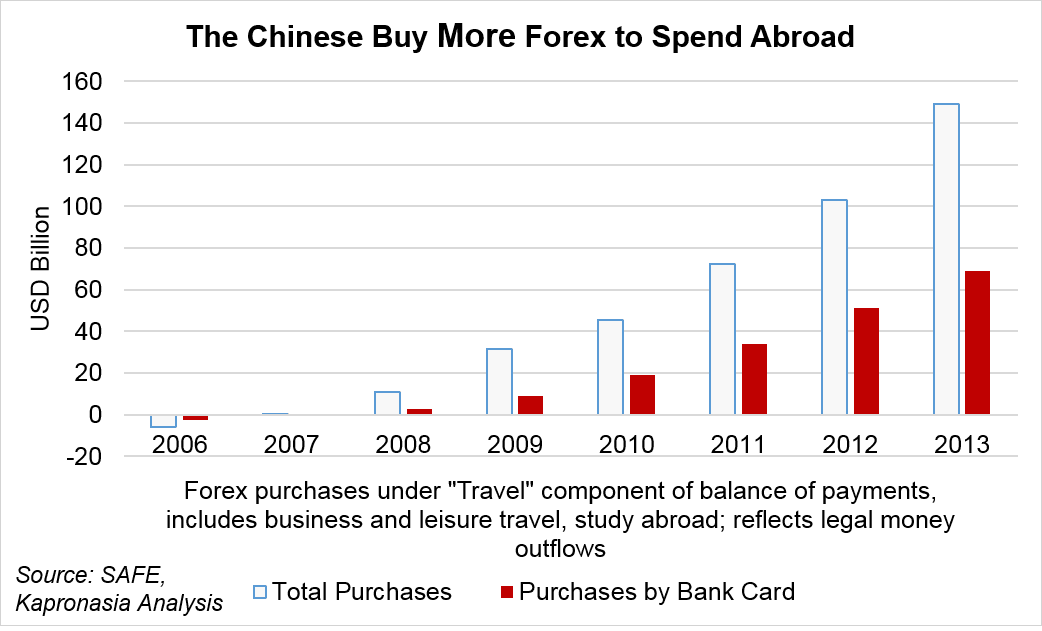

Second, the trend of Chinese capital seeping through the cracks in the dam set by State Administration of Foreign Exchange will continue. The metaphorical dam will never break, though, since the regulator will open doors slightly when it is necessary.

In our upcoming Investing Private Chinese Capital Abroad – Overview of Legal and Illegal Schemes report we talk comprehensively about all existing methods, from all-time-favorites like carrying precious artworks over the border to super high-tech tools such as cryptocurrencies.

We also talk about less exotic programs that allow domestic individuals to invest offshore, and some of them are similar to Guandong’s trial because they are quite recent. We overview more established but somewhat unpopular Qualified Domestic Institutional Investor program and the upcoming Shanghai – Hong Kong Stock Connect.

This report is the first of its kind to give an extensive coverage of all current cross-border channels available for individuals in China. If you are engaged in wealth or asset management, follow cross-border flows or in general are fascinated by various aspects of the Chinese financial system, you will find this report interesting and helpful. Please subscribe to our newsletter to get the notification once the research is published.