The move is aimed at decreasing account costs for new investors who would pay RMB 40 and RMB 50 for opening a retail account in Shanghai and Shenzhen each, respectively. After the merge, an investor will have to pay RMB 40 only to open a single account with access to both markets. Account opening fees were reduced for institutions as well.

Another benefit for investors is the convenience of trading on the two markets with the access to both bourses from the same account. From the macro perspective, capital markets will become less fragmented and will do a better job allocating funds in the economy.

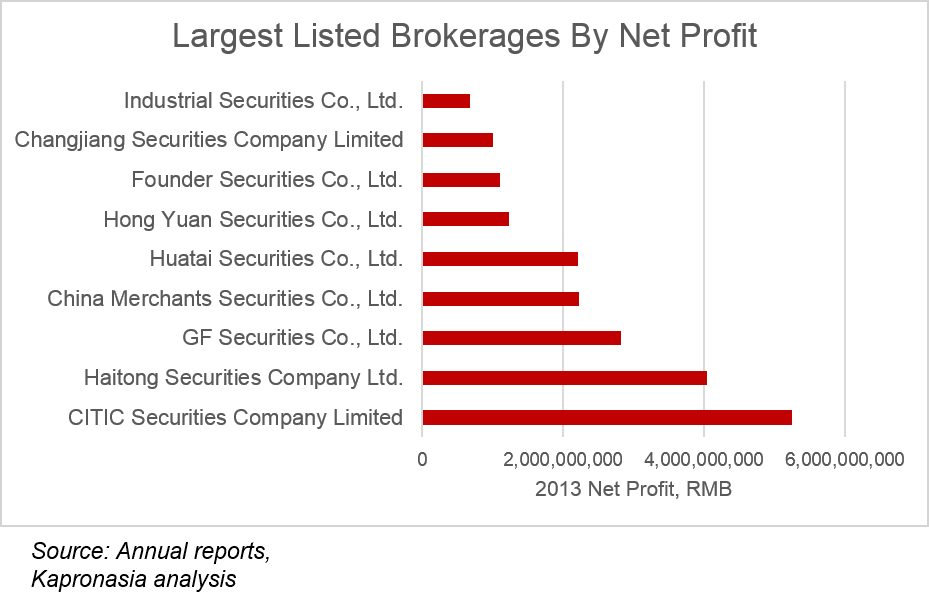

At the same time brokerages are less happy about the new system as it threatens to squeeze profit margins. Previously brokerages could differentiate themselves by offering discounted access to a specific market, but such a competitive edge will be eliminated by the new policy. As a result, investors will have more flexibility in switching between brokers. This will increase competition between securities companies and bring commission fees down and has the potential to reshape the structure of the industry. On the bright side brokers will be able to offer new cross-market products to attract investor’s money.