At this stage option contracts are limited to one asset: fund shares of the CSI 50 ETF, a fund launched by Huaxia Fund Management Company. The fund follows the CSI 50 index, comprised of 50 blue chips, with such heavyweights as ICBC, CNPC and Ping An Insurance on the list. The financial sector represents 72.6% of fund’s portfolio, reflecting the immense weight of banking stocks in the overall market. The financial sector is followed by manufacturing with a 17.4% share.

The fund has AUM of RMB 25.9 billion and its volatility is estimated to be ‘high’ by Morningstar. The combination of these factors make the fund a good choice for the underlying asset of the new option contracts. Also, the CSI 50 index exclusively follows Shanghai Stock Exchange’s stocks, eliminating additional complexity of cross-exchange registration and stock transfer.

Regulators were very cautious and set a high entrance threshold for participating investors. Individual investors must prove deployable assets of at least RMB 0.5 million and institutions must have twice as much. Also, individuals are requested to have ‘adequate experience’, including experience in margin and futures trading, as well as pass an options trading test. There are also limits on how many options each type of investor can hold and trade. These requirements are essentially China's version of an 'accredited investor' that you would expect in western markets.

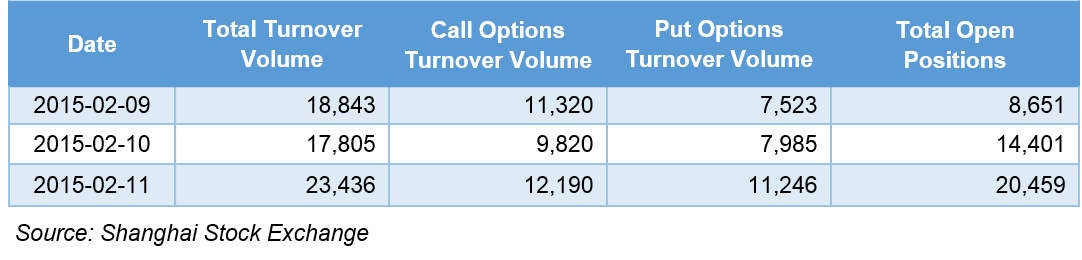

Nevertheless, there was a considerable interest in the new product, and 542 trading accounts were involved on the first day of trading, with the vast majority being accounts of individual investors (492 accounts); retail trading was, as could be expected, about 20% of all volume.

There are both put and call options on the index, four expiration dates (March, April, June and September 2015), and five classes of strike price (in-the-money, at-the-money, etc.). In total there are 40 types of tradable contracts.

Now that traders can hedge their bets on CSI 50 index and constituent stocks, what impact will this will have on the market? As options are a leveraged instrument, they can increase risk and volatility, since investors can magnify their exposure both when markets go up and down. At the same time, options enable hedging, and Chinese investors now can reduce the risk when a plunge in prices occurs. As investors feel safer at the time of bear markets, they might avoid panic-inducing sell-off behavior, which is certainly good for curbing some of the excessive volatility. More stable and efficient market is precisely the reason behind the push for innovation in financial derivatives. Options trading in China is an important step forward.