Alibaba’s online money market fund, namely Yu’e Bao, has been catching the attention of Chinese regulators as it continues to gain popularity and “suck the blood” of traditional state owned banks. No wonder; Alipay’s customers are lured to Yu’e Bao’s investment platform through higher interest rate payments than the 3% return on traditional deposit accounts. Understanding the regulatory environment and its disruptive potential surrounding this innovation will be a key element for investor’s looking to put their money into the Alibaba stock. Although technically Alipay and the Yu'e Bao product are not included in the Alibaba Holdings that was listed, Alibaba is entitled to a percentage of revenue and up-side should Alipay be bought or go public in the future.

Albeit slow, Xi Jinping’s government has shown an eagerness to liberalize the archaic and inefficient banking system and will allow the establishment of privately owned banks and free-market interest rate regimes. The Chinese state authority’s rhetoric surrounding Yu’e Bao’s money market fund has been in line with this sentiment. Zhou Xiaochuan, head of People’s Bank of China, has stated that “financial policy supports the application of technology, so it needs to the follow the footsteps of time and technology” and that “we definitely won’t ban financial products like Yu’e Bao”. President Xi himself has voiced his opinion and said that “Yu’e Bao should not be cancelled, but adequately regulated, because attacking financial innovation is an incorrect approach”. So far so good.

Yu’e Bao certainly needs some genuine state recognition if it is to become a legitimate source of money depositing. By offering higher interest rate returns than regulation allows, Yu’e Bao technically operates as a shadow bank, with no capital requirements and deposit insurance. Xi’s liberal but still very much “crossing-the-river-by-feeling-the-stones” approach toward the banking industry has paced the way for a private bank pilot programme whereby five private banks will established. Alibaba is applying for the license through its affiliated Small and Microfinancial Services Group and is among many institutions anticipating approval. If and when they are successful, remains to be seen.

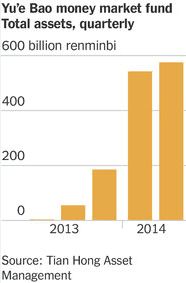

Yu’e Bao’s future strategy success is far from certain if it is to become a legitimate financial service provider. Facing competition from Tencent’s cross-product ecosystem, its own money market fund may pose a potential threat in maintaining Yu’e Bao’s impressive growth record. This may explain the loss of momentum of growth in Yu’e Bao’s 2014 second quarter AUM (see graph). In addition, a free-market interest rate regime, whereby banks set the deposit rate above the 3% hurdle to compete with money-market funds, would hurt the competitiveness of Yu’e Bao.

Yu’e Bao is still young and currently represents less than 1% of total Chinese deposits, therefore not posing a major threat to banks at the moment. However, if Yu’e Bao’s proves to be a real game-changer taking on 8%-10% of deposits, as estimated by some insiders, authorities would certainly revisit the regulatory framework surrounding this innovation. For now Yu’e Bao is here to stay.