Displaying items by tag: banking

September 16 2021

Webinar - Harnessing the power of ecosystems to create hyper-personalized customer experiences

Published in

Webinars

Published in

Webinars

Published in

Webinars

June 09 2021

Webinar - The Evolution of Capital Market Ecosystems and the Importance of Market Connectivity with ASX

Published in

Webinars

March 12 2021

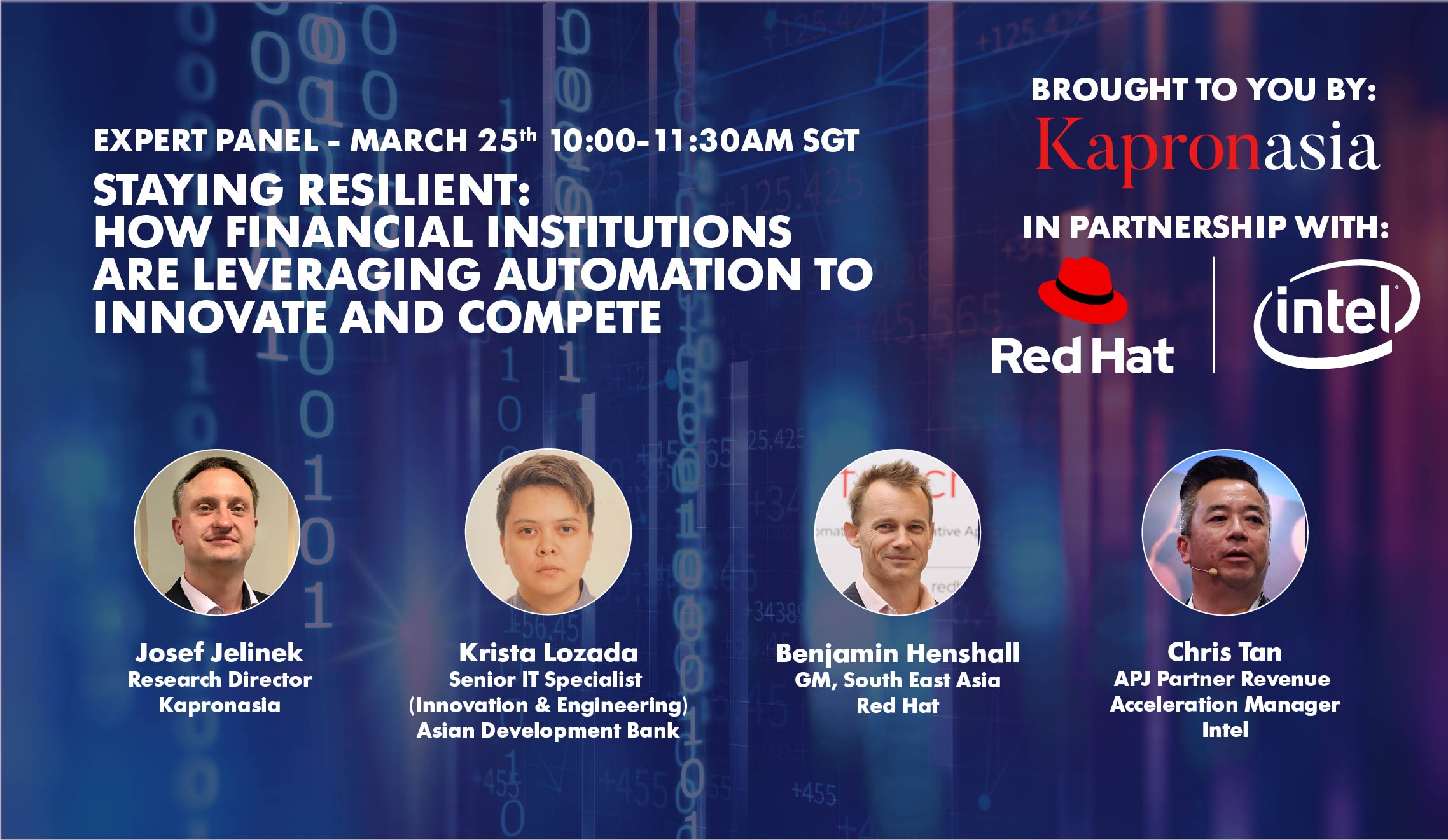

Webinar - Staying Resilient: How Financial Institutions are Leveraging Automation to Innovate and Compete

Published in

Webinars

One of the paramount challenges for banks in the 21st century is ensuring that their technology infrastructure is optimized to support their core business. For Chinese policy banks, which are venturing into different kinds of sovereign lending, and syndicated loans in particular, certain bottlenecks exist that can be more effectively surmounted by adopting distributed ledger technology (DLT) and artificial intelligence (AI).

Published in

Research Reports

May 28 2020

Leveraging Real-Time Cross-Border Payments: A report from Finastra, Accenture, and Kapronasia

The global economy is growing more interconnected and digitized. As such, there is an industry-wide consensus that revenues from cross-border payments will rise from US$144 billion in 2014 to roughly US$280 billion in 2024, driven by a surge in payment volumes.

Published in

Research Reports

©

2007 - 2024

Kapronasia