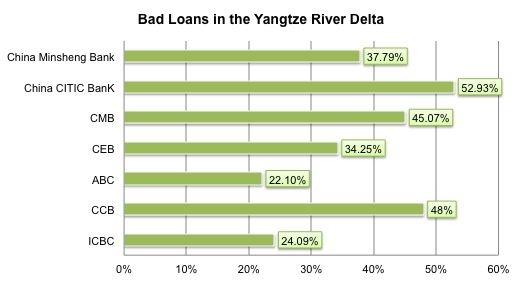

The latest 2013 annual reports from banks show that among the big five, CCB’s bad loan ratio reached 49%; and the joint-stock commercial bank CITIC even hit 52.93%.

As the Yangtze river region is the economic center for manufacturing and iron & steel. We think the higher bad loans are likely due to a slow down in manufacturing development and excess capacity in iron & steel. As the risks of excessive capacity in iron & steel being exposed, they are also moving into the value chain to segments such as copper, ship building, etc.. We estimate that the higher bad loans ratio in the Yangtze River Delta will continue in 2014.

As a result, there may be new opportunities for capital markets software providers here in China.