Chinese payment providers too risky

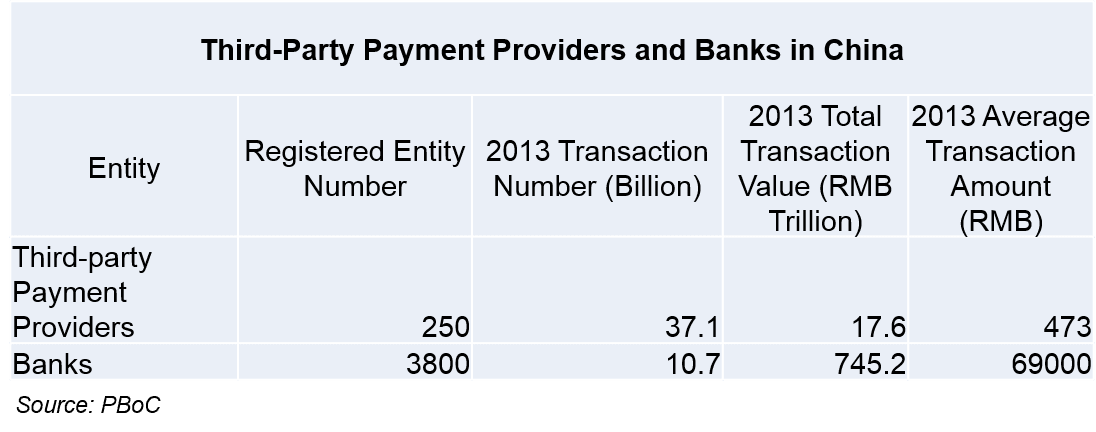

Said Mr. Li Xiaofeng at a conference organized by securities companies in September. “Third-party payment providers have not entered PBoC’s clearing system, are not able to provide national settlement, and each transaction is bilateral in nature, therefore involves higher risk than in traditional bank payment.” According to Mr. Li Xiaofeng’s statement, such companies need to apply for banking license to provide high-value payments and will remain “supplementary” without such a license.

Banks given priority

The statement hints at PBoC’s current thinking on the desirable structure of payment industry of China. Alipay, China’s most successful 3rd-party payment provider, has had phenomenal growth in consumer payments in recent years thanks to its constant innovation, smart marketing and customer-oriented service. Apparently, this became a concern for the banks who dominate the national financial system. While these banks don’t have the advantages of more agile 3rd-party payment providers, they often are on good terms with the government.

It is yet to be determined who will win in the battle for consumer’s hearts and payment fees. It seems like Mr. Li Xiaofeng’s comment represents the general sentiment in the PBoC, which will give more support to the banks and probably impede third-party payment companies’ growth as the regulator did with QR code payment suspension and inhibiting guidelines earlier this year. At the same time, market forces are also very strong in China, and consumers will continue to choose services for what they often value most: user-friendly interface, great customer support and new exciting products. However, it may prove challenging for Chinese payment providers to get an even larger market share and to encroach on the corporate payments market.