The main rationale behind the new rule is account security. After analyzing a number of the fraud cases related to personal payment and settlement, the government feels it necessary to guide the use of bank accounts. Under the new rule, one person can only open one Category 1 Account in the same bank where the individual can then store his/her main income, such as salary, and savings in a physical bank card or passbook. The guidance also suggests individuals can use this account for access to cash, high-value transactions, and investment.

The category 2 account is designed for everyday consumption, internet shopping, and online payment, etc.. These transactions are normally more frequent and lower value. When opening a Category 2 Account, the depositor will get a digital account as well as a physical bank card.

Finally, a category 3 account is more suitable for mobile payment services with new technology, for example, ApplePay, Sumsung Pay, and other small amount non-password transactions. In addition, customers will not get a related bank card with Category Ⅲ Account. All the information will be digital.

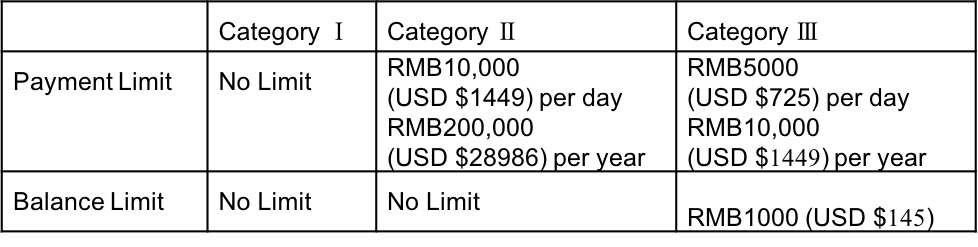

PBOC is also trying to control the payment risk by assigning three accounts with different limits under the new rule:

In general, the new rule shows government’s effort in adjusting with new trend of financial services such as digital payments. At the same time, the PBOC also focuses on how to minimize the risk. To most of us, people may worry about their existing bank accounts. For example, some people may already have more than one Category 1 Account at the same bank. Will they need to cancel the extra accounts or bank cards? The worry is unnecessary. The new rule only applies to newly set up bank accounts, which means the existing accounts will not be influenced.