According to Hong Kong government statistics, there have been an increasing number of Mainland Chinese purchasing life insurance policies for the sole purpose of cashing out and transferring their funds into USD or HKD. HKD21.1 billion worth of new policies were underwritten from January until September last year which represents almost a quarter (21.7%) of all new policy sales. In contrast to 2009, premiums underwritten were around HK$3 billion or 6.4 per cent of all new policy sales.

With such stringent regulations set by the Chinese government, how could Mainland Chinese possibly avoid such barriers for capital outflows you ask? Well, we should all know that money always finds a way out of the country. Mainland Chinese could effectively visit insurers in HK and use their China Union Pay cards to purchase policies typically for USD50,000 - but ranging up to and over USD1 million. After purchasing the policy, Chinese clients can then effectively cash out and send the money to any nominated destination of their choosing - all being within the bounds of the regulations in China and Hong Kong.

Of course, there are a variety of other benefits with having life insurance policy in Hong Kong rather than simply hedging against the possible further devaluation of the Yuan. Life insurance policies underwritten in Hong Kong cannot be seized by mainland Chinese authorities if the citizen in question becomes bankrupt or faces criminal proceedings. Thus, this makes the policies highly secure mechanisms for transferring over $50,000 worth of RMB wealth outside of China. Furthermore, in the instance where the policyholder dies, their chosen beneficiary is still entitled to the full insurance policy after death. It is no wonder why Hong Kong attracts an excessive volume of wealthy Chinese citizens who wish to secure the safety of their capital across the border.

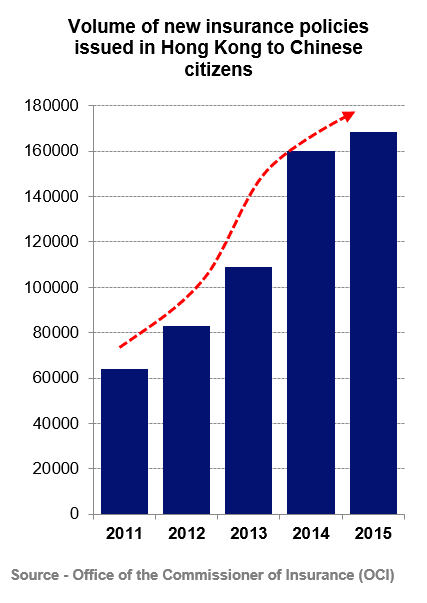

This method of RMB outflow has been a direct contributor to the dramatic rise in number of new insurance policies being issued to Mainland Chinese visitors. Data from the Office of the Commissioner of Insurance (OCI) indicates around 168,000 new policies issued to Mainland Chinese - an approximate 160% jump since 2011.

Along with the Mainland Chinese wishing to cash out their RMB wealth for justified and lawful reasons, this also brings the illegitimate aspects of money laundering to light. A Hong Kong based life-insurance policy has become the unlikely channel for money-laundering and is consequently causing detrimental effects to the stock price of a number of Hong Kong insurers.

As a result of these developments, Hong Kong insurance companies have suffered and their stock prices have consequently taken the initial impact. It is expected that even with UnionPay’s attempts to curb the purchases of insurance policies, that Mainland Chinese will still be able to maneuver themselves around this loophole by making multiple transactions at USD5,000 since the restriction only applies to each transaction. It seems that UnionPay’s efforts may not be as strict as they appear.