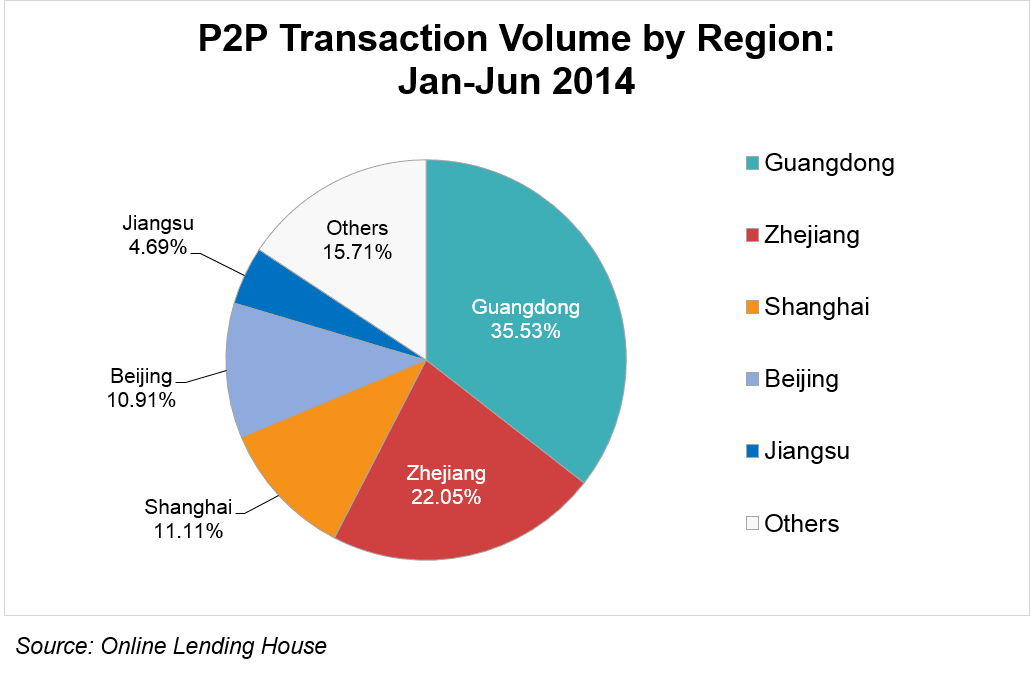

These five growth drivers contribute 84.29% of total volume. The largest contributor is Guangdong, with approximately RMB 29 billion in P2P transactions, or 35.53% of total. The second is Zhejiang, with 22.05%.

It is not surprising that these five became the dynamic regions are driving Chinese P2P lending growth. As known, P2P lending falls into the field of internet finance, which requires capital and talent for its development; precisely these five regions have the most developed finance industry in China. In addition, companies served by P2P lending platforms are mainly small, medium and micro enterprises (SMEs). After years of astounding economic development, Pearl and Yangtze River deltas have very advanced private economies along with SMEs. Many of these enterprises need funds urgently and are long accustomed to private lending.

In our upcoming P2P Platforms in China report we do a comprehensive review of existing P2P business models, regulation, trends and analyse how the new internet phenomenon fits into Chinese finance industry.