Government debt in China

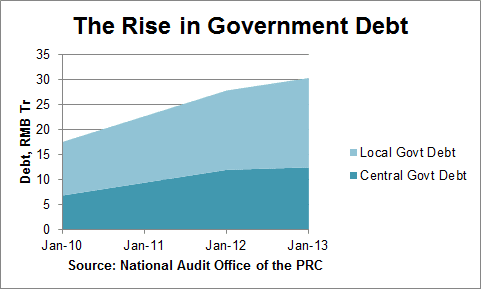

Private debt is only a tip of the iceberg. Government debt in China is very high and the number of loans is considerable and rising. Especially fast growth in debt was withing local governments, which are not allowed to issue bonds themselves, but do that via companies that they own.

However, we believe a massive debt unwinding will come in the next few years. While the politicians may allow a company here and there to default in order to show that risky borrowing is not encouraged, the stability-focused government will be quick to support any company whose collapse might have a systemic risk. In our view any necessary measures will be taken to prevent a full-blown crisis. We are more likely so see a Japanese-style restructuring with a decade or more of a slow dissolving of the debt excesses.