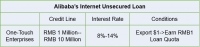

The purpose is to provide unsecured loans for small- and medium-sized enterprises (SMEs) engaged in foreign trade. Such companies have long bene leveraging Alibaba’s globally recognized international trade platform to reach overseas clients. With the new service, banks utilize the financial data from Alibaba’s One-Touch, a service platform for foreign trade SMEs, and then issue unsecured loans. It is said that the maximum credit line offered by banks for One-Touch enterprises is RMB 10 million.

As known, the “financing deficit” among SMEs in China has become a significant issue in recent years. At the same time, banks find it hard to access operational data for many SMEs that are willing to borrow. Thus, the new product was well-received by experts and industry players. We think this is a win-win cooperation, where banks not only will build up SME client base but also will learn how to work with big data. Alibaba, which is starting its own private bank this year, will accumulate experience in lending business.