China Banking Research

How Chinese companies are about to roll a Trojan dragon of innovation into global banking markets…in the year of the horse

For decades, China has been known as the imitator and not the innovator. The argument goes that the West came up with social networking, mobile payments, group-buying, etc. and China imitated it, sometimes better, sometimes worse. C2C – copy to China. R&D – rob and duplicate. There are numerous terms to describe it.

China's Tier 2 Banks Expansion Challenges

After 18 years of economic development, China’s Tier 2 Banks, mainly city commercial banks, are growing to fill a gap in-between state-owned banks, and rural commercial banks. As part of their growth, many city commercial banks are attempting to expand their branches in other regions, however, the Chinese Banking Regulatory Committee (CBRC) regulations are, in certain cases, holding them back.

The recent tight regulation regarding supra-regional city commercial banks is largely the result of increasing internal fraud cases in city commercial banks such as Qilu Bank and Hankou Bank. The good news is that the CBRC is not prohibiting city commercial banks from expanding supra-regionally. Instead, the approval process is just longer and the standard of regulatory evaluation indicators such as asset scale, capital adequacy ratio, profit margin, and non-performing loan ratios are higher than before. In this case, if city commercial banks attempt to expand outlets in other regions, they need to enhance their internal control and risk management abilities above the required standard.

Because the asset scale and business model vary based on the local economies in each city, the evaluation regulation will be different. If the investment in other regions is excessive, the CBRC will require a higher capital adequacy ratio; if the risk management does not match the fast growing asset scale, the CBRC will restrict the expansion of these city commercial banks. Thus, regulators support supra-regional expansion if the tier 2 banks meet the entire set of regulatory requirements.

China’s tier two banks are some of the more dynamic banks in China in terms of business models and innovation – they have had to be in order to compete with their larger counterparts that typically have much larger deposit bases and distribution networks.

The tier-2 banks are still focused on expanding their asset base and while supra-regional expansion will help them accomplish this, it is not the ultimate goal of the banks, at least not in the near future. The regulations do serve a valuable purpose to ensure that banks’ expansion is based on quality assets and business practices.

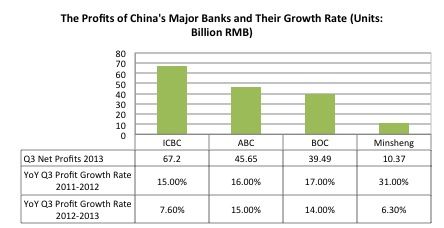

Net profits at China's major banks face interest rate pressure

As fixed interest rates in China start to loosen up, banks' bottom lines are starting to feel the pressure. According to the latest figures from China major banks’ annual reports, the net profits of China Mingsheng Banking Corp.(Minsheng), Industrial & Commercial Bank of China Ltd.,(ICBC), Bank of China Ltd. (BOC) and Agricultural Bank of China (ABC) in the third quarter 2013 shrank on a YOY base.

As shown in the graph below, the net profits growth rate of Minsheng, a relatively smaller bank, dropped dramatically almost 25% comparing with the same period last year, likely due to its relatively large interbank business, which was heavily affected by high interest rates in the middle of June. The high interest rates in China also had a big impact on ICBC. The banks' profitability growth rate dropped to around 7.5%.

Drivers of Supra-regional expansion in Asia

To a large extent, Asian banks are in a somewhat enviable position. China is certainly the economic giant of the region, and if China’s economy slows, it does have knock-on effects, yet, the economies of individual countries in Asia, while interdependent, often expand and contract quite independently. This can mean a bank facing slower growth in Indonesia, might look to the Philippines or Malaysia for expansion.

Event summary: Battle of the Quants Shanghai

Kapronasia attended the Battle of Quants Shanghai event on Nov. 13, 2013 in the newly launched Hongkou hedge fund park in Shanghai, China. There were two main topics that we discussed at the event: Chinese traders’ demands for trading platforms and key success factors for China's further economic reform.

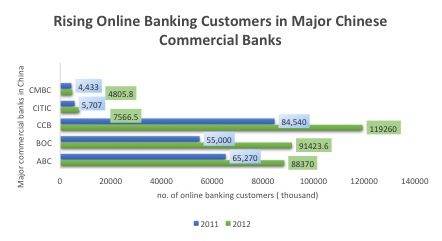

The Role of Online Banking in Asia

Over the past 3 years, online banking in Asia has been growing rapidly. A recent survey indicates that the usage of Internet banking has increased by 28% across Asia in the past five years, and the frequency of online banking usage actually surpassed branch banking in 2012, meaning that people in Asia access their account more online today than they do in person.

In China, there are over 650 million registered online banking customers in the 11 listed Chinese banks, and the combined online transaction volume represents over 60% of total transactions. Systems have matured to keep pace; not only do they provide scalability to deal with the increased transaction volume, but offer increased functionality for online banking in China customers.

In the densely populated areas like Singapore, Taiwan, and India, internet banking makes doing your banking less time consuming. Ten years ago, you may have had to wait hours in your bank to do simple transactions; today, customers can pay bills, transfer money, and even purchase investment products online rather than waiting in a crowded line.

Source: Cebnet, 2013

Although internet banking usage in Asia is high overall, individual countries have varied levels of online banking development. Among all the Asian countries, online banking penetration is particularly low in Indonesia, the Philippines, and Vietnam, although there are signs of growth.

Online banking usage has started to grow rapidly in Indonesia since 2010, yet, of the 55 million Internet users, about 25% of the population, only 7% of these internet users actually do online banking, which indicates online banking is still relatively underdeveloped in Indonesia. Enhancements in the mobile online banking platforms including better security and ease of use, may help the industry attract more users and increase market penetration.

With the rapid modernization of companies, infrastructure and overall economies in Asia, Online banking in Asiawill continually show a steady growing trend in the next few years because it plays an important role by sharing the operational burden from branches, and provides more efficient service for customers. The current growing trend also predicts that online banking is slowly making branches less important, and its popularity will increase dramatically in the near future in Asia.

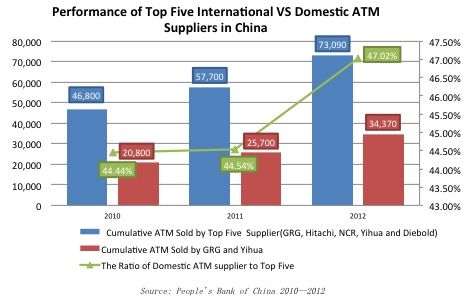

Chinese ATM Manufacturers continue to gain domestically

According to the latest figures from the People's Bank of China, the aggregate number of ATMs sold by top five international suppliers, including GRG, Hitachi, NCR, Yihua and Diebold, increased dramatically from 46,800 ATMs sold in 2010 to 73,090 sold in 2012, a roughly 56% growth.

What is interesting though is that the sales performance of Chinese ATM manufacturers including GRG and Yihua, has also been robust as well and in fact taking a larger percentage of overall ATM sales in mainland China. With a 20%+ increase year by year, Chinese ATM manufacturers have increased sales from 20,800 ATMs in 2010 significantly to 34,370 ATMs in 2012, a nearly 65% increase in 2 years. This is also reflected in the % of domestic ATMs sold as compared to the whole, which went from 44.44% in 2010 to 47.02% in 2012.

As the Chinese government starts encouraging the purchase of domestic ATMs, GRG and Yihua will likely continue to gain market share in the next few years to the detriment of the international players.

Should international banks move into The Pilot Shanghai FTZ?

Over the past few weeks, the Shanghai Free Trade Zone (FTZ) has captured business headlines here in China and abroad as discussion continues about the impact that the zone will have on reform in China. As of October 30th, 208 companies have registered in the zone in just under one month, notably 36 in the asset management sector.

One of the early announcments was the commitment from Citibank and DBS to enter the zone. When we initially heard that these banks were so committed, we were a bit skeptical. Often foreign companies in China support government programs to better their relationship with the government. However, in the past couple of weeks, we have changed our view.

The FTZ itself, although the future reforms are somewhat unclear, will open up a number of immediate near-term opportunities for international banks in the shanghai free trade zone. These opportunities primarily revolve around non-reform related products and services:

Chinese Yuan / RMB fungibility – One of the key aspects of the zone will be what happens to Chinese Yuan (also known as RMB) fungibility or the ability to exchange RMB freely for other foreign currencies. Although it is a bit unclear exactly what exchange will be possible, the feeling is that some reforms to help open up convertibility will happen. At a minimum, a RMB system somewhat similar to the Hong Kong CNH where the RMB currency is held offshore and is essentially treated as a completely separate currency – although still limited by exchange restrictions.

Trade – Interestingly, although this is a fairly obvious one, as the Shanghai Pilot FTZ is currently setup somewhat like a mini-HK or offshore port, trade services for companies setup in the FTZ will either need to come from international banks within the FTZ or overseas banks. So if you think about this, currently, if you are a manufacturer in China, you would likely either be using a domestic bank or the domestic branch of a foreign bank for LCs, Loans, Bank Guarantees, etc.. If you are a manufacturer in the free trade zone however, you will need to have a bank either also in the free trade zone or overseas as the FTZ is essentially an offshore market.

Interest rate exposure – As a few industry experts have pointed out, interest rates in the FTZ do not have to necessarily be the same as those outside of the zone. While this may bring some somewhat challenging issues for corporates who are setting up in the zone to manage interest rate risk both in the zone and outside, it does offer banks an opportunity to provide interest rate related services and risk management tools to the corporates they serve in the zone. It will take some time before we can really determine what these might be, but certainly will be an opportunity.

Experience with reforms – Finally, by being in the zone, banks will learn through first hand experience how any reforms will change their industry. Although there is some debate as to how lined up the Chinese government is behind real reform, especially with the November plenary on the near horizon, but certainly any of the near-term reform will happen in the Shanghai FTZ at least as a test and then for further roll-out through-out the country. Banks that are there now will be able to test and try reform.

Good relations and good opportunities

So overall, it would be remiss to say that banks and companies like Microsoft, Citi and DBS are not entering the zone to better their relationships with the government, there certainly is some of that involved in their decision-making process. It is also clear that first movers will likely have better advantages in the long-term. What the examples above do show as well is that there are additional product and service opportunities for banks in what will be a relatively open and uncompetitive market – at least in the short term.

Shanghai’s Free Trade Zone: What should your strategy be?

Few initiatives in the past couple of years have captured the attention of China’s financial services community more than the recently opened Shanghai Free Trade Zone. Situated in the eastern part of Shanghai and encompassing 29km2 of land which, like the rest of Pudong, was all farmland as little as ten years ago.

Opportunities for Foreign Banks in China

In a heavily regulated market like China, it’s easy to point out what can’t be done, but sometimes difficult to identify what can be. Many banks look at the market and see it as being too difficult or as you might say in Chinese ‘mafan’ or troublesome. It is easy to look at any industry in China being like this, but what’s critical in the market is to find a unique opportunity and take advantage of it. For western banks, that could be the slow but steady internationalization of the RMB.

More...

Chinese Shadow banking AUM reached a new high at the end of 2012

According to the figures from Chinese Academy of Social Sciences’ ‘Chinese financial industry supervision report’, the official figures show the shadow banking industry reached an AUM at the end of 2012 of about CNY14.6tn, but other research shows that the actual market is much larger, about CNY20.5tn. The number is so large that it even takes 40% of GDP according to the numbers and 2013 is expected to be even higher.

The shadow banking system in China is not sufficiently regulated and often many of the products created are carry high risks which are not explained clearly to the investors. In general, a more regulated shadow banking system should be beneficial to the banks and investors in long-run. If the current issues were not solved effectively, then the dramatic volume increase could be a financial time bomb that might severely damage the Chinese economy and financial stability.

|

Year 2012 |

Scale of Chinese shadow banking (CNYtn) |

Proportion of GDP |

Proportion of total asset of banking industry |

|

Official data |

14.6 |

29% |

11% |

|

Actual Market |

20.5 |

40% |

16% |

Strategy and Positioning of Supra-regional Banks

Although the Asian banking market presents a tremendous opportunity for banks, it is also increasingly competitive as smaller banks grow and innovate to compete against their large rivals. This competition, coupled with slowing growth in many countries is pushing large domestic banks to start looking abroad outside of their home countries. China’s Industrial Commercial Bank of China (ICBC), Hong Kong’s Bank of East Asia (BEA) and Singapore’s Oversea-Chinese Banking Corporation (OCBC) are great examples of domestic heavyweights who are rapidly expanding across the region.

So the reasons for expanding are fairly clear, but what about the strategies? How are banks able to justify expansion, at least in the short-term? If we look historically, many of the Japanese banks that initially expanded overseas in the 1970s and 1980s for access to deals as their customers moved abroad; we’re seeing much of the same trend today.

Although the Chinese banks started expanding for access to new f/x markets, but are increasingly following their Chinese customers as those firms also expand to ‘escape’ domestic competition and slowing demand in their home markets.

Facing almost the opposite problem, Taiwanese banks have been eager to enter the mainland China market for nearly a decade as their domestic market is relatively small and very saturated. Yet, similarly to Chinese banks, Taiwanese banks are looking to first enter the market to support their domestic customers who are represented by some of the largest manufacturers in the world like Foxcon, makers of most of the world’s iphones.

So following existing customers into new markets seems to be a good strategy to enter a new market, but what about positioning and expanding once you get there? That is actually where the challenge lies and where both supra-regional banks and global banks often struggle. How do you differentiate? How do you position your product?

Using China as an example, regulations on banking products and services for foreign banks are pretty controlled which doesn’t leave much scope to compete or innovate in terms of product scope or breadth, but where we have seen banks be more successful is looking at different underserved markets like rural banking.

BEA and HSBC in particular have been working with the government and regulators to follow the ‘go west’ policy and tap those new markets. Although the jury is still out on whether the strategy will be successful, it has helped the banks better their relationships with key stakeholders like the regulators and has positioned the two banks differently in the market.

How about you? What have you seen work in Asia? What are banks doing to successfully compete outside their home country?

This blog is part of the Oracle / Kapronasia series on Future Finance. For more information, please visit the Future Finance blog at here.

Hidden Risks in Mobile Banking: how are you overcoming them?

According to a user survey on mobile banking security conducted by the CFCA (Communications Fraud Control Association), users’ assessment of how safe mobile banking is has really not changed since 2010. But are the users’ security concerns valid or do they arise from a lack of understanding of how mobile banking works? Perhaps even more so than mobile payments, mobile banking seems to provoke more worries as it seems more closely attached to their banking accounts; no one wants to the risk before they understand how it works.

There is some validity to the concerns. Although mobile banking accounts and nearly all phones have passwords, they still cannot stop professional fraudsters. According to the Internet Security Report by Symantec, attacks on mobile phones have been increasing in recent years. Mobile hackers are possibly targeting users’ financial and personal information. With increased use of mobile financial services, banks will need to devote more effort in in eliminating these threats and customer concerns.

This is even more the case in Asia where mobile phone penetration is increasing faster than anywhere else in the world and millions of individuals are becoming ‘banked’ via mobile banking services. Although the region has pockets of very sophisticated and mature user bases, there are millions of rural users who may never have had a phone before much less mobile banking products and services.

In a fraud example that we found in China, one mobile banking user in China found 40,000 RMB (~US$6,700) missing from her bank account. An investigation with the bank revealed that someone used her phone number to report a lost mobile phone. After receiving her phone number, the fraudster transferred all of her deposits out of her account by using her mobile banking service.

Unfortunately these few examples of fraud stand out much more in the press and in consumers minds more than many examples of successful transactions. We have seen financial institutions put education programs in place as well as implementing new more secure versions of their mobile banking software.

But what have you seen? What ways have you seen Asian banks mitigate risk and security concerns and still drive consumer adoption?

This blog is part of the Oracle / Kapronasia series on Future Finance. For more information, please visit the Future Finance blog at here.

Self Service Innovation in Asia: Little changes, big impact

Many countries in Asia have been traditionally cash and brick focused: customers have been used to holding and using physical cash and visiting the brick and mortar branches. That’s changing rapidly as competitive pressures and demands from an increasingly sophisticated customer base are driving banks to create a new normal in both business model and customer interaction. A key part of that transformation will come from self-service innovation, yet self-service means different things in different countries.

In Japan, regular bank ATMs actually have limited hours of service both during the week and on the weekends. Historically this has been down to increased costs in terms of security / safety of both the machines and people and less demand from customers outside of normal business hours, especially in rural areas.

A certain subset of Japanese customers however, have, over the years, increasingly looked for “Anytime, anywhere” banking services. In early 2007, Japanese Seven bank brought ATMs into Japanese 7-Eleven convenience stores; the integration was made easier by the fact that 7-Eleven stores and Seven Bank itself are both owned by Ito Yokado. Japan actually has the largest absolute number of 7-Eleven stores in the world so now customers can withdraw money any time of day or night with their debit and credit card in more than 18,000 ATMs installed in 7-Eleven stores in Japan.

These ATMs also process remittances from Japan to other countries allowing Seven bank’s customers to send money nearly anywhere in the world, at any time of the day. It provides a convenient cash service for their customers and also satisfies their remittance needs, which means a more satisfied customer and bank.

ATMs in China have never had challenges of hours as most of them, unless they run out of cash, run 24/7 in nearly all locations. What has changed is the functionality. 10 years ago if you wanted to transfer money from one person to another, you faced a potentially hour plus wait at your local bank branch and many times had to transact in cash unless you wanted to go through the paper work.

Today you can use a Chinese ATM to directly pay anyone who has an account with that bank. Further, even if you don’t know their account number, you can even input their mobile phone number if it is associated with the account.

Although many of the changes in self-service aren’t major, they are tailored to the local customers and what might be an issue in one geography might not be in another. They can also result in increased revenue, such as the surcharge on out of hours transactions at the 7-Elevens in Japan, and decreased costs, such as fewer branch visits in China’s case, but they aren’t one size fits all.

Many financial institutions have come to Asia with this ‘one size fits all’ mentality and really struggled to gain market share and drive business. Not having the right mix can result in decreased revenue and incredible costs from poor strategies, but can also alienate customers which gives the bank a different problem: not how to move customers to self-service, but even how to have customers in the first place.

This blog is part of the Oracle / Kapronasia series on Future Finance. For more information, please visit the Future Finance blog at here.