China Banking Research

This past weekend Alibaba and Baidu met with the People's Bank of China (PBOC) in a closed door session to discuss the ongoing challenges with Chinese online finance regulation. The fact that the regulators are consulting with the industry is a great sign that the regulations will (hopefully) be built on consultation and discussion, and as both Baidu and Alibaba have intentions of setting up their own private banks, it's likely in their best interest to sit down with the regulators as well.

RMB/USD spot fluctuation range increase to ±2%

On March 15, 2014, the PBOC announced that the daily RMB/USD exchange rate float range in the Chinese interbank market would increase to ±2%, which will be implemented on March 17. The chart below shows the expansion of fluctuation range for RMB/USD spot, which is meaningful to Chinese FX market.

Analysts from Kapronasia believe that it is an important step towards fully internationalization of RMB. The data below also illustrate that Chinese government is accelerating the process of internationalization of RMB. We are looking forward to further FX market reform, in the Shanghai Pilot Free Trade Zone, or in the whole country in 2014.

Chinese banks start to push back against money funds

Over the past week news headlines have been awash with how Chinese banks are pushing back against Alibaba's Yuebao and Laicitong as the online finance products have rapidly grown their AUM at the expense of bank deposits. The banks now are expanding their push though and are challenging money funds' market share in China.

In another foray from the Internet giant into high finance, Alibaba recently announced that one million virtual credit cards will be issued next week.

File under: 'another bank losing out to money funds', but numbers from Ping An Bank show just how difficult things are getting for banks in China.

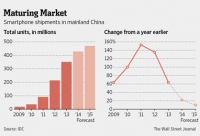

China's smartphone market might be maturing

An interesting graphic from IDC and WSJ looks at the declining growth rate in smartphone sales in China. China's smartphone market is maturing.

Money funds in China have been around for a long time with the first launched just over a decade ago in 2003. For the most part, these funds existed in relative harmony with the banking industry and occupied a small niche in the investment market. However, the emergence of Yuebao in 2013 started to change that. Money funds have now grown significantly in prominence and present an increasing threat to traditional banking services.

China banking net interest margin continuing to increase

The latest figures from the China Banking Regulatory Commission (CBRC) shows that China commercial banks’ deposit net interest margin has been increasing from 2.57% in 2013Q1 to 2.68% in 2013Q4, despite of the pressure from the interest rate liberalization.

Get paid to ride Taxis in China

The Basics

If you haven’t been following Chinese online finance innovation industry, here’s a quick brief: leveraging mainly underlying high-yield interbank deposits as assets, China’s main internet giants including Tencent, Alibaba and Baidu have launched online finance products where users can quickly and easily move money out of their banks accounts onto these platforms. Tencent uses their nearly ubiquitous Wechat app as the main user interface which Alibaba uses their Alipay platform to distribute the products; the underlying funds are managed by an external asset manager.

The typical returns of Chinese online finance innovations are between 5-8% and greatly eclipse traditional bank deposits, which yield less than 1%. With this kind of return, it’s not surprising that consumers are moving assets over to the platforms at an astonishing rate with some funds accumulating over 400 billion RMB (~US$66B) in AUM in less than a year making the asset managers some of the largest in China.

At the same time, taxi booking apps are growing incredibly rapidly in in China’s eastern coastal cities – some with the support of the internet giants as well. Over US$40 million of investment has gone into the taxi booking apps over the past two years and it’s not uncommon to ride in a taxi where the driver will have 3-4 phones all running the apps on his/her dashboard.

Bring it together

A key part of the internet giants’ strategy has been to bring everything together in one platform. Tencent, already with a significant user base through it’s ‘whatsapp on steroids’ Wechat app allows you to invest in their online finance product called Licaitong and they have integrated a taxi booking app called Didi Taxi where you can ‘tip’ taxi drivers a pre-selected extra amount to come and pick you up.

Money for nothing and your taxi for free

So, all of the above is well and good. Where it gets interesting is the level of competition in the marketplace and what companies are doing to gain marketshare. A Chinese friend related her experience:

She initially called a taxi via Didi taxi. Didi is running a promotion where you can get 12 RMB (~US$2) back on your taxi ride when you use the app. Base fare in a taxi is 14 RMB (~US$2.33), so she paid 2 RMB (~US$0.33) for the taxi ride. But wait, there’s more…

The taxi driver then asked if she could pay using Alipay and she said yes. Why? Because Alipay is running a promotion where she could get 13 RMB (~US$2.15) back and the taxi driver then likely also received some reward. The taxi driver then gave her the 14 RMB in cash and she sent him 14 RMB via Alipay.

So let’s do the math:

|

Rider |

Taxi Driver |

Internet Giant |

||||

|

Change |

Balance |

Change |

Balance |

Change |

Balance |

|

|

Initial Ride |

-14 RMB |

-14 RMB |

+14 RMB |

+14 RMB |

0 |

0 |

|

Bonus for using Didi |

+12 RMB |

-2 RMB |

0 RMB |

+14 RMB |

-12 RMB |

-12 RMB |

|

Driver pays rider cash |

+14 RMB |

+12 RMB |

-14 RMB |

0 RMB |

0 RMB |

-12 RMB |

|

Rider pays driver w Alipay |

-14 RMB |

-2 RMB |

+14 RMB |

+14 RMB |

0 RMB |

-12 RMB |

|

Bonus for Using Alipay |

+13 RMB |

+11 RMB |

?? |

?? |

-13 RMB |

-25 RMB |

|

Net |

11 RMB |

14+ RMB |

-25 RMB |

|||

So basically, my friend was paid to ride the taxi. She can then take that 11 RMB and instantly put it on her online finance account where she’ll earn about 6% and the internet giants are out a combined 25 RMB.

Of course in the internet space, we’ve seen plenty of companies providing products or services for free or nearly for free, but the scope with which this is happening in China is amazing. And it’s happening more and more.

Take your lessons to go

Time is compressed here. Group buying developed over years in the US and took another couple to fade away. In China, it was started and finished in less than 3 years. Will taxi booking and online finance be similar?

Although both products are essentially in the middle of a ‘perfect storm’ of a huge potential user base, very tight liquidity (giving high overnight lending / fixed deposit rates) and tremendous mobile and internet penetration and momentum, the winds are shifting in terms of innovation and it has put fear into the financial industry.

Both banks and securities firms are feeling the pinch from internet finance. Banks are facing eroding deposits in the face of gradually liberalizing interest rates, while brokers and asset managers are seeing their customers move to relatively high-return products that carry very few fees.

Although the same ‘perfect storm’ may not be happening in the west, paying attention to how things are developing in China is important as more Walmarts and Tescos move into the banking space. Not that banks were ever really known for innovation, but here in China, it's clear that the innovation is certainly not - which is putting them in an increasingly tight position.

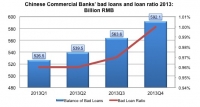

Bad loans rise in both amount and proportion in China

According to the latest figures from the China Banking Regulatory Commission (CBRC), both commercial banks' balance of Chinese bad loans and the ratio of bad loans increased throughout 2013.

The continuing increase of bad loans is an indication of the challenges in China's economy currently. With an economic transition happening and increased lending on bad loans, this is not likely to decrease in 2014 which will pose even more of a challenge for banks as they face increased interest rate liberialization and other financial industry reform.

More...

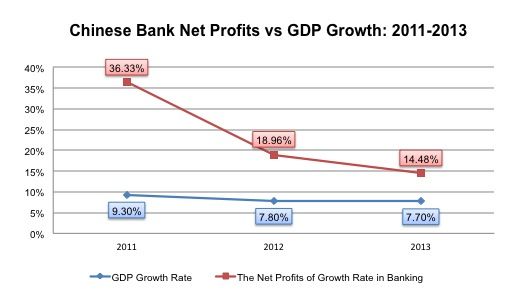

Chinese Commercial Bank Profitability continues to struggle

According to the latest figures from the China Banking Regulatory Commission (CBRC), Chinese commercial banks’ accumulated net profits reached 1.4 Triliion RMB in 2013, up 179.4 Billion RMB from 2012. However, the growth rate of net profits has been decreasing in recent years. In 2011, profits grew 36.33%, then dropped dramatically to 18.96% in 2012, and again in 2013 to 14.48%.

Research shows that the decreasing trend of Chinese commercial banks’ profitability growth rate seems to be in line with China’ declining GDP growth rate, shown in the chart below. It reflects that with the acceleration of interest rate reform and the influence from internet finance, China’s commercial banks profit margin faces continuing pressure.

Competition for online finance cash increases in China

Not satisfied with just taking deposits from banks, online finance platforms are facing more competition from each other.

2014 China Top-10 Financial Technology Trends Webinar Slides and Recording Available

Thank you to everyone who attended the Top-10 China Financial Technology trends webinar just over a week ago.

The sheer size of China's population and geography means that you get some pretty amazing statistics out of it. Couple that with increasing internet and mobile penetration and you have some pretty sizable numbers.