China Banking Research

Margin Call on Overleveraged China

The explosion in margin lending has fueled a baseless rally in the Shanghai Composite, but the magnitude of leverage in the stock market is still coming to light.

It's official. Although the bank has already technically been approved (several times), it seems like WeBank, 30% owned by Tencent, will finally make its big splash on January 18th.

China's P2P problems part of larger shadow banking squeeze

According to data from Online Lending House, a China P2P industry data provider, as many as 92 P2P websites had issues in December 2014, significantly more than the 76 that had trouble in all of 2013, Some websites went offline temporarily, some products turned out to be fraudulent and some businesses were closed outright.

The Shanghai Free Trade Zone (FTZ) expands. A lot.

Sneaking it in while the west was busy sipping eggnog and taking a break, the Chinese government has big plans for expanding the Shanghai Free Trade zone geographically. The new zone will include some of the most important real estate in Shanghai including the Lujiazui Financial disctrict.

Tencent's Webank approved for operation

On December 12th, Webank, the proposed bank from Tencent received regulatory approval to start operations.

Kapronasia releases comprehensive China P2P Lending Research Report

Kapronasia is pleased to release our P2P Lending in China report. Based on primary and secondary  research, the report is one of the most comprehensive reports on the development of Peer to Peer lending in China.

research, the report is one of the most comprehensive reports on the development of Peer to Peer lending in China.

For more information on the report click here.

PBOC drafts outline for long-awaited deposit insurance scheme

The PBOC has announced it will be introducing a deposit insurance system in China, which will have a profound impact on banks’ behaviour. Liberalizing the banking sector may put it on a more sustainable path but short-term risks should not be ignored.

Chinese P2P lending risks continue to rise

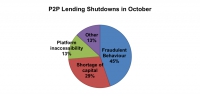

October has been a tough month for China's P2P lending platforms as more and more are pressured to shut down due to capital shortages and fraudulent behaviour.

The Next Big Thing: China's Digital Banking

The digital revolution has finally caught up with the Chinese banking sector. As it undergoes important reforms, industry leaders are faced with numerous challenges and must innovate to stay on top of their game.

Like a piece of delicious cake, all good things come to an end and after robust growth since the launch, Yuebao has seen the first decline in 2014Q3. According to the data from financial news website East Money, although Yuebao has achieved 5.69 Billion in net profits, Yuebao AUM has declined 6.84% for the first time, reaching RMB 534.89 Billion. Is this part of a larger trend?

More...

Alibaba's Bankers' acceptance online lending product, another online finance innovation coming from China?

After over a year of incredible growth, Yuebao is starting to slow slightly and the expected returns on the platform are dropping down to about 4%, not entirely different than what is possible in a bank. In April 2014, Alibaba made a decision to roll out a new online finance product, a bankers' acceptance online lending.

Alibaba rebrands Ant Financial; now dominating world banking?

Last week, Alibaba’s finance arm rebranded their “Small and Medium Financial Services Company today to “Ant Financial Services Group” or “Ant Financial”.

Payment Providers Face an Uphill Battle with Banks

Mr. Li Xiaofeng, head of PBoC Financial IC Card Panel, believes that Chinese payment providers will not play a major role in payments in China's financial industry. “From the scale and channel perspective, Central Bank and commercial banks remain the main payment providers.”

Alibaba about to move forward on private bank in China

Although Alibaba was in the first round of initial approvals to setup a private bank in China earlier this year, it was only at the end of September 2014 that they finally received approval to move forward on the project along with Juneyao, another large Chinese company who is also looking to setup their own bank.