China Banking Research

Baidu the biggest winner in the Ctrip and Qunar's tie-up

Chinese largest online travel company Ctrip.com International Ltd announced a 45% tie-up with its competition Qunar Cayman Islands Ltd to create an absolute dominant position for China’s fiercely competitive online travel market.

The US ATM manufacturer Diebold is discussing a potential takeover with Wincor Nixdorf, a German ATM manufacturer. Wincor Nixdorf was offered approximately EUR 1.74 billion at EUR 52.50 per share, a price which includes a 30% premium over the stock price on the date of the offering.

The two companies are number 2 and 3 globally, but the ATM market is slowing down, as mature markets are already saturated and sales in the emerging markets are quickly reaching their peak. The industry is also feeling pressure from virtual payments as the shift away from cash and bank cards is happening across the world.

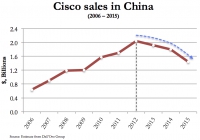

Facing hard choices in the midst of China's new banking cyber-security law, Cisco announces a $10 billion China initiative starting with a local JV with Inspur

With growing national security concerns surrounding imported western network equipment, China’s intensions have been to utilise homegrown network equipment to support its IT infrastructure. Tech giants like Cisco have been displaced to the sidelines with shrinking market share and deflating revenues in the Chinese market. It seems Cisco, who was once critical to the design and construction of China’s internet revolution in the 90’s will be marginalised if it does not take action to boost its sales in China.

As a national idol and a self-made billionaire in China, Jack Ma has already shown how he could change the e-commerce industry. He is now creating an internet entertainment empire with Alibaba's previous expansion into music and movies, and now sports.

Is the People's Bank of China internally synced on the future of China's financial industry?

China’s economy is changing. Consumers have taken to e-commerce in a big way and have clicked and shopped their way to make China's e-commerce industry the biggest in the world. A key enabler has been financial reform, which has let the online and mobile payments industry grow and develop. Yet with the regulations of the past month, you'd be forgiven for scratching your head and wondering what the government had in mind...

Big data continues to be big in China's financial industry as China's Qihoo 360 moves into the segment with a data-driven finance product of its own.

Chairman of ICBC welcomes fintech regs. No really?

Earlier this week, Finance Asia reported that Yang Kaishen, CEO and Chair of the Industrial Commercial Bank of China stated that recent moves by regulators would be good for innovation. Wait...so the chair of one of the biggest SOEs in the country is in favor of legislation that cuts off the legs of innovation? Well, I'll be...

There's something to be said for the refreshing marketing on Ant Financial's new online wealth management app "Ant Fortune." Whether or not it will actually make a fortune for users is a bit unclear, but you can be sure Alibaba will do well out of it.

China issues first "Internet Finance Guidelines" to kick off what should be a completely new area of regulation

Online loans, payments, and banking - nearly every segment of the banking industry has been affected by China's rapidly growing internet finance industry. For the past two years, it has done so without much regulatory oversight or intervention. That looks like it will change soon.

Eastern philosophy, Western banking - How China is quietly building its own digital bank disruption

Kapronasia will be presenting at Oracle's Digital Bootcamp on August 4th in Singapore. As a sneak peak of what Zennon will be talking about, here are a couple of intro thoughts on Digital Banking in China

More...

CSRC investigation of Alibaba invested Hundsun could foreshadow new fintech problems for the tech giant

Finger pointing on global stockmarket crashes continues unabated as The China Securities Regulatory Commission starts an investigation into Alibaba invested Hundsun Technology.

Italian authorities investigate Bank of China Milan branch on suspected money laundering-related transfers

As Italy’s economy is struggling to find growth opportunities, well-off Chinese immigrants and businessmen seem to do well in the country. Chinese individuals are reported to be buying everything from fancy cars to real estate and are opening small businesses. But according to local government, their prosperity was not reflected in the local tax records to the extent the government expected it to be.

The big data e-commerce powerhouse Alibaba is now eager to leverage their data on millions of users and transactions in new projects. This time they have followed their formidable rival JD.com by moving into the crowdfunding area to extend financing to SMEs.

Is MYBank’s self-reliance on in-house cloud feeding the de-IOE (IBM, Oracle, EMC) trend?

Since Beijing became more cautious on the use of foreign technology in the banking sector, Chinese banks have been intensely trying to figure out what to do next. One bank is not waiting and it's no surprise that the soon-to-launched Alibaba-affiliated internet private bank MYbank is moving in lockstep with the government policy as well as develop its own long-term technology strategy. MYbank announced it will be using an in-house cloud computing system instead of products from IBM, Oracle and EMC (IOE).