Displaying items by tag: china

Insurance companies to kick-start the Shanghai Stock Exchange?

The Shanghai Stock Exchange has been in the doldrums for the past couple of years and was the worst performing Asian exchange of 2013.

Bitcoin in China: so where are we now?

It sounds trite if you’ve read my other posts on Bitcoin in China, but ‘wow! What a week it has been for Bitcoin in China’. With the PBOC effectively cutting off (legal) funding of accounts on exchange platforms, is there a future for the currency in China?

SSE releases TMT and National Defense indices

Shanghai Stock Exchange and China Securities Index co.ltd announced that the new TMT (Technology, Media and Telecom) industry index and national defense indices would be released on December 25th, 2013.

PBOC notice on Bitcoin hurts online and offline acceptance in China

Kapronasia began researching Bitcoin in China in August 2013. Our Bitcoin in China report released on September 18th mentioned that in the future there would be two factors that really influence the fate of Bitcoin in China: the Chinese government’s attitude towards Bitcoin and Bitcoin’s acceptance as a method of payment, at least initially, by merchants.

China's Tier 2 Banks Expansion Challenges

After 18 years of economic development, China’s Tier 2 Banks, mainly city commercial banks, are growing to fill a gap in-between state-owned banks, and rural commercial banks. As part of their growth, many city commercial banks are attempting to expand their branches in other regions, however, the Chinese Banking Regulatory Committee (CBRC) regulations are, in certain cases, holding them back.

The recent tight regulation regarding supra-regional city commercial banks is largely the result of increasing internal fraud cases in city commercial banks such as Qilu Bank and Hankou Bank. The good news is that the CBRC is not prohibiting city commercial banks from expanding supra-regionally. Instead, the approval process is just longer and the standard of regulatory evaluation indicators such as asset scale, capital adequacy ratio, profit margin, and non-performing loan ratios are higher than before. In this case, if city commercial banks attempt to expand outlets in other regions, they need to enhance their internal control and risk management abilities above the required standard.

Because the asset scale and business model vary based on the local economies in each city, the evaluation regulation will be different. If the investment in other regions is excessive, the CBRC will require a higher capital adequacy ratio; if the risk management does not match the fast growing asset scale, the CBRC will restrict the expansion of these city commercial banks. Thus, regulators support supra-regional expansion if the tier 2 banks meet the entire set of regulatory requirements.

China’s tier two banks are some of the more dynamic banks in China in terms of business models and innovation – they have had to be in order to compete with their larger counterparts that typically have much larger deposit bases and distribution networks.

The tier-2 banks are still focused on expanding their asset base and while supra-regional expansion will help them accomplish this, it is not the ultimate goal of the banks, at least not in the near future. The regulations do serve a valuable purpose to ensure that banks’ expansion is based on quality assets and business practices.

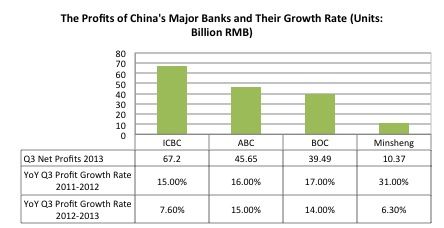

Net profits at China's major banks face interest rate pressure

As fixed interest rates in China start to loosen up, banks' bottom lines are starting to feel the pressure. According to the latest figures from China major banks’ annual reports, the net profits of China Mingsheng Banking Corp.(Minsheng), Industrial & Commercial Bank of China Ltd.,(ICBC), Bank of China Ltd. (BOC) and Agricultural Bank of China (ABC) in the third quarter 2013 shrank on a YOY base.

As shown in the graph below, the net profits growth rate of Minsheng, a relatively smaller bank, dropped dramatically almost 25% comparing with the same period last year, likely due to its relatively large interbank business, which was heavily affected by high interest rates in the middle of June. The high interest rates in China also had a big impact on ICBC. The banks' profitability growth rate dropped to around 7.5%.

Opening the door for hedge funds in China

Hongkou is a geographic district in Shanghai, on the west side of the Huangpu River, north of the center of Shanghai and close to Pudong District. The Hongkou Hedge Fund Park was officially established on Oct. 18, 2013, as the first test-bed specifically for developing local hedge fund industry and introducing foreign hedge funds in China. Through market reforms and special incentives, the Hongkou government hopes to make the Hedge Fund Park a key part of Shanghai, and indeed China’s, hedge fund industry.

Alipay's Yu'ebao deposits hit 100 billion Chinese Yuan

The latest figures from Tianhong Asset Management show that the AUM (asset under management) of Yu’ebao deposits, the currency market fund which is co-launched by Alibaba and Tianhong on 13 June, 2013, has rocketed from June 13th to November 14th, 2013, from 0 to CNY100B. Now Yu’ebao is the largest fund in China leveraging it's enormous Taobao, T-mall and Alipay customer base.

The latest figures from Tianhong Asset Management show that the AUM (asset under management) of Yu’ebao deposits, the currency market fund which is co-launched by Alibaba and Tianhong on 13 June, 2013, has rocketed from June 13th to November 14th, 2013, from 0 to CNY100B. Now Yu’ebao is the largest fund in China leveraging it's enormous Taobao, T-mall and Alipay customer base.

The success story of Yu’ebao has not only encouraged the Chinese IT giants and online payment providers to enter the asset management market, but also is a worry to the traditional asset management firms. Currently, most public funds in China sell their products on their own websites or choose to cooperate with the online platforms to sell their products. Asset managers do recognise the benefit of selling funds online including low cost and convenience, but struggle as they simply just do not have the customer base of Alibaba/Alipay.

| Date | 13 June | 30 June | 9 Sept | 14 Nov |

| AUM (CNYB) | 0 | 6.6 | 55.65 | 100 |

What the Chinese government notice means for Bitcoin

From purchasing property with Bitcoins, to the world’s largest Bitcoin exchange, to incredible mining operations, China over the past few months has become the largest Bitcoin market in the world and a key part of the Bitcoin story.

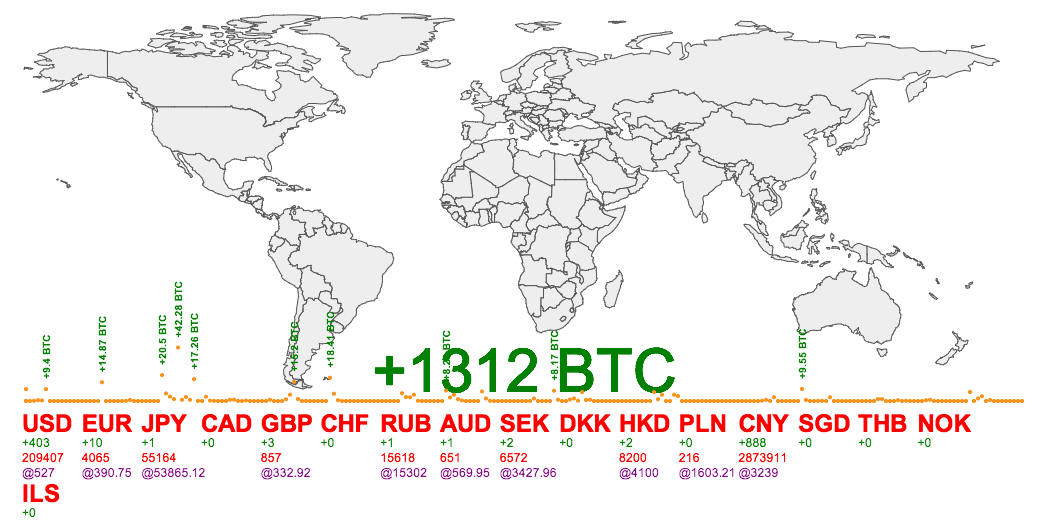

An amazing image showing the global flow of Bitcoin

This is a great image from Fiatleak.com that shows the global flow of Bitcoins to various countries sourced from data from the world's biggest Bitcoin exchanges. Go to their site to see the real-time animated image, which is rightly described as a bit hypnotic.